- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Line 26 on1040 form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

On line 26 of form1040 turbo tax list the word "div". The program states I can't report a quarterly tax payment with the same SSN as the person who is divorced. My wife and I are married and have listed us as filing as married 'jointly'. I can't see anywhere on my entries that would make the program think we are divorced.

Also for insurance coverage in 2020 the program states my wife had lapse in health care coverage. She didn't.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

To address your second issue first:

Your issue is with the question that asks "What type of High Deductible Health Plan did [name] have on December 1, 2019?"

Unfortunately, the question does not clarify that it is only for a small group of taxpayers and that all other taxpayers should answer "NONE".

NOTE: each spouse can have an HSA. The use of "you" below refers to whichever spouse's name was in the question above.

This question is trying to determine if you utilized the "last-month" rule in 2019 (yes, 2019). The last-month rule lets you use the full annual HSA contribution limit if you had HDHP coverage on December 1, even if you were not covered by an HDHP for all of the year.

However, the catch is that if you used the last-month rule, the IRS requires that you stay under HDHP coverage for all of the following year (2020).

***NOTE*** This question occurs on the taxpayer who does not have an HSA, so never had a chance to tell TurboTax in the HSA interview what their HDHP coverage was for 2020.

So, the fix is this: go back to the question (at the end of the HSA interview), and:

- If you had HDHP coverage for all of 2019 , then enter NONE

- If you had no HDHP coverage for all of 2019, then enter NONE.

- If you did not have an HSA in 2019, then enter NONE.

- If you had an HSA in 2019 but did not contribute to it in 2019, then enter NONE.

Only taxpayers who had their own HSA in 2019 AND who contributed to their own HSA in 2019 should answer “Family” or “Self” or “None” (which can be the right answer in some cases).

***

As for the "div" on line 26, I imagine that somehow TurboTax got the idea that you were divorced.

Off hand, I would suggest "deleting" your spouse (as awful as that sounds), then re-adding your spouse, your spouse's W-2 (and any other forms directly tied to your spouse), and reconfirm that you are filing married joint.

I hope that fixes it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

The solution for the insurance work. Thanks! Unfortunately even though I removed my wife from the program and then re-entered it still shows us as being divorced

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

If you are using the CD/Download version of TurboTax, go into Forms Mode and check the Personal Information Worksheet for both you and you wife. To do this:

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, click on Personal Wks (your name) to open. [Screenshot #1, below]

- Then check the Personal Wks (wife's name).

- Look at the Info Wks to make sure the married filing jointly box is checked.

- To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

If you are using TurboTax Online, review your information using these steps:

- Click My info in the black bar at the left of your screen.

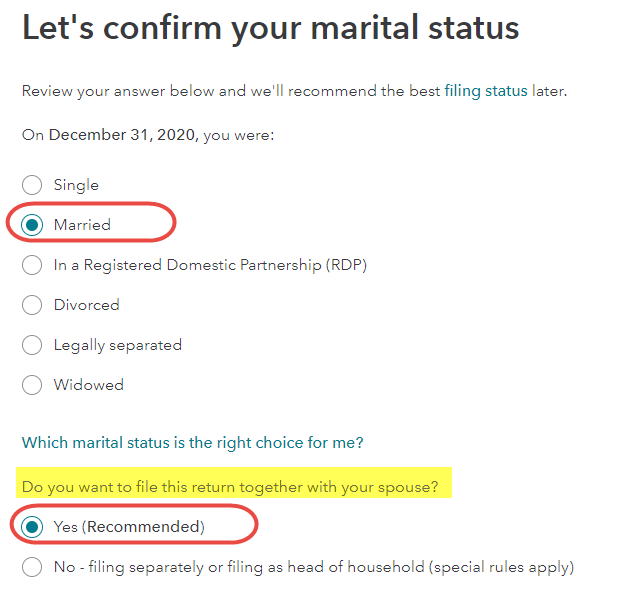

- The section below your name is the filing status. Click Edit and confirm your marital status on the next screen. [Screenshot #2]

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

I went into the forms as you said. It did show my wife to be single. I changed it to married. It does list as married filing jointly. Even after the correction it still says we're divorced. The only thing I've done is gone into the federal forms and an explanation. I put a note to the IRS stating that the program won't let me change that we're not divorced. I may file and see what happens at this point

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

I would delete the estimated payment, close the program, re-open and re-enter the estimated tax payment.

Sometimes an error "sticks" in the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Line 26 on1040 form

I deleted the estimated payment, re-opened, re-entered, and still the same result. I even 'right-clicked' over the 'div' on the form, clicked on 'over-ride' and got rid of the 'div' notice on the form. But as soon as I re-entered my estimated tax payments for 2020, the program re-entered the 'div'.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lcgundo

Level 3

annhendrick833

New Member

Chris-Mc

Level 2

user17699805167

New Member

mizmarieschneider

New Member