- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K1 Box 13 Other Deductions -- Passive Entry on Schedule E, Page 2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Box 13 Other Deductions -- Passive Entry on Schedule E, Page 2

I have a K1 with an entry for 13d code W that I wish to flow to Schedule E, Page 2, in the Passive columns.

The Turbotax prompt for 13d Code W has these questions below (screenshot). Depending on what I select, it flows to different parts of return.

The “I have another description item” one does not flow anywhere when I tested it -- where is it supposed to flow to?

I can select the “nonpassive deduction to be reported on Schedule E, page 2” selection and that flows to Schedule E, page 2, but it’s not technically correct since it’s not nonpassive income (my entry should be passive).

Why is there not an entry for Passive deduction to be reported on Schedule E, page 2?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Box 13 Other Deductions -- Passive Entry on Schedule E, Page 2

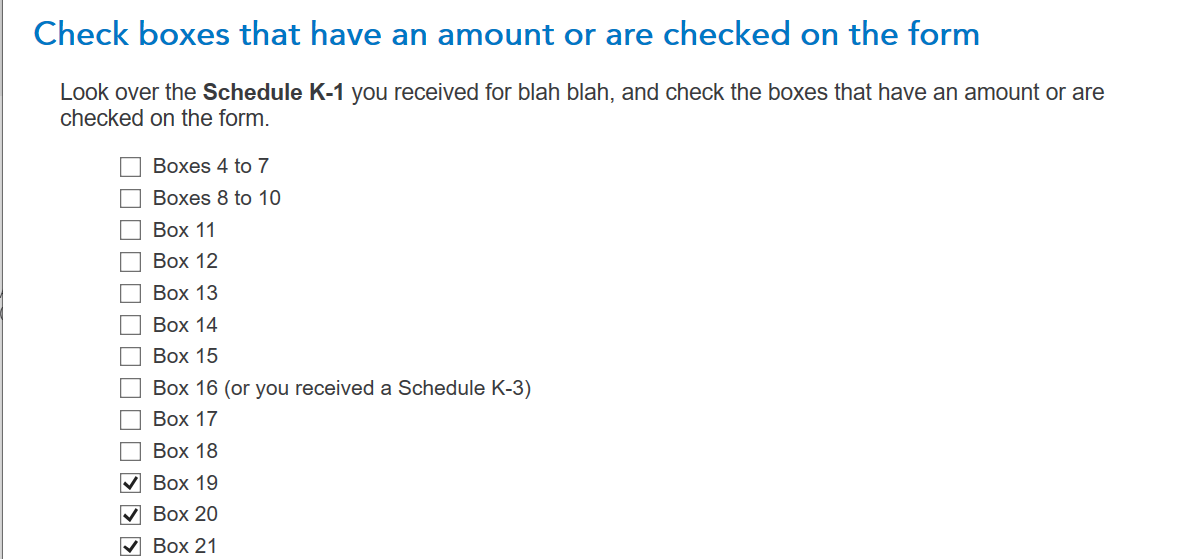

Here's what you are going do, in the k-1 input, you will check off boxes 19,20,21 like this

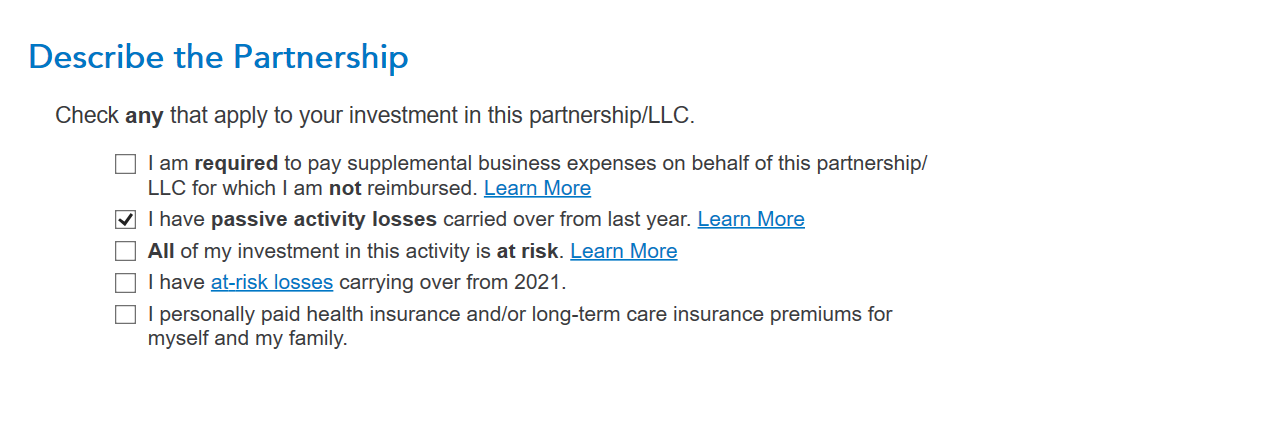

then continue, continue, continue till this screen, check off I have passive actrivity loss

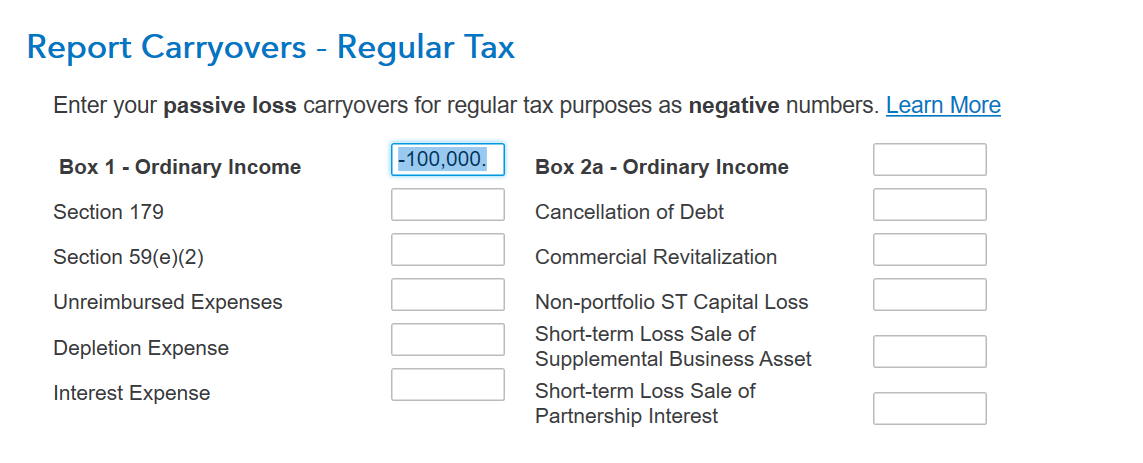

next screen, enter it in as a loss like this

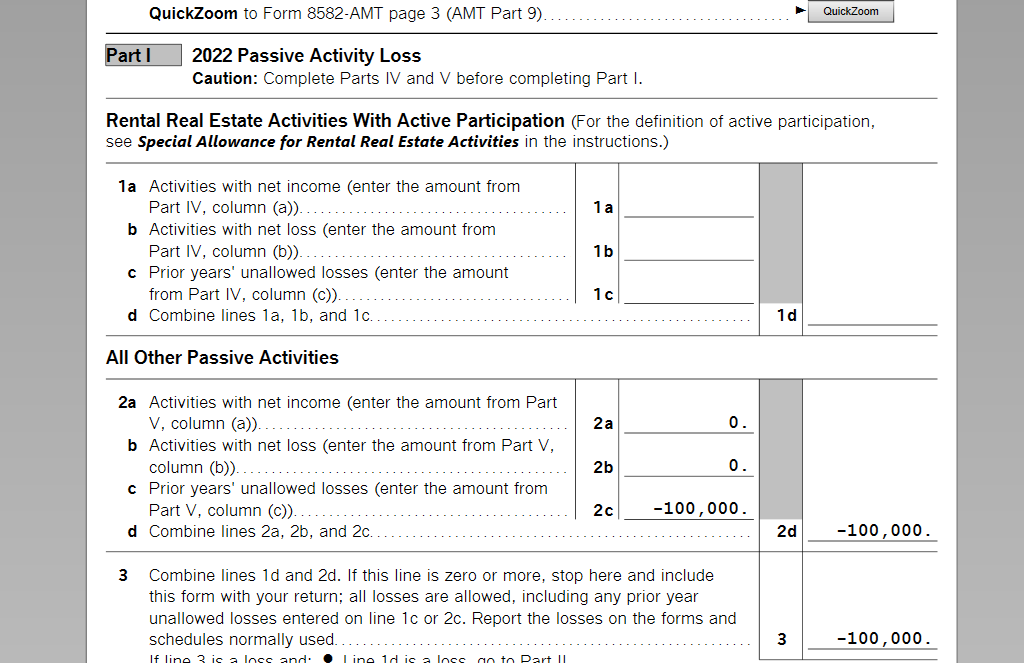

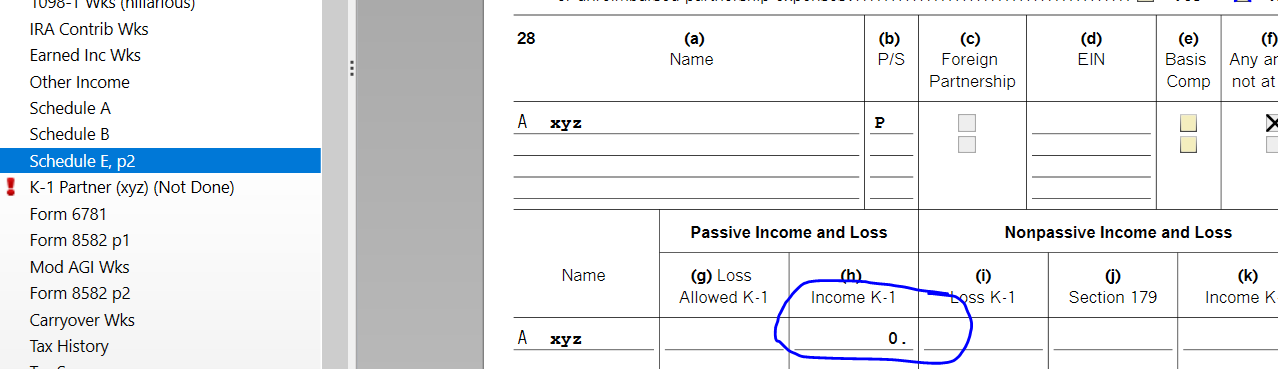

and depending if you have passive activity to have these losses offset against them it will show up on the form 8582 like this

This would be a good workaround to pick up these losses from the passive activity which would seamlessly flow to Sch E pg. 2

In my particular case, it remains 0. Depending on your circumstances however the number may be different. Nonetheless, see how it shows in the Passive Income and Loss section as per your request.

Enjoy the rest of your day!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Box 13 Other Deductions -- Passive Entry on Schedule E, Page 2

@AbrahamT thanks for the reply.

Do I still check Box 13 during the K-1 input, since the K-1 I received has Box 13 entry.

Also I'm curious, what is the checkbox for "Nonpassive deductions to be reported on Schedule E, Page 2"? what is the purpose of this?

And how come there is no similar for "Passive deductions...on Schedule E, Page 2"?

And what is "I have another description item" and where does it flow to?

see below image.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 Box 13 Other Deductions -- Passive Entry on Schedule E, Page 2

1- Yes, check the Box 13 entry.

2- Nonpassive activities are businesses in which the taxpayer works on a regular, continuous and substantial basis. Also, salaries, guaranteed payments, 1099 commission income and portfolio or investment income are deemed to be nonpassive.

3- Passive income include the following;

Equipment leasing.

- Rental real estate (unless the taxpayer qualifies as a real estate professional)

- Sole proprietorship or farm in which the taxpayer does not materially participate.

- Limited partnerships with some exceptions.

4- Most likely passive deductions would not be entered here. It would typically reported as a carryover from the year before like I already explained to you where that goes or may be from a rental property which would be entered in Box 2 from the k-1 unless you are a qualified real estate professional . See HERE pg. 3 and 5 as to what goes under that category.

5- Does your code 13W show another description item, then depending what it is, that's where it will flow through to.

Lots of luck! I hope I answered all your questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BAJuliano

Level 2

coby-mccamant

New Member

Jennmcclary

New Member

allipark

New Member

Canonical

Level 2