- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

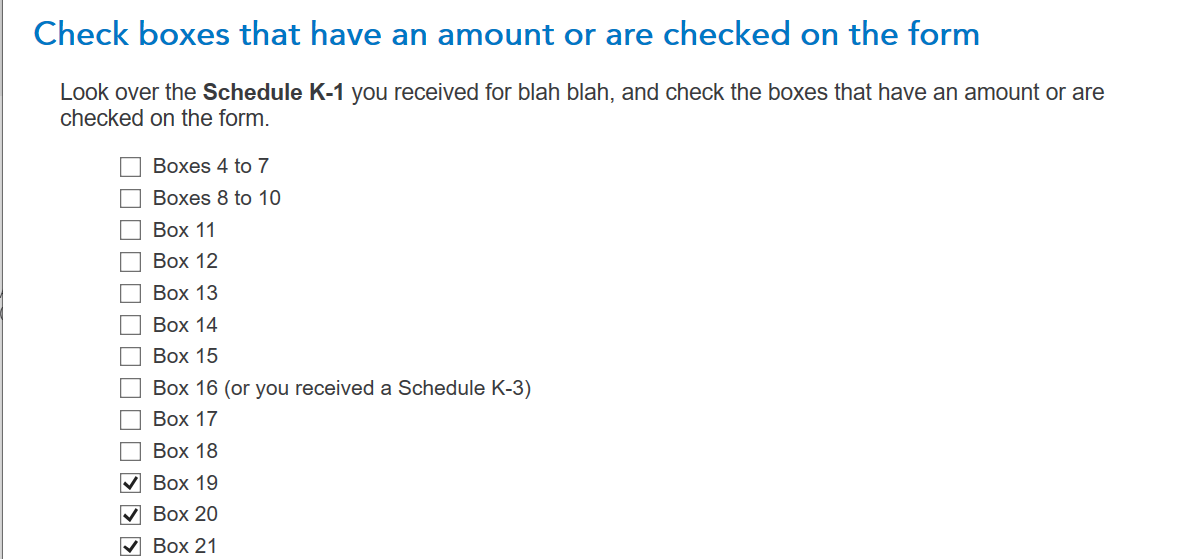

Here's what you are going do, in the k-1 input, you will check off boxes 19,20,21 like this

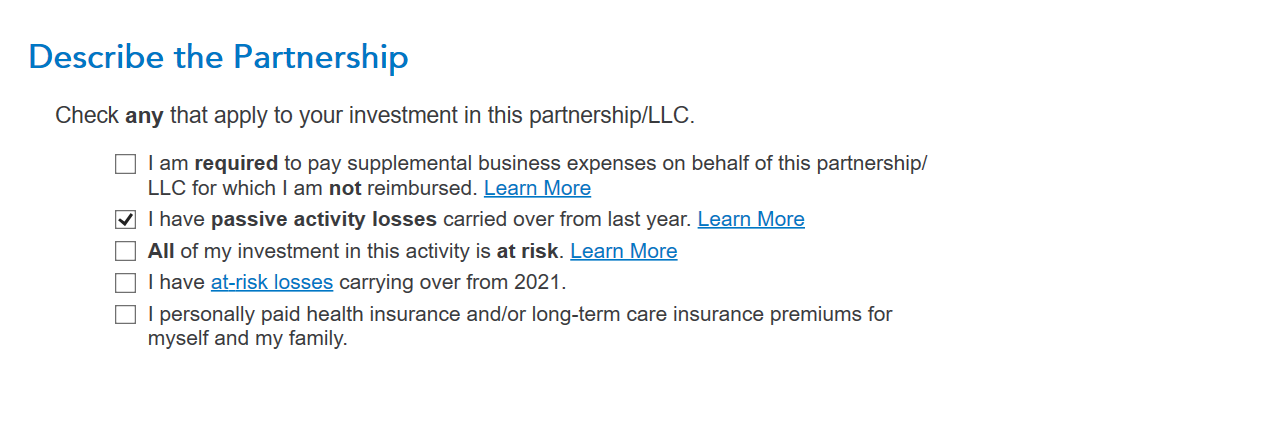

then continue, continue, continue till this screen, check off I have passive actrivity loss

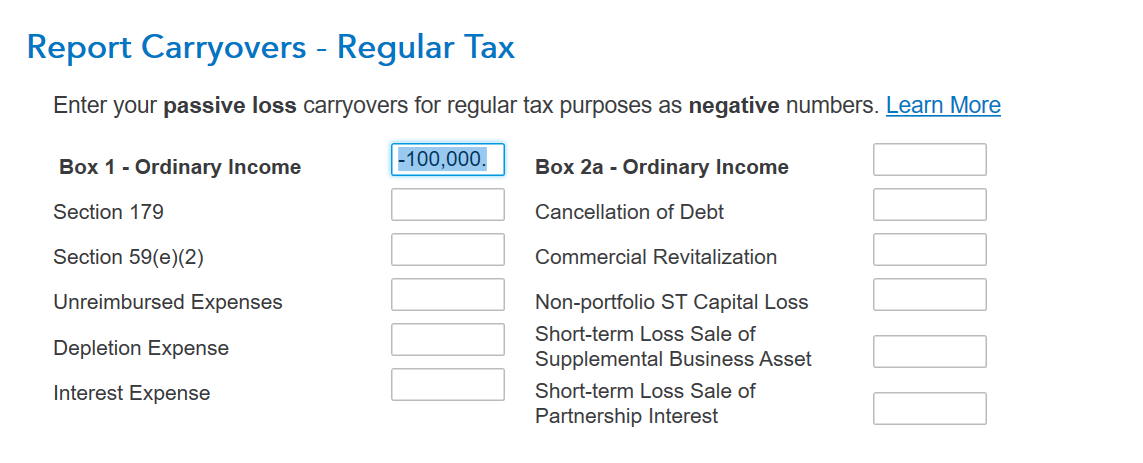

next screen, enter it in as a loss like this

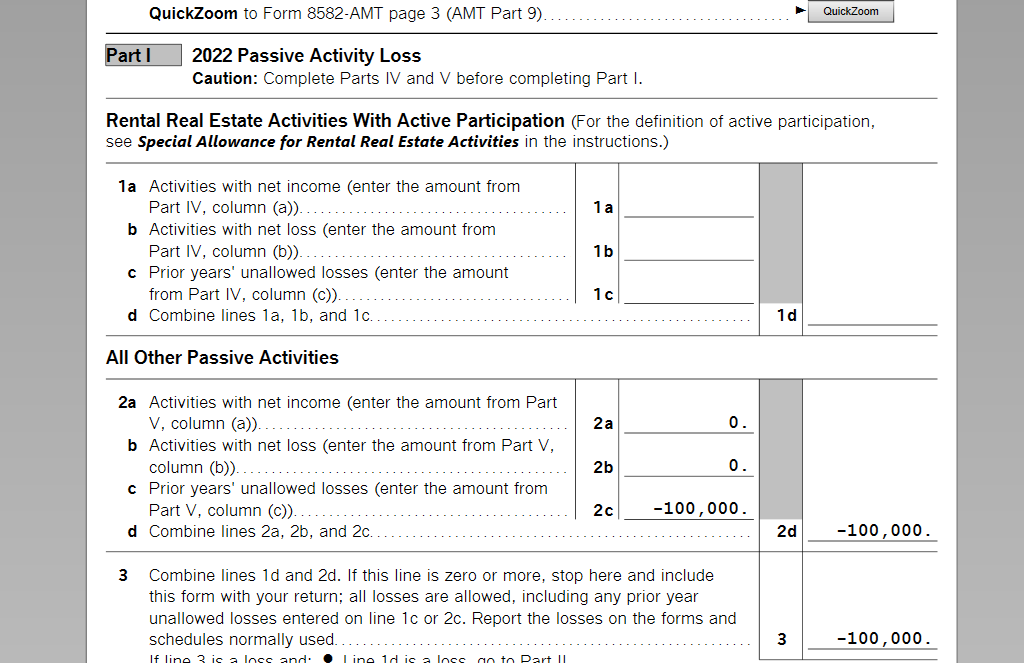

and depending if you have passive activity to have these losses offset against them it will show up on the form 8582 like this

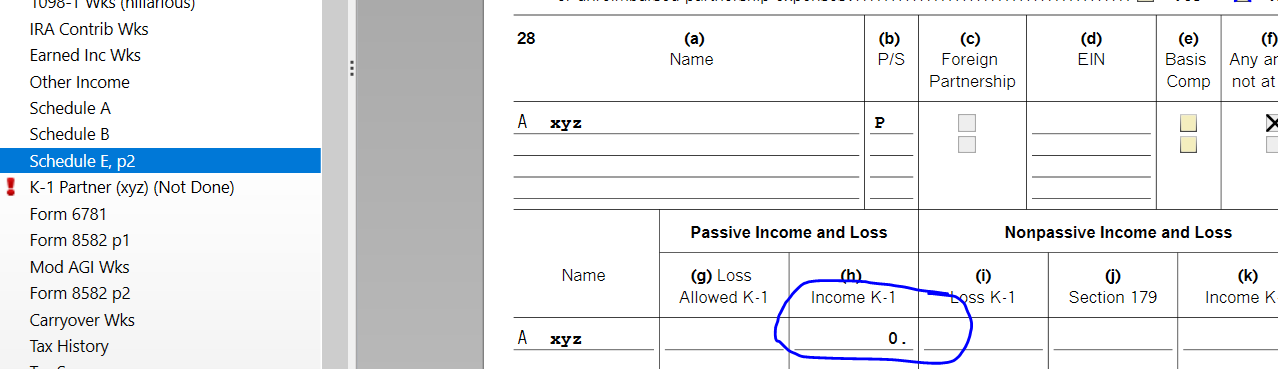

This would be a good workaround to pick up these losses from the passive activity which would seamlessly flow to Sch E pg. 2

In my particular case, it remains 0. Depending on your circumstances however the number may be different. Nonetheless, see how it shows in the Passive Income and Loss section as per your request.

Enjoy the rest of your day!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2023

12:14 PM