- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: K-1 box 20 z

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

My K-1 Box 20 says see statement, and then the statement says:

Description (and has numbers for each):

Ordinary Income

Self-Employment Earnings

W-2 wages

The ordinary and Self Employment numbers are the same, and slightly higher than the W-2 wages.

What do I enter in the box on Turbo Tax, or do I select Z three times and enter all three?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

@Bigbak78 the STMT you see on your K-1 form means that there is a statement attached to it that includes the numbers that you are to enter in TurboTax for box 20. Code Z indicates that this is for your qualified business income (QBI) entry. You should see an amount for that on your statement, often it is the same amount as the income reported on your K-1 schedule box 1 to 3.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Revisit your partnership interview.

For Box 20 Item Z: the 2019 IRS Instructions for Form 1065 Partnerships states:

- page 1: "Box 20—Codes Z through AD that were previously used to report section 199A information have been changed. Only code Z will be used to report section 199A information."

- page 47: "Partnerships should use Statement A—QBI Pass-Through Entity Reporting, or a substantially similar statement, to report information for each partner’s distributive share from each trade or business, including QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends by attaching the completed statement(s) to each partner’s Schedule K-1. The partnership should also use Statement A to report each partner’s distributive share of QBI items, W-2 wages, UBIA of qualified property, qualified PTP items, and section 199A dividends reported to the partnership by another entity.

Please see screenshots below. You will be asked a series of questions that you can answer based on the Schedule K-1 you received. There should be a statement attached that will provide you with the information you need to answer the questions.

Apparently, your answer needs to be YES at the screen above, "We're almost done" which would be that your taxable income might exceed a threshold. If you were to answer no, you would not be providing the details requested that appear to be generating the error.

See below for the next screen after answering YES. There are intricacies to the Section 199A that TurboTax needs to calculate based on your details. Answer the questions depending on your circumstances.

Continue on through the questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

If there is more than one separate business owned by the partnership to add under Section 199A income, how can that additional business be added? TT premier software appears to only provide interview questions to add only one separate business and not multiple businesses owned by the partnership.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

TTAX BUSINESS appears to have a bug here. I have an LLC ("LLC A") that owns a portion of LLC B. The K-1 that LLC A received from LLC B contains Statement A information for completion of Sec 199A reporting, tied to Box 20 Code Z on the LLC B K-1 provided to LLC A.

In TTAX BUSINESS, when entering BOX 20 information, there's a box that says: "NOTE: Check this box if you have entities with codes of Z [etc]. We'll have you enter those on the next screen." But when I check that box and click continue, TTAX sends me back to the K-1 summary screen, not to another screen to fill in the code Z Sec 199A details.

BUG? How to report??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

I have the same problem. Is this a glitch in the program? Does anyone know a work around?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Hey JimmyJ1, Did you get or find an answer to your question? I have the same question, my Partner's Section 199A Information Worksheet (I got that instead of a Statement A) has multiple columns of information, pertaining to the income items from each property (the LLC owns multiple properties being rented out to the same business that is NOT owned by the LLC). I saw one person in a post say he totaled each column manually and just entered that amount, although he didn't say a TT support person recommended that. I saw another post say to enter separate Code Z's for each Column and TT will calculate the amount. I also am not sure how to answer the very first question, "Is the business that generated the Section 199a income a separate business owned by the partnership?". I'm certain it is not, but then the buttons to check corresponding to that question is "The income comes from another business". That's different from "a separate business OWNED BY THE PARTNERSHIP. So I'm not sure how to answer that question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

When TurboTax asks "Is the business that generated the Section 199-A income a separate business owned by the partnership?", it is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. Notice that when you indicate the QBI comes from another business, you'll get additional questions, including the name and EIN of the business that passed through the income to the partnership that sent you the K-1.

If you have both types of QBI on your K-1 (generated by the partnership that sent you the K-1 and passed through from another business to the partnership that sent you the K-1) you need to "split" that K-1 into two separate K-1s for entry into TurboTax: one K-1 for the QBI generated by the partnership that sent you the K-1, and a separate K-1 for the QBI passed through to that partnership by another business.

Similarly, if your Schedule K-1 shows both passive and nonpassive activities, or it shows more than one type of activity, (i.e. trade or business, rental real estate, or other rentals), or there are multiple rental activities and at least one of the activities is subject to the recharacterization rules (the property type is either 5 (Self-rental) or 7 (Land)), use a separate K-1 worksheet for each activity. In other words, there should not be entries on any two boxes of boxes 1 through 3 and separate K-1's must be completed for rental activities reported on lines 2 or 3 where at least one of the rental activities is self-rented or land and there are also additional rental activities that are NOT self-rented or land.

All that having been said, when you get to the Section 199-A Statement information, you can add it together within those same categories used to "split" the K-1 (generated by the partnership vs passed through to the partnership, and type of activity).

If your partnership has no pass-through QBI, and only one type of activity, you can add the amounts on the Section 199-A Statement together to enter into the TurboTax "Section 199-A" information screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

You can enter Section 199-A Statement associated with box 20 code z in TurboTax Business Forms mode.

For a K-1 received by a partnership preparing Form 1065, go to Forms mode (icon at top right in blue bar) and in the left column find the "K-1 Partner" form for the K-1 the partnership received. Click on that K-1 Partner form and it will open up in the window. Scroll down to Section A and in the applicable boxes enter the information on the "box 20 code Z Section 199A Statement or "STMT" that came with that K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Thanks David, I figured that was the correct way to do it. Indeed I had both types of QBI on my K-1 (generated by the partnership that sent the K-1 and passed through from another business to the partnership that sent the K-1). But I also had amounts in both box 2 and 3, so I had to enter two K-1's anyway. So I indicated there was a Box 20 Code Z on each K-1, put the QBI from the other business (they indicated the name, EIN and entity type on the attached 199A Information Worksheet) on one and the QBI from the partnership (the EIN and entity type was blank on the Worksheet so I assumed it was from the partnership that sent the K-1) on the other. And since there were six columns for the other business (corresponding to the six sites but the same EIN), I totaled the Rental Income and Qualified Property amounts in each of the six columns related to the other business and put those totals on the first K-1, and then entered the amounts related to the partnership on the other. Thanks for the confirmation though, it's reassuring to know that I did it correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Hi everyone,

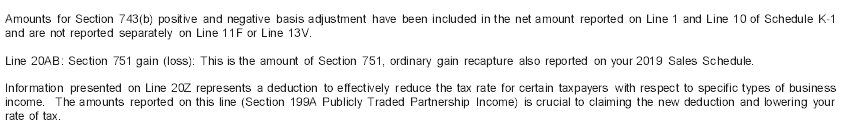

I too have an amount for box 20 code Z on my MLP K-1 and after reading the PTP IRS instructions for code Z it appears that one must file form 8995. Is that the accepted process for those using TT to enter this info? Below is the IRS explanation around code Z for tax year 2019:

Codes Z. Section 199A information.

Generally, you may be allowed a deduction of up to 20% of your net qualified business income (QBI) plus 20% of your qualified REIT dividends, also known as section 199A dividends, and qualified PTP income from your partnership. The partnership will provide the information you need to figure your deduction. Use one of these forms to figure your QBI deduction.

Use Form 8995, Qualified Business Income Deduction Simplified Computation, if all of the following apply.

You have QBI, section 199A dividends, or PTP income (defined below), and

Your 2019 taxable income before the QBI deduction is equal to or less than $160,700 ($321,400 if married filing jointly or $160,725 if married filing separately or a married nonresident alien), and

You aren’t a patron in a specified agricultural or horticultural cooperative.

Use Form 8995-A, Qualified Business Income Deduction, if you don't meet all three of the above requirements.

Use the information provided by your partnership to complete the appropriate form listed above. For definitions and more information, see the Instructions for Form 8995 or the Instructions for Form 8995-A, as appropriate. IRS Partner's Instructions for Schedule K-1 (Form 1065) (2019)

On my K-1 the partner instructions page specifically says that one should claim code Z deductions:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

I'm deep into it and am trying to figure out what I've been given and what not. I have the K-1 and I have something called K-1 Supplemental Information. The SI provides a description for 20Z that says it's 199A PTP Income (Loss), but doesn't provide any additional detail that appears to be necessary to allow me to complete the questionnaire. Should I be asking for something else from the PTP, and, if so, what is it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Before you make that entry, you must determine if your Section 199A information is from your "main" partnership or was passed through to your "main" partnership from another entity. If the Section 199A amounts were passed through to your "main" partnership from another PTP, you'll need to enter a second K-1 for that main partnership with only the "passthough" PTP amounts.

When you enter that second K-1, look for the "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen where you indicate that whether the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. When you indicate the QBI comes from another business, you'll get additional questions, including whether the pass-through entity is a PTP, and on the next screen the name and EIN of the business that passed through the income to the partnership that sent you the K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Did this get answered? I recieved a K-1 where there were multiple QBI entities listed, but TurboTax only permits one. Do I really have to do multiple K-1 reports just to record these?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Yes, multiple Qualified Business Income (QBI) "passthrough entities" require a separate K-1 for each entity.

Because your K-1 is reporting Section 199A information generated by the partnership and Section 199A information generated by several passthrough entities, you'll need to "split" this K-1 into separate K-1s for entry into TurboTax. Enter one K-1 with only the "box" amounts generated by the "main" partnership, and a additional K-1s with only the "box" amounts generated by each separate passthrough entity.

During the first part of the K-1 entry, all the separate K-1s use the name, address, and EIN of the "main" partnership shown on the K-1 you actually received. In other words, enter each additional Schedule K-1 just like the first through Part II Line I (India), and the appropriate at-risk answer under Line K. You don't need to enter the partner share percentages or the partner capital account amounts on the additional K-1s.

The boxes 1-20 on the K-1 you received are the combined totals of the main entity and the passthrough entities. You must figure out how much of each box 1-20 is for the main entity versus each passthrough entity, and that is the "split" you use to enter the box 1-20 on the separate K-1s. The total each numbered box for your separate K-1 forms must equal the total for that box on the K-1 you actually received. For example, all box 1 amounts on the separate K-1s should add up to the box 1 amount for the actual K-1 you received. If you can't figure (deduce) that "split" from the information you have, you will need to contact the preparer of the K-1 to get those amounts.

The Section 199A Statement you received for box 20 code Z should already "split" the Section 199A amounts between the entities, so you enter the Section 199A amounts for each entity on the K-1 you've created for that entity.

Note that when you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the "main" partnership, and on the other you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 box 20 z

Hey all,

I think there is a much simpler fix than described in many of the previous answers, that does not require splitting into separate schedule K-1s.

All I did was open the Schedule K-1 form, scroll down to Section D1 (entitled "Qualified Business Income Deduction - Statement A Information"), and fill in the first table there. Just above the table is a line saying, "Shareholder's share of QBI or qualified PTP items subject to shareholder specific determinations". In my case, I simply needed to supply a number for "Ordinary business income (loss)" in the first line of the table, which I took as the value of Box 1 in Part 3 earlier in the Schedule. Re-ran TurboTax check, and it passed! My refund went up a bit too. 🙂

I believe this is the correct table to fill in to correct the error, because if you look at a paper version of 199A Worksheet, at the top there is a Statement A, and the lines there match the entries in the Turbotax Section D1 of Schedule K-1.

Took me over an hour to figure that out. You. Are. Welcome!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17714450184

New Member

gattaca

Level 3

traceeolsen70

New Member

dcarroll3

New Member

user17714393469

New Member