- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi everyone,

I too have an amount for box 20 code Z on my MLP K-1 and after reading the PTP IRS instructions for code Z it appears that one must file form 8995. Is that the accepted process for those using TT to enter this info? Below is the IRS explanation around code Z for tax year 2019:

Codes Z. Section 199A information.

Generally, you may be allowed a deduction of up to 20% of your net qualified business income (QBI) plus 20% of your qualified REIT dividends, also known as section 199A dividends, and qualified PTP income from your partnership. The partnership will provide the information you need to figure your deduction. Use one of these forms to figure your QBI deduction.

Use Form 8995, Qualified Business Income Deduction Simplified Computation, if all of the following apply.

You have QBI, section 199A dividends, or PTP income (defined below), and

Your 2019 taxable income before the QBI deduction is equal to or less than $160,700 ($321,400 if married filing jointly or $160,725 if married filing separately or a married nonresident alien), and

You aren’t a patron in a specified agricultural or horticultural cooperative.

Use Form 8995-A, Qualified Business Income Deduction, if you don't meet all three of the above requirements.

Use the information provided by your partnership to complete the appropriate form listed above. For definitions and more information, see the Instructions for Form 8995 or the Instructions for Form 8995-A, as appropriate. IRS Partner's Instructions for Schedule K-1 (Form 1065) (2019)

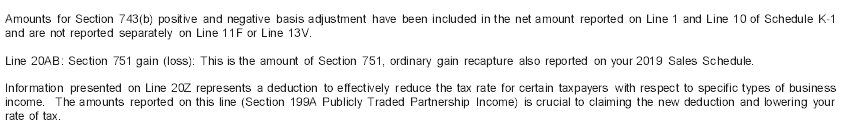

On my K-1 the partner instructions page specifically says that one should claim code Z deductions: