- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

Here is the answer I found online

"Here's how you can tell which deduction you took on last year's federal tax return: If the amount on Line 12a of last year's Form 1040 ends with a number other than 0, you itemized. If this amount ends with 0, it's likely you took the Standard Deduction."

look at my tax return of 2021. And I know I took standard deduction that year. How shall I understand the above answer?

And For year of 2023, there is no 12a on 1040 form, so where can I find out the type of deduction? And I am very sure I took standard deduction for 2023.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

If this is standard one, then the online answer confused me:" If there is any other digit, there would be a 100% chance it was an Itemized deduction".

Or this is for past years when standard deduction is zero. It is not applicable for 2021 and after years.

That is right and is for every year even 2023. If the amount on line 12 ends in a zero (the last digit) it is 99% sure it used the Standard Deduction. All the Standard Deduction amounts end in a zero like your 25,100. There are a couple situations that the SD can end in a digit other than 0. Like if you are a dependent.

If line 12 ends in a number other that zero like 26,187 that usually means you took the Itemized Deductions and would have Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

Your standard deduction lowers your taxable income. The standard deduction makes some of your income “tax free.” It is not a refund. You will see your standard or itemized deduction amount on line 12 of your 2023 Form 1040.

2023 STANDARD DEDUCTION AMOUNTS

SINGLE $13,850 (65 or older/legally blind + $1850)

MARRIED FILING SEPARATELY $13,850 (65 or older/legally blind + $1500)

MARRIED FILING JOINTLY $27,700 (65+/legally blind) ) + $1500 per spouse

HEAD OF HOUSEHOLD $20,800 (65 or older/blind) + $1850)

2022 STANDARD DEDUCTION AMOUNTS

SINGLE $12,950 (65 or older + $1750)

MARRIED FILING SEPARATELY $12,950 (65 or older + $1750)

MARRIED FILING JOINTLY $25,900 (65 or older + $1400 per spouse)

HEAD OF HOUSEHOLD $19,400 (65 or older +$1750)

Legally Blind + $1750

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

And just so you know-----there was a line 12a and 12b on a 2021 Form 1040 but for tax years 2022 and 2023, there is just line 12. (no a and b) So you were looking at old FAQ that referred to lines 12a and 12b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

For 2021, the standard deduction is: Single or Married filing separately—$12,550. Married filing jointly or Qualifying widow(er)—$25,100.

In 2023 the reporting of the deduction is not 12a it is simply line 12.

Line 12 reads: Standard deduction or itemized deductions (from Schedule A).

For years the standard deductions have ended in zero.

If there is any other digit, there would be a 100% chance it was an Itemized deduction.

If there is a zero, you would have to double check the number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

Hello,

I just want to figure it out what deduction I took was identified on 1040 form.

Still take the picture I attached

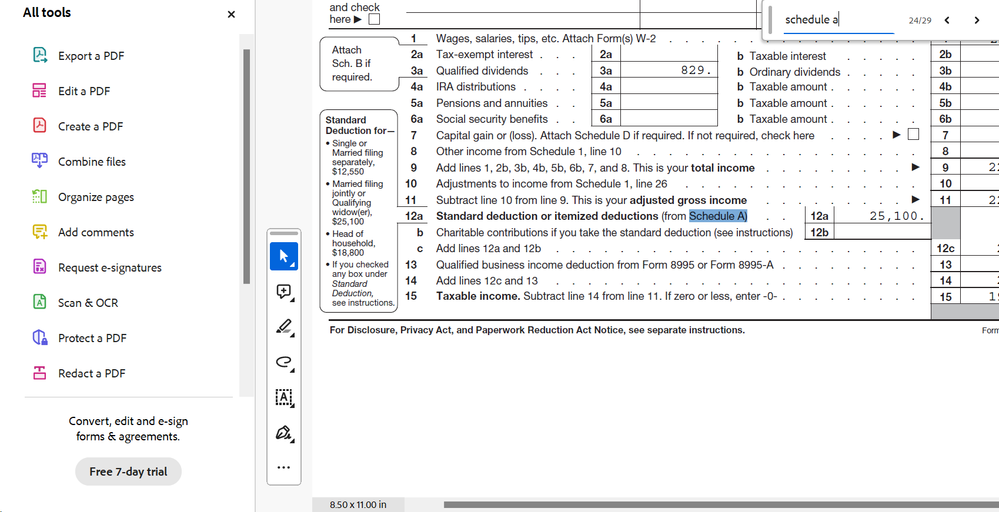

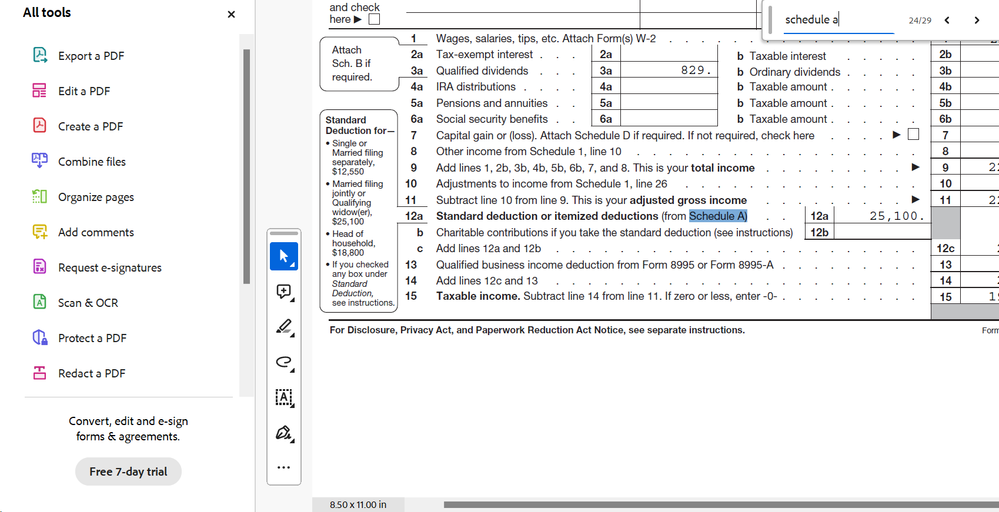

on line 12aStandard deduction or itemized deductions (from Schedule A). , it is 25100.

It also list out standard deduction for married jointly is 25100 on the left side.

So is this standard deduction or itemized one?

If this is standard one, then the online answer confused me:" If there is any other digit, there would be a 100% chance it was an Itemized deduction".

Or this is for past years when standard deduction is zero. It is not applicable for 2021 and after years.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

As you can see----the standard deduction for tax year 2021 for a married couple filing a joint return was $25,100.

2021 STANDARD DEDUCTION AMOUNTS

SINGLE $12,550 (65 or older + $1700)

MARRIED FILING SEPARATELY $12,550 (65 or older + $1350)

MARRIED FILING JOINTLY $25,100 (65 or older + $1350 per spouse)

HEAD OF HOUSEHOLD $18,800 (65 or older +$1700)

Legally Blind + $1350

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

If this is standard one, then the online answer confused me:" If there is any other digit, there would be a 100% chance it was an Itemized deduction".

Or this is for past years when standard deduction is zero. It is not applicable for 2021 and after years.

That is right and is for every year even 2023. If the amount on line 12 ends in a zero (the last digit) it is 99% sure it used the Standard Deduction. All the Standard Deduction amounts end in a zero like your 25,100. There are a couple situations that the SD can end in a digit other than 0. Like if you are a dependent.

If line 12 ends in a number other that zero like 26,187 that usually means you took the Itemized Deductions and would have Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

Just look at your tax return and see if a Schedule A is included with the deduction amount shown on the Schedule A that matches the deduction amount on line 12 of form 1040. If there is a Schedule A with that amount, you itemized deductions rather than taking the standard deduction. If there is no Schedule A, you took the standard deduction which matches the amounts shown by the other posters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the answer on turbo tax regarding how to tell whether you take standard deduction wrong?

Ok, I misunderstood before.

The digital here mentioned in the online statement refers to the last digital of the amount( deduction), not means the whole amount.

I got the point.

Thanks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17571743601

New Member

user17571442625

New Member

CathyZoo

Level 1

user17570046275

Level 1

2cats4me

Level 2