- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Incorrect Number in 1099-MISC Box for Previous Year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

I used TurboTax Home and Business for 2020, and now again for 2021. As I'm finishing up 2021, I noticed that under my personal income under the Income from Form 1099-MISC, it shows a number that it has imported for 2020 over over $16,000. I thought this was odd, because I didn't have any 1099-MISC's in 2020. I had one small 1099-K and my business had some 1099-NEC's, but neither had any 1099-MISC forms. I opened up the 2020 software and my return and verified that $0 was entered in that section in 2020. Then I searched the actual 2020 return for the number reported. Nothing came up. I thought maybe something had gotten messed up here, so I started fresh with a new 2021 return and imported the 2020 return again. It still put that number in the previous year 1099-MISC line as soon as I did the import.

I have no idea where this number is coming from, or why it's saying I had 1099-MISC income from 2020. Has anyone else run into this? Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

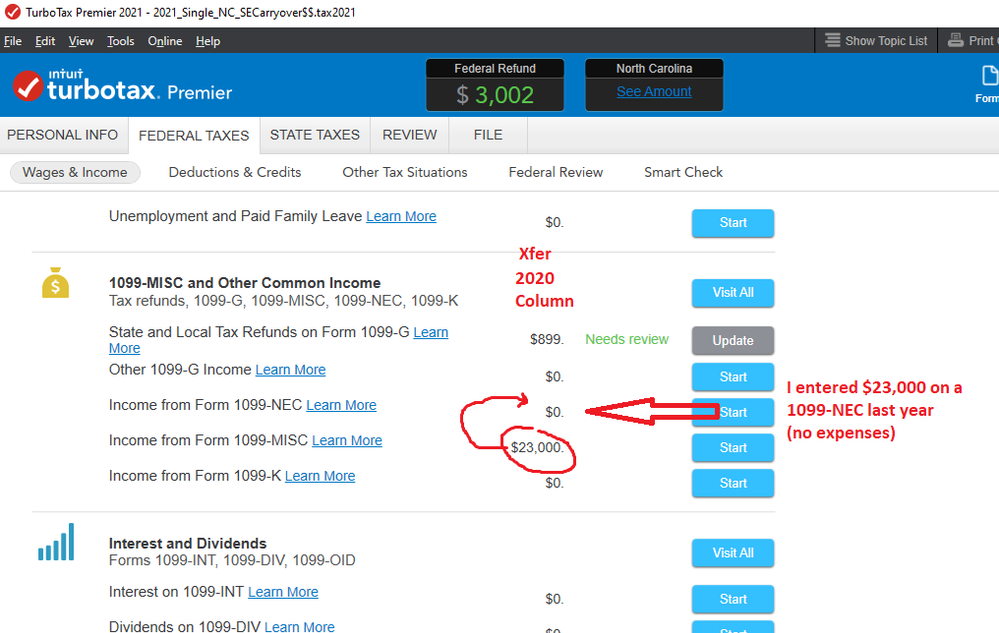

OK...I tested this using 2020 and 2021 Premier.

That appears to be a mis-directed prior year transfer-over designation from years before, when a 1099-NEC didn't exist and all SE income was reported either as cash or on 1099-MISC forms.

____________________

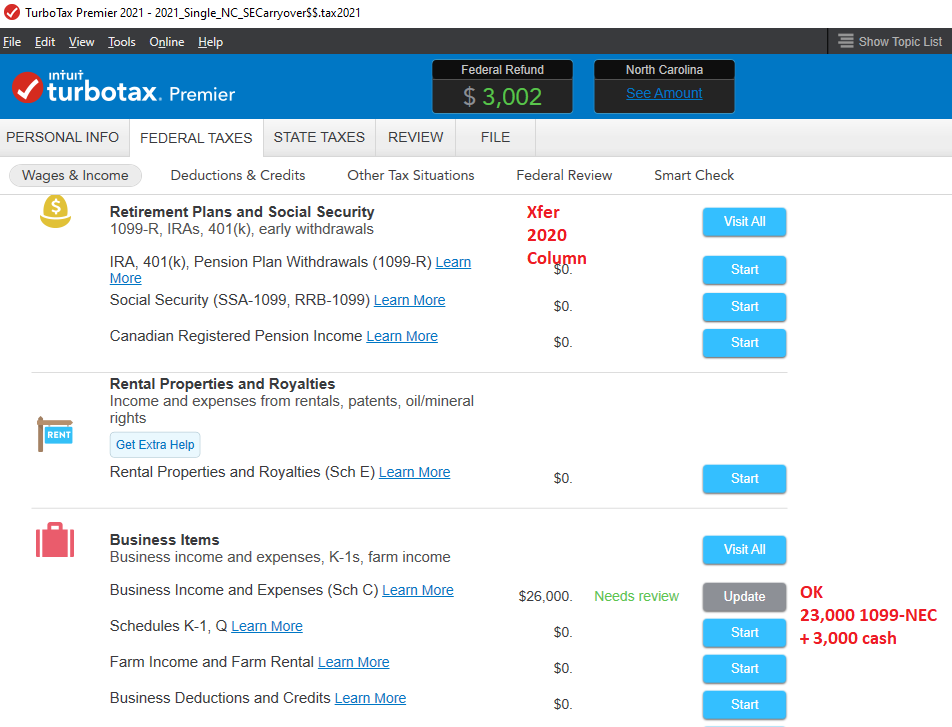

I created a 2020 tax return for a self-employed person, with $23,000 on a 1099-NEC and $3,000 as SE cash with no 1099-NEC, and no expenses for either.

Transferring the file to a new 2021 file, the 2020 column from the prior year showed $23,000 as being from a 1099-MISC.

(Further down the menu page, in the Business Income section, it showed the whole 26,000 for the 2020 column....but as I said, I'm using "Premier" and I don't know if H&B will have both listings in your Income menu page)

____________________________

As long as you had at least 16,000 of SE income for 2020, you can probably ignore that listing.

_____________________________________

@Anonymous_ @DoninGA : Any of you Champs willing to poke the moderators to get this software transfer bug fixed? Perhaps won't happen this year, but maybe next.

____________________________________________

_________________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

Followup....I don't know where 1099-K $$ show up in the Xfer from 2020 to 2021to the next year....I'm not sure how/were to enter those.

Might end up totaled with the 1099-MISC too. BAH ! I'm really not a knowledgeable SE person, just testing & troubleshooting on a Sunday afternoon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

We can pass it along, @SteamTrain.

They will most likely want to do the "Send to Agent" thing and then provide a number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

Yeah......I can provide a Diag # for my 2020 and 2021 files, if needed.

Not sure how the 1099-K $$ss get transferred to the following year summary column.....I didn't see a 1099-K worksheet in the 2020 software, and the software "kind-of" implied you entered it as cash...or Other income in the (edit) Schedule-C area.....but I don't really know SE entry stuff.

1099-K's might just get lumped in with the either of the 1099-MISC/1099-NEC numbers (or neither?) after transfer to the next year, IF

there's no real worksheet for it. But 1099-NEC's should get re-pointed to the proper field in the database since there's a separate line for it.

_______________

Thankfully, I don't think the improper display actually affects the next year's taxes.....jsut a confusing reference point for those paying close attention.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

@SteamTrain wrote:

Yeah......I can provide a Diag # for my 2020 and 2021 files, if needed.

I think that would be the first thing they would ask for in this instance.

You could provide the number to one of the Mods/Admins via PM (or a Champ could forward it).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Number in 1099-MISC Box for Previous Year

You nailed it. I went back and looked and it matches the 1099 NEC amount that I entered from my business from 2020. I had in my mind that it was higher than that, but most of my sales for 2020 were retail sales, which I obviously didn't get a 1099 for. Does it matter that it's showing up as the 1099 MISC for the previous year under my personal section, even though it was actually 1099 NEC income for my business from the previous year?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kaijadcaraway

New Member

dibbeena1

Level 2

candylou2008

Returning Member

karunt

New Member

kevinwright57

New Member