- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

OK...I tested this using 2020 and 2021 Premier.

That appears to be a mis-directed prior year transfer-over designation from years before, when a 1099-NEC didn't exist and all SE income was reported either as cash or on 1099-MISC forms.

____________________

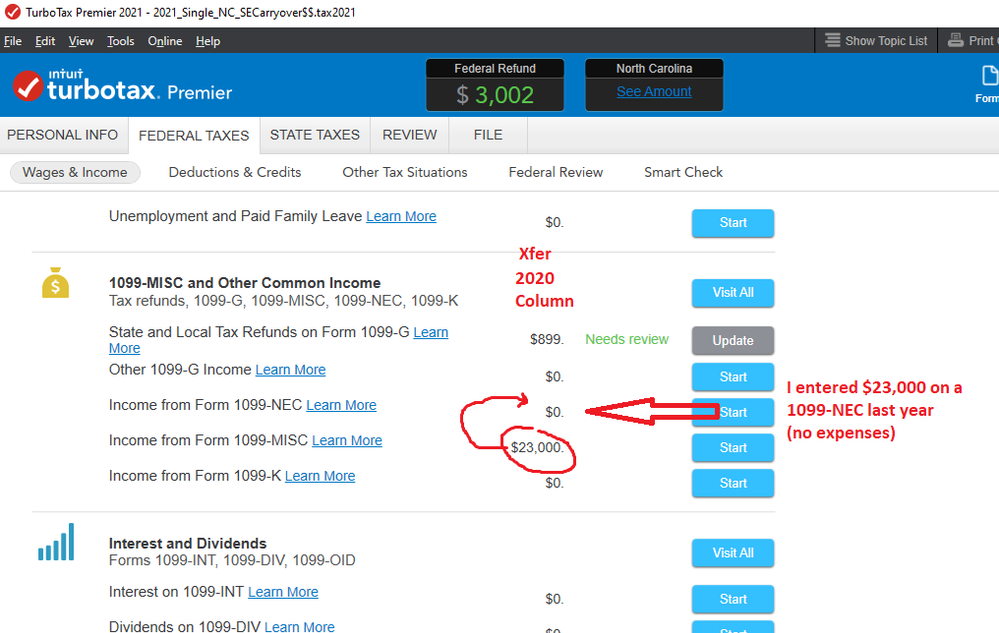

I created a 2020 tax return for a self-employed person, with $23,000 on a 1099-NEC and $3,000 as SE cash with no 1099-NEC, and no expenses for either.

Transferring the file to a new 2021 file, the 2020 column from the prior year showed $23,000 as being from a 1099-MISC.

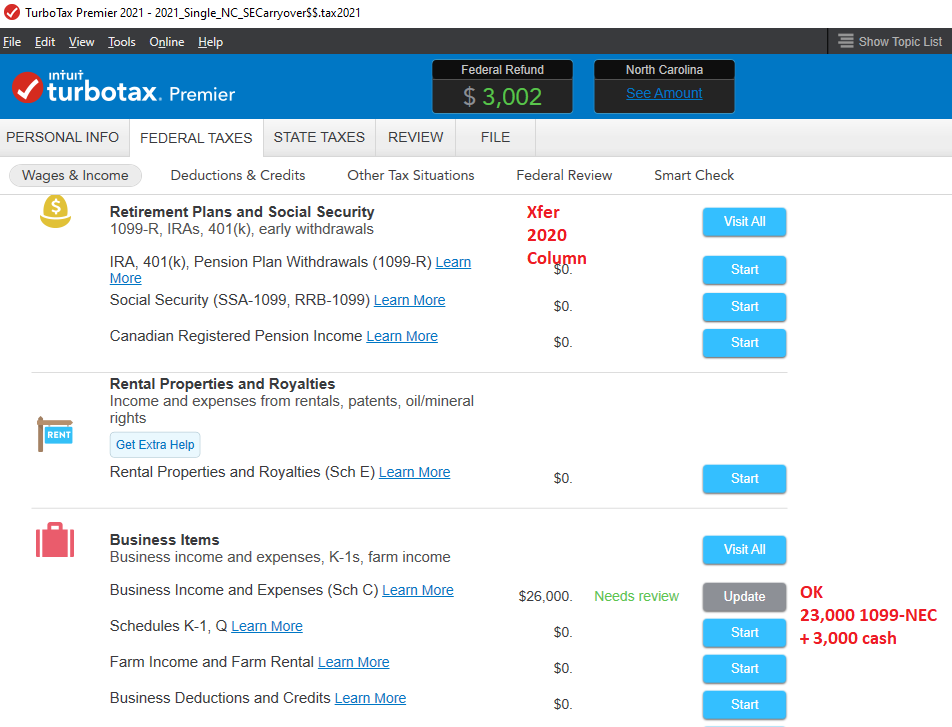

(Further down the menu page, in the Business Income section, it showed the whole 26,000 for the 2020 column....but as I said, I'm using "Premier" and I don't know if H&B will have both listings in your Income menu page)

____________________________

As long as you had at least 16,000 of SE income for 2020, you can probably ignore that listing.

_____________________________________

@Anonymous_ @DoninGA : Any of you Champs willing to poke the moderators to get this software transfer bug fixed? Perhaps won't happen this year, but maybe next.

____________________________________________

_________________________________________________