- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Use Other self-employed income. Includes 1099-K, cash, and checks.

This includes cash income which would be the tips you receive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Ok thank you. One other question . Can I add my yearly storage space ( for equipment ) as a deduction and if so under what section .

Thank you kindly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

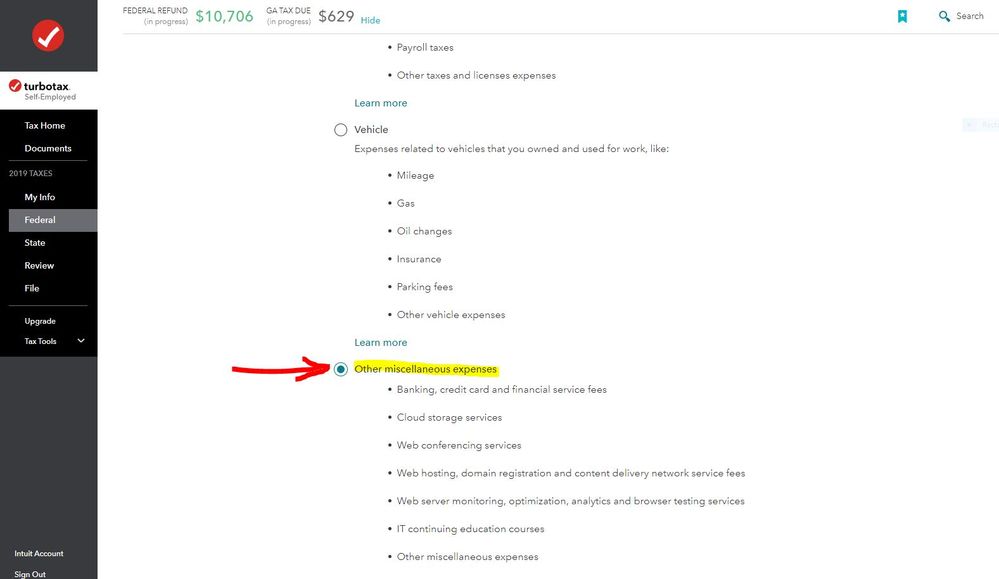

In the Expense section for self-employment use Other miscellaneous expenses for the storage fees.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Hi .

You wrote :

In the Expense section for self-employment use Other miscellaneous expenses for the storage fees.

I can not find what you said . There is no area that says Other Miscellaneous expenses. I've looked for well over an hour ! Even under Other Deductible Expenses there is nothing to add this expense.

Please advise . Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

@sugarbear9876543 wrote:

Hi .

You wrote :

In the Expense section for self-employment use Other miscellaneous expenses for the storage fees.

I can not find what you said . There is no area that says Other Miscellaneous expenses. I've looked for well over an hour ! Even under Other Deductible Expenses there is nothing to add this expense.

Please advise . Thank you.

In the expenses section of the program for self-employment, on the screen Tell us about any expenses select

Other miscellaneous expenses - See Screenshot #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

There is no rectangle that says add expenses , I have been trying for hours .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Please advise .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

@sugarbear9876543 wrote:

There is no rectangle that says add expenses , I have been trying for hours .

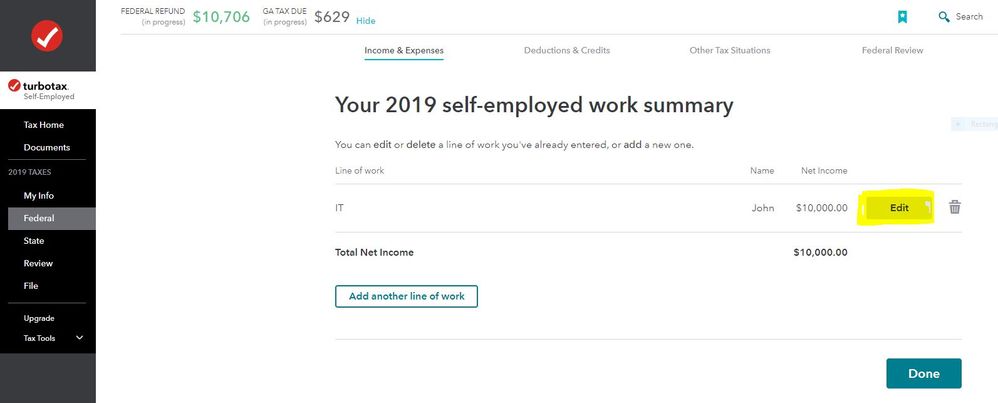

On the screen for your 2019 Self-Employed Work Summary, when you click on the Edit button the following screen has two boxes.

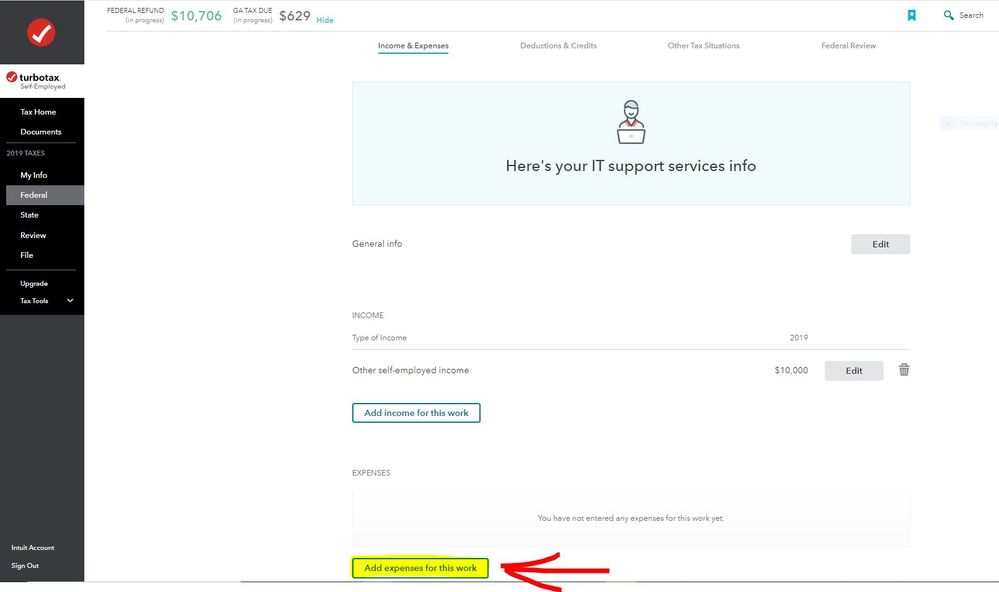

One states Add income for this work and the other states Add expenses for this work

You need to scroll down the page slightly for the Expense box to be visible.

There are also other selections on this page. Do you see these? -

Carryovers, limitations, at risk information, etc. and a Start button

Qualified Business Income and a Details button

2-Year Comparison and a Details button

A clickable link How do I add another line of work? and a Done button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Nope its not there . I restarted for the 4th time ! The choices keep changing and now it says click on one of 2 option boxes which are :

1. I DONT HAVE EXPENSES

2.UPGRADE TO SELF EMPLOYED .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Yes sorry, you need to upgrade.

You can enter 1099Misc Self Employment Income into Online Deluxe or Premier but if you have any expenses you will have to upgrade to the Self Employed version.

How to enter self employment expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Is that free ? I made crap this year and now unemployed , do you really think I want to keep paying more and more ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

Not free. The Self Employed version is the highest version.

OR There is also The Turbo Tax Freedom website which is free for federal and state. And has more forms than the Federal Free Edition, like the full 1040 return and Schedules A, B, C , D, E, F, EIC, H, K-1, SE, etc.

To qualify for the Tax Freedom website you just need to meet one of these 3 things

AGI $34,000 or less

Active duty military with AGI of $66,000 or less

OR qualify for EIC (earned income credit)

In order to use the Tax Freedom Edition, you have to start it at a special website:

http://turbotax.intuit.com/taxfreedom/

How to switch to Tax Freedom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

I made 17.500 . Do I qualify ? Im not military .

I do not have have 1040 and would I have to start all over again ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Im confused , your service doesnt have I am needing . I am self employed and income is tips only. What do I file under ?

I live in Florida so just federal.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bluemoon

Level 3

liz50

Level 1

in [Event] Ask the Experts: Biz Recordkeeping & 1099-NEC Filing

sommer-johnson

New Member

user17581279083

Level 1

Reynan2124

New Member