- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I tried filing my 2019 tax return, it was rejected due to missing information on the 2018 ret...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I tried filing my 2019 tax return, it was rejected due to missing information on the 2018 return I filed through TurboTax. How did this happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I tried filing my 2019 tax return, it was rejected due to missing information on the 2018 return I filed through TurboTax. How did this happen?

I am sorry, we do not have access to your TurboTax account to see why or how this may have happened. However, you can correct your 2018 AGI in your 2019 return so that you can electronically file your 2019 return. Here's how:

To correct your 2018 AGI in TurboTax account follow these steps while in TurboTax:

- Select File from the left hand side of your screen,

- Complete Step 1 and 2 if you haven’t already done so, then go to Step 3.

- When getting to the Let’s get ready to e-file screen after selecting Step 3, select I want to e-file before you continue.

- Follow the online instructions. When prompted, put in your exact 2018 AGI.

- Continue through the screens until you’ve re-transmitted your return.

Here is where you can find your 2018 AGI:

If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

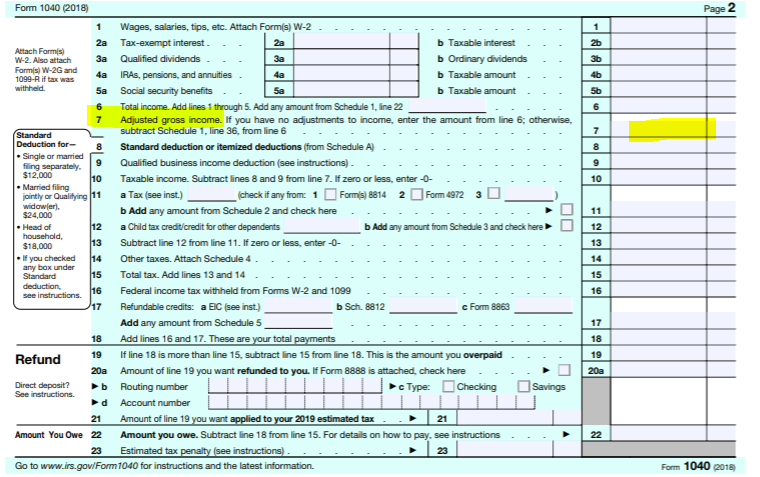

If you have a copy of your 2018 tax return, your AGI is located on line 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I tried filing my 2019 tax return, it was rejected due to missing information on the 2018 return I filed through TurboTax. How did this happen?

I want to file my 2019 return electronically, but just mailed my 2018 return last week. What figure should I use to file the 2019 return electronically, to avoid an error message and non acceptance. The IRS is woefully behind in processing returns so I know they haven't had time to do anything with mine, which includes a schedule C and E. Should I just use the total of the W-2s and 1099s the only information that is known to them as of last year? Or leave it blank. Needing guidance on how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I tried filing my 2019 tax return, it was rejected due to missing information on the 2018 return I filed through TurboTax. How did this happen?

If you didn't file 2018 on time last year then enter 0 (zero) for the AGI to efile 2019.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ZeZa

Level 2

ZeZa

Level 2

dusty-rhodes

New Member

antwon-palmore

New Member

ranhill62

New Member