- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I received a 1099misc for work done as an independent contractor . Which version of turbo tax can i use: Deluxe, Premier or Home/Business. I only have a few expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099misc for work done as an independent contractor . Which version of turbo tax can i use: Deluxe, Premier or Home/Business. I only have a few expenses.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099misc for work done as an independent contractor . Which version of turbo tax can i use: Deluxe, Premier or Home/Business. I only have a few expenses.

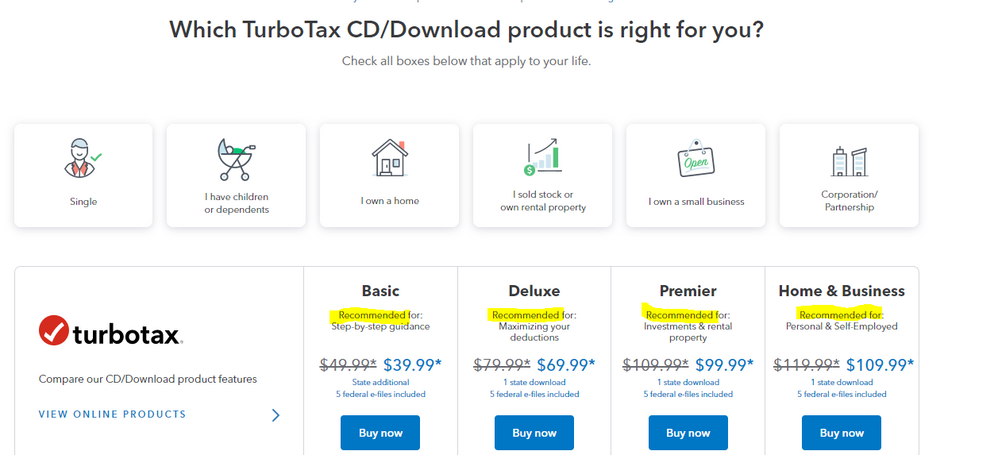

If you use the ONLINE version you MUST use the SELF EMPLOYED program ... but if you use the Downloaded/CD version any of them will do... Basic if you don't need to file a state return or Deluxe or better if you do.

Online:

https://turbotax.intuit.com/personal-taxes/online/

Download:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099misc for work done as an independent contractor . Which version of turbo tax can i use: Deluxe, Premier or Home/Business. I only have a few expenses.

You would need to use TurboTax Self-Employed online or TurboTax Home and Business to enter your 1099 Misc as an independent contractor. Both of these programs will generate a Schedule C which is where this income needs to be reported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099misc for work done as an independent contractor . Which version of turbo tax can i use: Deluxe, Premier or Home/Business. I only have a few expenses.

YOU DO NOT NEED HOME & BUSINESS TO ENTER A SCH C ... ANY of the downloaded versions will complete that form ... the H&B version will just give you more directions (hand holding) and you can upgrade from a lower version if you feel the need but it is NOT mandatory (although the company selling the upgrade "recommends" it) that you start with the most expensive version.

AND ... if you qualify .... you could use the IRS FREE FILE version instead ... it will not be operational until sometime in January but the fed & state returns are free if you meet the qualifications :

IRS Free File Program - https://apps.irs.gov/app/freeFile/

If you are eligible you can use the TurboTax Free File Program which is free to file both a federal and state tax return. The Free File Program edition is a full featured personal tax program and on a separate website from the TurboTax online editions.

To qualify for free 2019 federal and state tax returns with the Free File Program, you'll need to meet at least one of these requirements:

• A maximum 2019 adjusted gross income (AGI) of $34,000; or

• You qualify for the Earned Income Tax Credit (EITC); or

• You served as active duty military (including Reservists and National Guard) with a maximum 2019 AGI of $69,000 (you'll also need a military-issued W-2).

See this TurboTax support FAQ on the Free File Program - https://ttlc.intuit.com/questions/1900583-what-is-the-turbotax-free-file-program

See this TurboTax support FAQ for the difference between the Free File Progam and the Free edition - https://ttlc.intuit.com/questions/2572617-what-s-the-difference-between-free-file-program-and-free-e...

And see this TurboTax support FAQ on how to switch to the TurboTax Free File Program - https://ttlc.intuit.com/questions/2026912-how-do-i-switch-to-turbotax-free-file-program

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

litzyrios13

Level 1

AnywhereArtist

New Member

amruby2003

Level 1

lily32

New Member

in Education

Naples2013

Returning Member