- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I need a help for my tax return 2018 and 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

I am an American citizen and in January 2017 I went back to my country to visit my family and I fell ill with a herniated disc. So I couldn't even walk or work. So I decided to stay there and do traditional treatments. So I didn't know that even if we don't work, I have to do my tax return so I didn't do the 2018 and 2019 one. And here I am I came back to America this month and I wanted to ask for my Economic Impact Payment but I am told that they will not give me because I missed the tax returns of 2018 and 2019. So please what should I do at the end so I can win my Economic Impact Payment because I really need it. and also about my tax returns for 2018 and 2019, what should I do to avoid having a penalty?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi You do not show the IRS that you did not have income. If you had NO income then you just do not file a tax return. The next round of stimulus checks is on its way (we think) and we can hope for some information from the IRS about how non-filers such as yourself can get the stimulus for 2020. We do not know yet. You do no mention how you have been supported for 2020---can someone else claim you as a dependent? How have you been supported?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi wrote:

Hello there, there is someone can help me the procedure how to get the Recovery Rebate Credit and how to file in that I can get the Economic Impact Payment please? I can't figure out how to do that.

Thanks for your help

If you are eligible for the Recovery Rebate Credit then all you need to do is to complete the 2020 federal tax return. You will be asked if you received or did not receive a stimulus payment in 2020. The credit will be entered on the federal tax return, Form 1040 Line 30.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

You do not say if you had any income during 2018 or 2019. If you had no income you do not need to file tax returns for those years. If you did have income for 2018 or 2019 you can prepare those returns using desktop software for each year and mail the returns--they cannot be e-filed.

As for the stimulus checks, they were an advance on a credit you can get on your 2020 tax return, so you can still get it when you file your 2020 return if you are eligible for it.

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

Who has to file?

http://www.irs.gov/uac/Do-I-Need-to-File-a-Tax-Return%3F

Online preparation and e-filing for 2017, 2018 and 2019 is permanently closed.

To file a return for a prior tax year

If you need to prepare a return for 2017, 2018, or 2019 you can purchase and download desktop software to do it, then print, sign, and mail the return(s)

https://turbotax.intuit.com/personal-taxes/past-years-products/

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sam’s, etc.

Remember to prepare your state return as well—if you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Note: The desktop software you need to prepare the prior year return must be installed/downloaded to a full PC or Mac. It cannot be used on a mobile device.

If you are getting a refund, there is not a penalty for filing past the deadline. If you owe taxes, the interest/penalties will be calculated by the IRS based on how much you owe and when they receive your return and payment. The IRS will bill you for this; it will not be calculated by TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

Thank you so much for your answer.

But I had no income from January 2017 until now because like I said I was sick. I have hernie discal (L5- S1)on my back. So how can I show them that I don't and I didn't have income from 2017-2018-2019 and 2020? because this year 2020 too I don't have income.

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi You do not show the IRS that you did not have income. If you had NO income then you just do not file a tax return. The next round of stimulus checks is on its way (we think) and we can hope for some information from the IRS about how non-filers such as yourself can get the stimulus for 2020. We do not know yet. You do no mention how you have been supported for 2020---can someone else claim you as a dependent? How have you been supported?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

Like I said I was back home , I mean in my country when I was born so my family supported me since I was sick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

You say that you are now back in the U.S. If some family member here has been supporting you they might claim you as a dependent for 2020. Just trying to figure out if that is the case or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

I came here by myself and I was living here bymyself. That mean that I don't have any family here. I am back to US this month yeah. Do I need to call IRS and to ask them or let them know my situation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

No you do not call the IRS about it. The IRS is backlogged during the pandemic and they are struggling to process tax returns and stimulus payments. They do not need you to call them and tell them about your health issues or that you will not be filing a tax return. You just do not file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

Hello there, there is someone can help me the procedure how to get the Recovery Rebate Credit and how to file in that I can get the Economic Impact Payment please? I can't figure out how to do that.

Thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi wrote:

Hello there, there is someone can help me the procedure how to get the Recovery Rebate Credit and how to file in that I can get the Economic Impact Payment please? I can't figure out how to do that.

Thanks for your help

If you are eligible for the Recovery Rebate Credit then all you need to do is to complete the 2020 federal tax return. You will be asked if you received or did not receive a stimulus payment in 2020. The credit will be entered on the federal tax return, Form 1040 Line 30.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

Thanks for your answer, But do I need to complete the 2020 federal tax return if I didn't work since 2017 until now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi - it is the only way to get additional stimulus, if you believe you didn't receive the correct amount to date

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

I look the form 1040 and on the line 30, they just write: Recovery rebate credit. See instructions . so what I need to put? Please some can just help me to fill up? please just take the form 1040 and help me. you can leave blank where I have to write my details like name and social security. please please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi wrote:

I look the form 1040 and on the line 30, they just write: Recovery rebate credit. See instructions . so what I need to put? Please some can just help me to fill up? please just take the form 1040 and help me. you can leave blank where I have to write my details like name and social security. please please

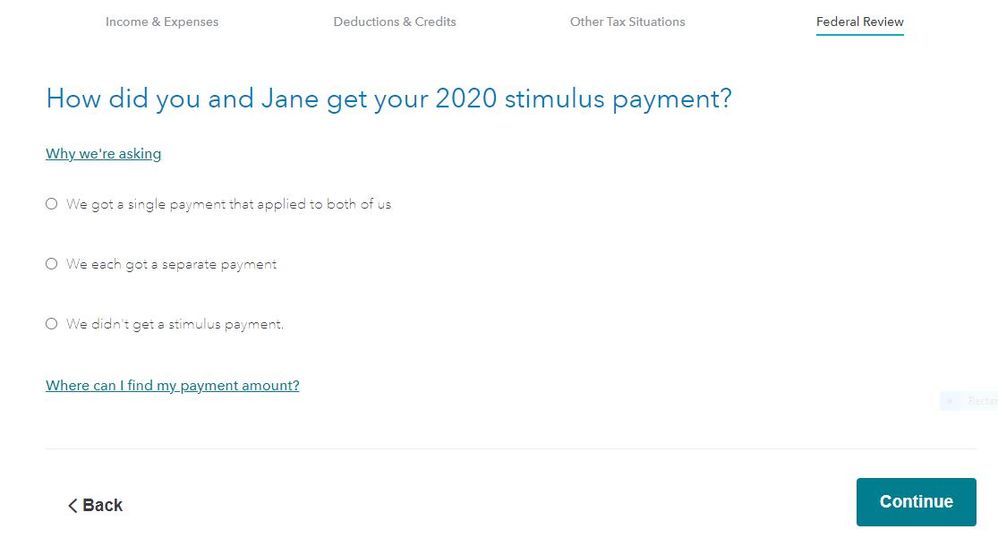

Complete all of your 2020 Federal tax return, the Wages & Income section and the Deductions & Credits section. Then complete the Other Tax Situations section. After completing that section you will be asked about any stimulus payments you received or did not receive in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need a help for my tax return 2018 and 2019

@imsambi are you trying to do this with pencil and paper?????

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CTinHI

Level 1

SB2013

Level 1

fahmida-bangert

New Member

annettebw

New Member

blackwelldebbie1959

New Member