- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

I have reviewed the file you sent. Thank you! I found this error to be resolved in two ways~

Option 1: Enter 0, which you were saying did not appeal to you since income was earned during that time frame. The 0 would be ok in that it is the amount you wish to calculate any deferral, but I understand your point.

Option 2: In your case, TurboTax calculates that you are not eligible by entering 279/365ths of your income. (percentage for days of the year Mar-Dec)

Therefore, enter the percentage of income applied pro rata. In your case, this should result in the conclusion that you are not eligible and let you continue.

In TurboTax Online, prompt the Federal Review which will generate the error. Adjust the value of income attributable to March 27-Dec 31 (280/366ths of your self-employed income) from the Check this Entry section.

In TurboTax CD/Download, follow these steps:

- Go to the Forms mode, scroll in the left menu to Sch SE-T.

- Scroll down to Line 18 and enter 280/366 of your self-employed income.

- Return to the Step-by-Step and run the Review again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

The numbers are the number of days in one year, March 27 through December 31 is 280 days. It was a leap year in 2020, so the bottom number is 366 days for the total number of days in the year. I apologize for the delay-did not mean to miss your reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

You may defer the payment of 50 percent of the Social Security tax imposed under section 1401(a) of the Internal Revenue Code on net earnings from self-employment income for the period beginning on March 27, 2020 and ending December 31, 2020. You can enter this amount on line 18 of Schedule SE. It is optional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

It is not optional and is holding me up from filing. There is nothing for me to defer as I have already paid all of my 2020 tax prior to filing. How do we work around this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

To resolve this issue, try two troubleshooting steps:

First, revisit the section for the Self-employment tax deferral entry by following these steps:

- Return to the Deductions & Credits section.

- Scroll to Tax relief related to COVID-19 and Show More.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Select Continue.

- At Tell us how much you'd like to defer, "Enter amount" should be blank.

- Select Continue.

- If you do not want to defer any self-employment income, "Enter your eligible self-employment income" should be blank.

- Scroll down and select Wrap up Tax Breaks and Continue.

- At Charitable Cash Contributions under Cares Act, if you made cash donations to eligible organizations, enter the amount up $300 for married filing jointly ($150 for single) and Continue. Otherwise, leave this section blank, do not add 0 if this is not applicable.

- I recommend running through the Federal Review again.

Secondly, if the error is still in the return:

- Delete the Sch SE that applies--(Sch SE-T is for Taxpayer, Sch SE-S for Spouse)--by following these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to Sch SE-T and/or Sch SE-S and select Delete Selected Form and Continue.

- Return to Deductions & Credits and scroll down to Tax relief related to COVID-19.

- Select Self-employment tax deferral and Revisit.

- Do you want more time to pay your self-employment tax? select No.

- Tell us how much you'd like to defer. Enter zero and Continue.

- Review the return again.

[Edited 02/10/2021 | 5:14 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

@KathrynG3 - I really appreciate all the troubleshooting you provided, however, I'm afraid neither one worked.

The first troubleshoot ended abruptly when it said I was not eligible for deferment since I am receiving a refund so the rest of the steps could not occur.

I then went through the second troubleshoot, deleted the form, completed all the rest of the steps and the review shot me right back to the Sch SE-T line 18 box to be filled out.

I feel like I'm in the Twilight Zone. TurboTax is telling me I am not eligible for the deferment but is preventing me from being able to file because it needs to know how much I'd like to defer?

What am I to do next?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

Yes, you may have to delete the form again to correct the error. To edit form Schedule-SE, follow the steps below:

- Login to Turbo Tax.

- Jump to Business tab, then click Business taxes..

- Click Self-employment taxes, then continue.

- The screen "Some of your self-employment taxes maybe eligible for deferral" click continue.

- Answer Yes on "Did you want more time to pay your self-employment taxes?".

- Next screen, "Enter the net self-employment income you earned from March 27, 2020 through December 31, 2020, or if you received steady self-employment income throughout the year, enter 76.5% of self-employment income", enter zero here. The next screen will show how much self=employment taxes you may defer, enter zero again

(edited 02/09/2021 @ 4:37 PST)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

My estimated taxes have already been entered on my 1040-ES and is not my issue.

Per TurboTax, I do not qualify for social security deferment and yet TurboTax will not let me move past

Sch SE-T line 18, a form mind you I have already tried to delete, so TurboTax is blocking me from being able to file my taxes.

Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

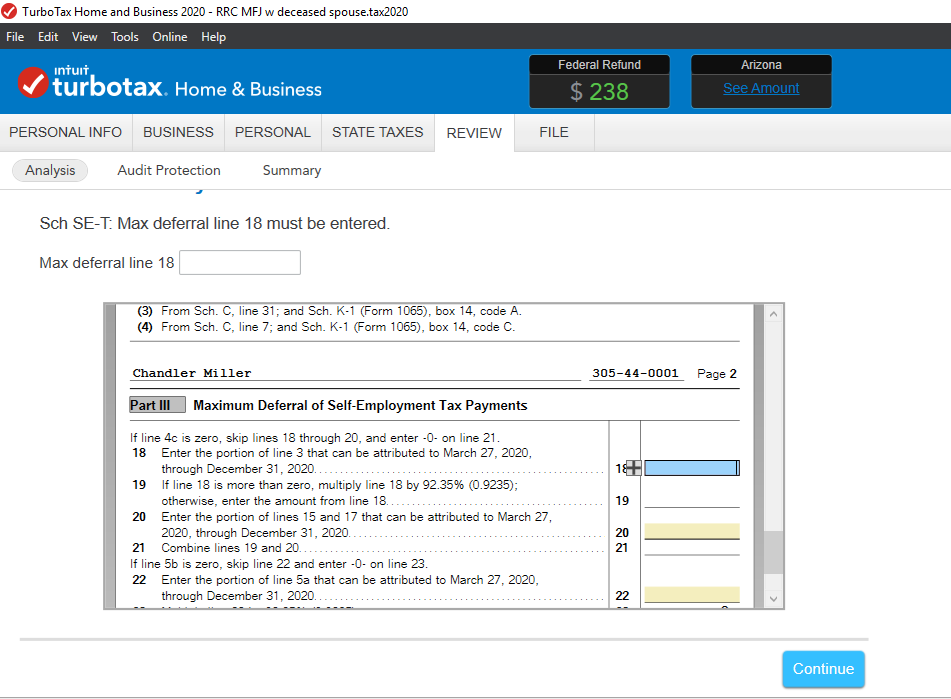

The problem is you do not qualify for deferral of self-employment tax, since you've paid all of your tax already through estimated payments (and are getting a refund) . The workaround is to enter zero in the error check. See screen shot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

I guess I'll just have to start over with a new question feed. The last three responses haven't addressed it and have talked about things that do not pertain to my situations. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

I appreciate your reply and I am hoping to get some clarification from you.

By putting a zero in that box, I am saying I made zero income from March through December. Since that is false, I'm uncomfortable putting anything on my tax form that is not true.

Is that not what the box is asking for?

Thank you for your patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

It would be helpful to have a TurboTax ".tax2020" file that is experiencing this issue. Send us a “diagnostic” file that has your numbers, but otherwise, will not include your personal information. That may help to diagnose the issue.

If you would like to do this, here are the instructions:

In TurboTax Online: From the left menu, select Tax Tools and Tools.

Scroll down to Share my file with Agent.

Reply here with the token number and I'll be able to open a TurboTax file.

In TurboTax CD/Download: On your menu bar at the very top, click “Online” and then “Send Tax File to Agent”.

When you click to send, you will get a pop-up with a token number.

Reply here with the token number and I’ll be able to open a TurboTax file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

My token number is 732767.

Thank you VERY much for continuing to try and help!

I am hopeful my data may provide the information you need to help me file.

Thanks again so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

I have reviewed the file you sent. Thank you! I found this error to be resolved in two ways~

Option 1: Enter 0, which you were saying did not appeal to you since income was earned during that time frame. The 0 would be ok in that it is the amount you wish to calculate any deferral, but I understand your point.

Option 2: In your case, TurboTax calculates that you are not eligible by entering 279/365ths of your income. (percentage for days of the year Mar-Dec)

Therefore, enter the percentage of income applied pro rata. In your case, this should result in the conclusion that you are not eligible and let you continue.

In TurboTax Online, prompt the Federal Review which will generate the error. Adjust the value of income attributable to March 27-Dec 31 (280/366ths of your self-employed income) from the Check this Entry section.

In TurboTax CD/Download, follow these steps:

- Go to the Forms mode, scroll in the left menu to Sch SE-T.

- Scroll down to Line 18 and enter 280/366 of your self-employed income.

- Return to the Step-by-Step and run the Review again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

I really appreciate your reply and I'd like to get clarification, because I'm not sure I understand what you mean by "Adjust the value of income attributable to March 27-Dec 31 (280/366ths of your self-employed income) from the Check this Entry section."

Do you mean I need to figure out how much I made in that date span, enter it on line 18 (even though I do not want to defer anything) and since TurboTax already says I am not eligible, once that figure has been entered, TurboTax will simply move on to my next step to file?

Again, thank you very much for all of your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm self-employed, paid all my estimated taxes prior to filing, I'm being asked to fill in a box on 'Sch SE-T: Max deferral line 18 must be entered'??? What is this?

Correct. It is allowable to calculate the total income for 2020 by 280/366 to determine this value, even though that may not be exactly how it was received.

What I meant to say is: In TurboTax Online,

- Run the Review, but expect to have the error unresolved still.

- Enter the partial period income as described above

- Finish the Review (Run the Review again if you want to confirm the resolution).

- This action should resolve the issue, and it will not defer any tax since it ends up you aren't eligible.

- File your return!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bagator1

New Member

Omar80

Level 3

bob

New Member

pivotresidential

New Member

Al2531

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill