- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

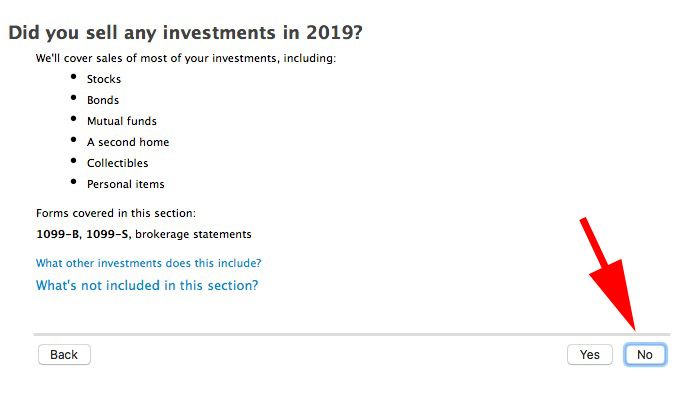

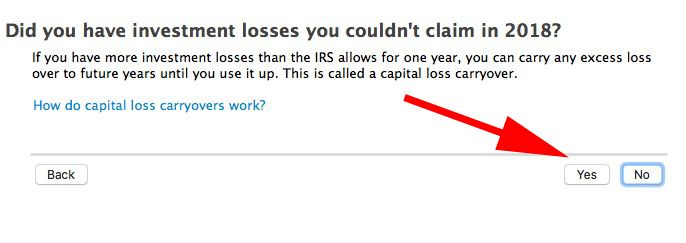

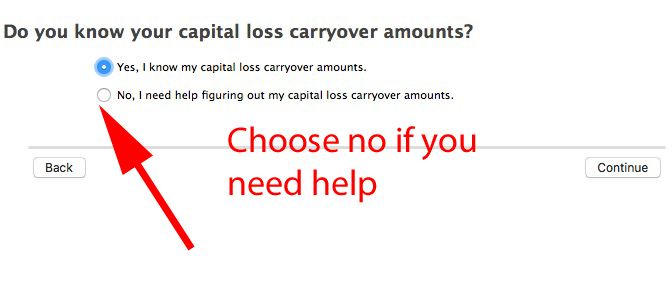

You can enter it manually.

If you transferred last year's TurboTax return over, you don't have to do a thing—we've already entered it for you.

Otherwise, just open your TurboTax return, search for capital loss carryover, and then select the Jump to link in the search results.

We'll take you to the screen where you can enter that info from your prior year return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

There appears to be a bug in the transferred amount but I am not sure that the coming fix properly addresses the issue. The workaround to to manually enter the correct carry-over amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

Coleen,

Thanks, I really appreciate the reply. In the capital loss carryover bucket I see the following:

- 2018 -$1,852 (I did prepare my taxes with turbo tax last year)

- 2019 there's a $0.

It looks like a software issue to me, (i.e. the carryover amount is incorrectly flowing to prior year) but maybe I'm missing something.

Is there a tax code reason that I'd be ineligible for the carryover? Positive AGI and owe the IRS net of the carryover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

Can someone ( @ColeenD3) at Intuit confirm that this is in fact a bug. Is there a fix/patch that will be rolled out? If not, can someone walk me through entering the loss manually as a work around? Also, I'm getting an access denied message when I try and click through on the link in @macuser_22 note.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

@jbryan1 wrote:

Can someone ( @ColeenD3) at Intuit confirm that this is in fact a bug. Is there a fix/patch that will be rolled out? If not, can someone walk me through entering the loss manually as a work around? Also, I'm getting an access denied message when I try and click through on the link in @macuser_22 note.

Thanks!

The article is gone - probably because it was fixed or will be in the upcoming update.

If you already started your 2019 tax return then the fix makes not difference. You can only transfer form 2018 as the first step in a new tax return and people that did not use TurboTax in 2018 cannot transfer anyway.

Simply enter your 2018 carry forward loss in the Schedule D interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

Thanks for the quick reply. So, you're saying I'd have to start my return from scratch to see the fix to the carryover bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

I think the 0 in the 2019 column might be right.

On the income page The 2019 column shows the carryover to 2020 (not your current loss for 2019). Schedule D doesn't actually show the carryover amount. To find your Capital Loss Carryover amount you need to look at your return schedule D page 2. Line 16 will be your total loss and line 21 should be a max loss of 3,000. The difference between line 16 and 21 is the carryover loss for next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

@VolvoGirl There is (or was a bug) in transferring 2018 into 2019 if the 2018 1040 "would" have been a negative number if a negative number was allowed on line 10. TurboTax transfers a 0 instead of the correct negative number that the IRS carry over worksheet specifies be used.

@jbryan1 Yes, that is exactally what I am saying. I have not actually tested this with a new 2019 return and a 2018 transfer to see if they really fixed this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

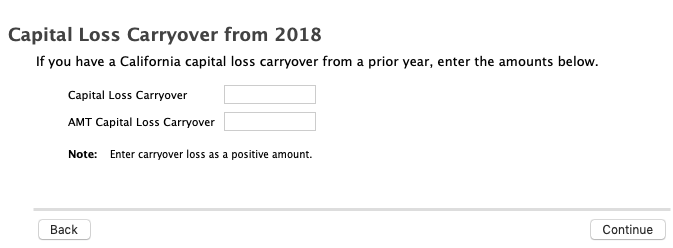

Hi, on the 2019 form it actually notes entering the carryover loss as a positive amount, so negative number does not make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a capital loss carryover. Why does it show as a negative amount in prior year, but $0 in current year?

Yes, although the loss is referenced as a negative number (since it is a loss), you still enter the amount as a positive number on the capital loss carryover screen. @talez

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

titan7318

Level 1

Jim_dzg5zg

New Member

DIY79

New Member

Ed-tax2024

New Member

fantomemast

New Member