- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Please try these steps to fix the rejection issue:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

Please let me know if this worked for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Same thing happened to me, from what I can tell they left the word “Covid-19” off of form 8915-f as reason for distribution. I have no clue how to fix, pretty sure it’s turbo taxes way of getting more folks signed up for the premium tax filing package. I’ve used them for a decade now and thinking I’ll do something different next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Please try these steps to fix the rejection issue:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen I selected the blank entry and click "back"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and continue.

Another option is to delete "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Same thing happened to me. I already paid for web TurboTax filing but ended up getting a desktop TurboTax which cost me additional $50, but seemed to be the only way to remove the word “Covid 19” manually from the worksheet other than printing the forms out and mailing them. Worked like a charm though. I removed it, resubmitted and my returns were accepted by both IRS and NY State within minutes. Shame on you TurboTax. It’s March 11th and the worksheet is still incorrect. Unacceptable!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

I deleted the 8915-F and started over then it was accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Deleting the 8915F and then going back and redoing it worked. It was accepted after I did. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

This did not work for me. My 8915F looks exactly as it did in 2021 but is still getting rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Did you try the solutions from Tax Expert, DanaB27 in this discussion thread to fix Form 8915-F rejection code? If you did and your return is still getting rejected, please let us know so we can further assist you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Hi, yes, I tried both sets of instructions (second being delete the form and re-input the data). Still getting rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

If you have tried fixing the error and are still having your tax return rejected, you can print your return and file by mail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

mine is not being rejected i havent gone through with the file yet because it doesnt seem to be calculating the additional money i owe for the 3rd installment ....after reading about all the rejections im terrified of filing until its fixed and because it is the same amount due after the 3/9 notice of availability its obviously NOT seeing the form....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

IRS form 8915-F should be available for electronic filing.

Are you simply reporting the third year of a 2020 Qualified Disaster Distribution or something else? Did you make any repayments? Did you have other disaster distributions for other years?

If you are reporting the third year of a Qualified Disaster Distribution, you will report 1/3 of the 2020 distribution. In TurboTax Online, follow these steps to the screen Did You Take a 2020 Qualified Disaster Distribution:

- Down the left side of the screen, click on Federal.

- Down the left side of the screen, click on Wages & Income.

- Click Edit / Add to the right of IRA, 401(k), Pension Plan Withdrawals.

- At the screen Here's your 1099-R info, click Continue.

- Continue to the screen Did You Take a 2020 Qualified Disaster Distribution.

If you are reporting the third year of a Qualified Disaster Distribution, you will report 1/3 of the distribution:

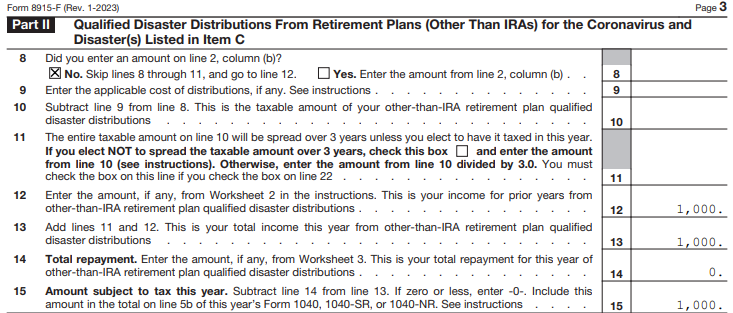

- on lines 11 and 13 for retirement plans (other than IRA's) or

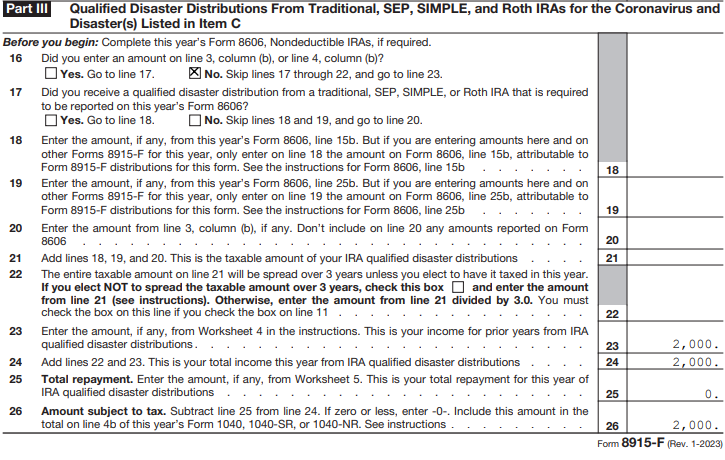

- on lines 22 and 24 for traditional, SEP, SIMPLE and Roth IRA's?

If you reported $1,000 on lines 11 and 13 of the screen Did you take a 2020 Qualified Disaster Distribution?, IRS form 8915-F would look like this. $1,000 would be reported on line 5b of the Federal 1040 tax return.

If you reported $2,000 on lines 22 and 24 of the screen Did you take a 2020 Qualified Disaster Distribution?, IRS form 8915-F would look like this. $2,000 would be reported on line 4b of the Federal 1040 tax return.

To be able to electronically file, there is a workaround concerning checking the box If this was a Coronavirus-related distribution reported in 2020, check here at the screen Did you take a 2020 Qualified Disaster Distribution.

Please see @DataB27's explanation here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed and federal rejected my return bc of the 8915F form for Cares Act early withdrawal. Now it doesn’t help me fix whatever is wrong. Anyone else have this happen?

Thanks JamesG1. This time it worked!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ronscott2003

New Member

caitastevens

New Member

bob

New Member

wcrisler

New Member

csilerm

New Member