- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

IRS form 8915-F should be available for electronic filing.

Are you simply reporting the third year of a 2020 Qualified Disaster Distribution or something else? Did you make any repayments? Did you have other disaster distributions for other years?

If you are reporting the third year of a Qualified Disaster Distribution, you will report 1/3 of the 2020 distribution. In TurboTax Online, follow these steps to the screen Did You Take a 2020 Qualified Disaster Distribution:

- Down the left side of the screen, click on Federal.

- Down the left side of the screen, click on Wages & Income.

- Click Edit / Add to the right of IRA, 401(k), Pension Plan Withdrawals.

- At the screen Here's your 1099-R info, click Continue.

- Continue to the screen Did You Take a 2020 Qualified Disaster Distribution.

If you are reporting the third year of a Qualified Disaster Distribution, you will report 1/3 of the distribution:

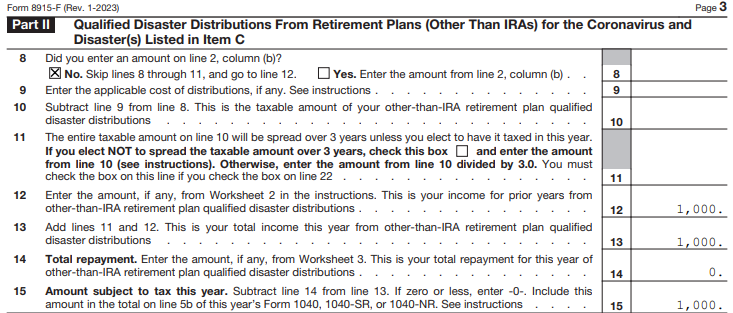

- on lines 11 and 13 for retirement plans (other than IRA's) or

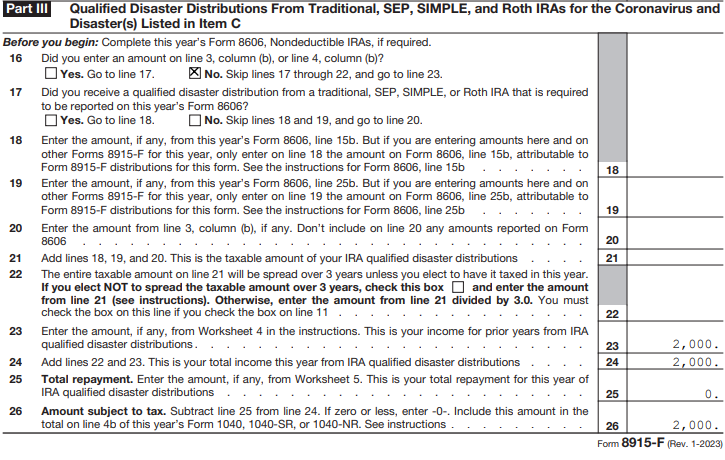

- on lines 22 and 24 for traditional, SEP, SIMPLE and Roth IRA's?

If you reported $1,000 on lines 11 and 13 of the screen Did you take a 2020 Qualified Disaster Distribution?, IRS form 8915-F would look like this. $1,000 would be reported on line 5b of the Federal 1040 tax return.

If you reported $2,000 on lines 22 and 24 of the screen Did you take a 2020 Qualified Disaster Distribution?, IRS form 8915-F would look like this. $2,000 would be reported on line 4b of the Federal 1040 tax return.

To be able to electronically file, there is a workaround concerning checking the box If this was a Coronavirus-related distribution reported in 2020, check here at the screen Did you take a 2020 Qualified Disaster Distribution.

Please see @DataB27's explanation here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"