- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax ...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

People posting solutions to questions that arn't asked in the forms anymore and it's only been a week, what a garbage website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

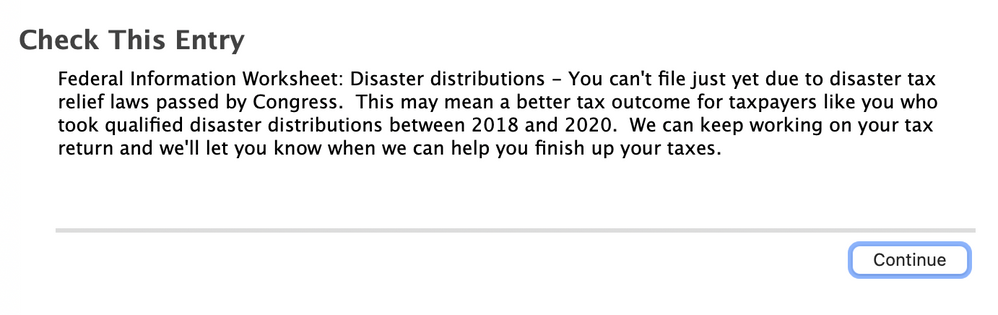

So I click "no" and I still can't e-file the return. This message keep coming up:

Federal Information Worksheet: Disaster distributions - You can't file just yet due to disaster tax relief laws passed by Congress. This may mean a better tax outcome for taxpayers like you who took qualified disaster distributions between 2018 and 2020. We can keep working on your tax return adn we'll let you know when we can help you finish up your taxes.

Help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

You may be able to delete the form at Tax Tools / Tools / Delete a form, but there may be an entry in the software that re-generates form 8615.

Did you take a disaster distribution from your pension funds between 2018 and 2020? A disaster distribution allowed you to spread the distribution over three 1040 tax returns.

If so, IRS Form 8915 will be needed to complete your tax return but that form is not yet available. See this TurboTax Help.

If you did not take a disaster distribution from your pension funds between 2018 and 2020, there may be a question that needs to be reviewed. Follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

Now watch the headings under Federal closely.

- When you are in Deductions & Credits.

- Scroll down and click on Wrap up tax breaks.

- Then you are in Other Tax Situations.

- Scroll down and click on Let's keep going.

- Continue through to Federal Review.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

What about if you took money from the CARES act?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I had the same exact issue. When I try to amend my answer it won't change my answer and it says "needs review" every time I answer no to both questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Did you mean that you took a disaster distribution from your pension funds between 2018 and 2020? A disaster distribution allowed you to spread the distribution over three 1040 tax returns. Or do you mean something else? Please clarify.

If so, IRS Form 8915 will be needed to complete your tax return but that form is not yet available. See this TurboTax Help.

If you did not take a disaster distribution from your pension funds between 2018 and 2020, follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

- Then run through the tax return through Review.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I think I can help with the majority of concerns here ( I am the original poster for the thread lol)

Many people check "Yes" on the box during the Disaster Distribution Questions because it says, "This includes distributions for CVOID-19 under the CARES Act of 2020". So when people see that, we think the check "yes" if you received a Stimulus in 2020. Maybe the wording of this question needs to be reworked, but it seems to be mainly about if you withdrew from your retirement for COVID (at least I think). If any Tax Expert can help clear this up for everyone, that would be great.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

In general, section 2202 of the CARES Act provides for expanded distribution options and favorable tax treatment for up to $100,000 of coronavirus-related distributions from eligible retirement plans (certain employer retirement plans, such as section 401(k) and 403(b) plans, and IRAs) to qualified individuals, as well as special rollover rules with respect to such distributions.

A coronavirus-related distribution is a distribution that is made from an eligible retirement plan to a qualified individual from January 1, 2020, to December 30, 2020, up to an aggregate limit of $100,000 from all plans and IRAs.

The distributions generally are included in income ratably over a three-year period, starting with the year in which you receive your distribution. For example, if you receive a $9,000 coronavirus-related distribution in 2020, you would report $3,000 in income on your federal income tax return for each of 2020, 2021, and 2022. However, you have the option of including the entire distribution in your income for the year of the distribution.

Use this link for additional information: Corona Virus Related Distribution - IRS

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I took money from my 401k in 2020 under the cares act and I did split my taxes into 3 payments.

What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

The form that you need in order to finish and file your return is Form 8915-F. This form is used to report a disaster-related retirement distribution, and any repayments of those funds. It also allows you to spread the taxable portion of the distribution over three years, if needed, and reports prior-year distribution amounts to be taxed in 2021. Form 8915-F replaces Form 8915-E.

Form 8915F will be available on 03/24.2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

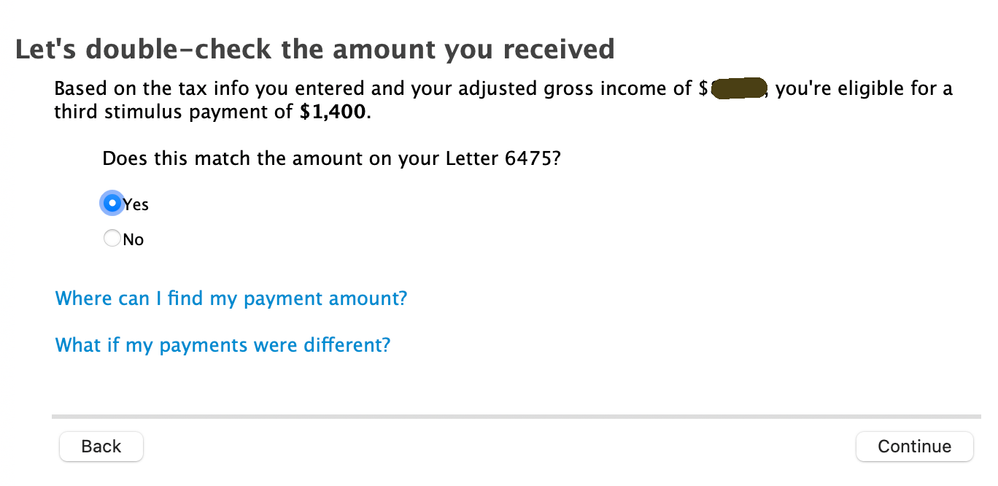

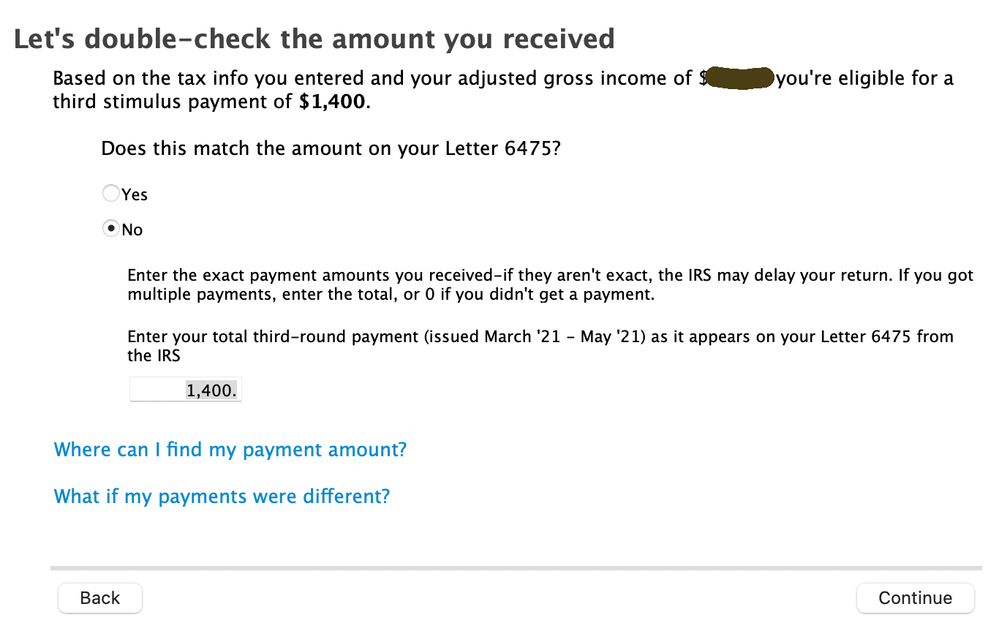

I'm posing some images just to clarify the problem of my case (I'm using a desktop version). Thank you for helping.

Image 1: I can't e-file if I click "yes". The Image 3 text comes up when I tried to e-file. If I choose paper file, the app tells me there is an error and I should get it fixed before I sent it out.

Image 2: I can't e-file with this option either because I did receive a third stimulus payment. The Image 3 text comes up when I tried to e-file. If I choose paper file, the app tells me there is an error.

Image 3: This is the text that comes up when I used the Smart Check feature.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Actually the error you are receiving is not related to the Stimulus Payments screens you posted.

There should be a page in the step-by-step section of your return where you can answer the question about disaster distributions with 'No'.

If you entered any Form 1099-R in your return you will have already seen that question one time, but there is another one out there for users who did not enter any Form 1099-R information.

Please try the following steps if you are using a CD/downloaded version of TurboTax:

- Go to Wages & Income at the top of the screen (or Personal > Personal Income)

- Click I'll choose what I work on

- Scroll to the bottom of the section without making any changes and click Done with Income

- Continue moving forward until you see a question about whether you took a disaster distribution in 2020 and select 'No'

- Run the Federal Review again to see if the error has cleared

If you have tried these steps and you did not see a question about the disaster distributions in 2020, then repeat the steps for the Deductions & Credits section of your return until the question is located.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

MarilynG1,

I can't thank you enough. This worked! Much, much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

MarilynG1, I can't thank you enough. This worked! Much, much appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Hello,

I am getting the same error message, however I did receive through the CARES Act during 2020. I received money through my university for housing, technology, and food and this is reflected in my account summary. I am unable to edit the final document. What do I need to do in order to file correctly?

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ericasteven2017

New Member

Veronicapena25

New Member

KELC

Level 1

wphannibal

New Member

mudtech61

Level 1