- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

If you did not take money out of your retirement accounts such as a 401(k) account or IRA account, then this does not apply to you. The money you received through your university may or may not be taxable income and it does not impact your 2021 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Great! Good to know! Definitely a poorly worded question then.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Same problem here. Please advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I did take money from IRA in light of the CARES act, am finished with the return, but get the message:

"Federal Information Worksheet: Disaster distributions - You can't file just yet due to disaster tax relief laws passed by Congress. This may mean a better tax outcome for taxpayers like you who took qualified disaster distributions between 2018 and 2020. We can keep working on your tax return and we'll let you know when we can help you finish up your taxes."

It's getting close to the date and I would really like to file asap. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

@christian36 Try this procedure so that you can file your tax return -

Did you take a disaster distribution from your pension funds between 2018 and 2020? A disaster distribution allowed you to spread the distribution over three 1040 tax returns.

If so, IRS Form 8915 will be needed to complete your tax return but that form is not yet available. See this TurboTax Help.

If you did not take a disaster distribution from your pension funds between 2018 and 2020, there may be a question that needs to be reviewed. Follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

Now watch the headings under Federal closely.

- When you are in Deductions & Credits.

- Scroll down and click on Wrap up tax breaks.

- Then you are in Other Tax Situations.

- Scroll down and click on Let's keep going.

- Continue through to Federal Review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

That is scheduled to be available 3/31/2022

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

richa816 I was in the same boat you were and when I finally did the steps, it took me right on through. Thank you! I was so confused! lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I took a disaster relief for covid from my 401k. When I filed in 2021 I broke the tota amount in to three years. When I’m trying to file this year it is having me pick a disaster and I do not see covid as an option? What am I doing wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

You are right. Inv 20057 has confirmed an issue with the 8915-F today. Please have patience while the programmers make adjustments.

@mwheidel

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

Do we have an ETA on the fix for those of us who took an early withdrawal in 2020 due to Covid, and the error I am getting when I try to file telling me that I "can't file just yet"? I DID take out the money in 2020 and I DID spread it out over 3 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

@stillettoz wrote:

Do we have an ETA on the fix for those of us who took an early withdrawal in 2020 due to Covid, and the error I am getting when I try to file telling me that I "can't file just yet"? I DID take out the money in 2020 and I DID spread it out over 3 years.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

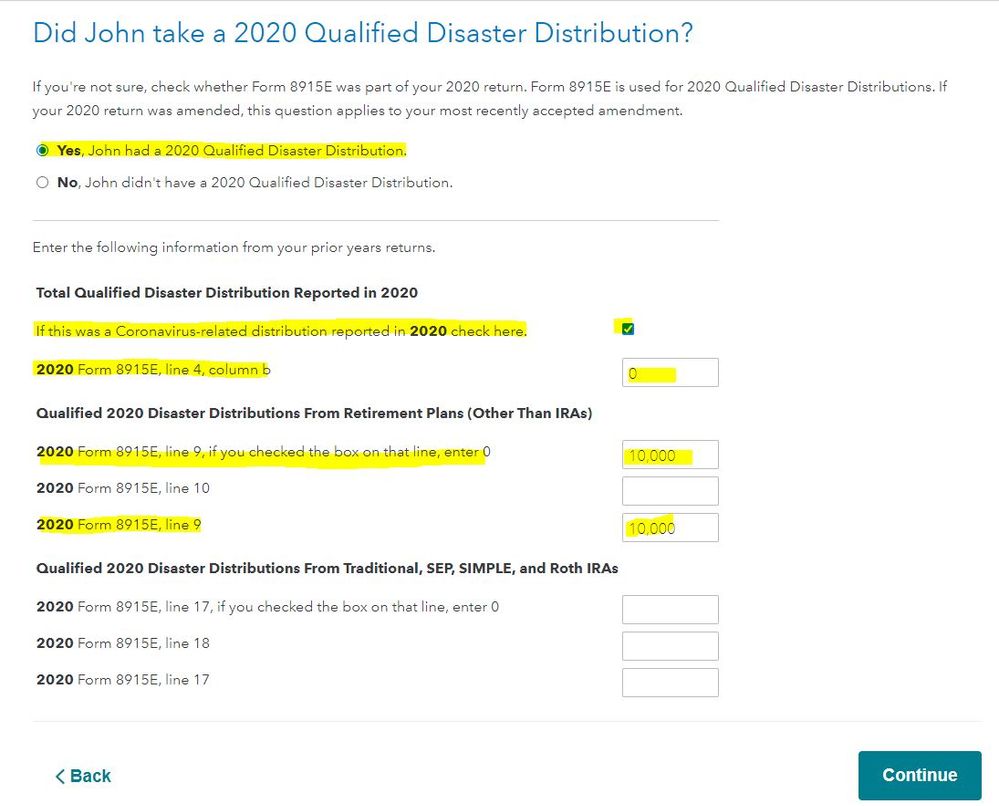

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

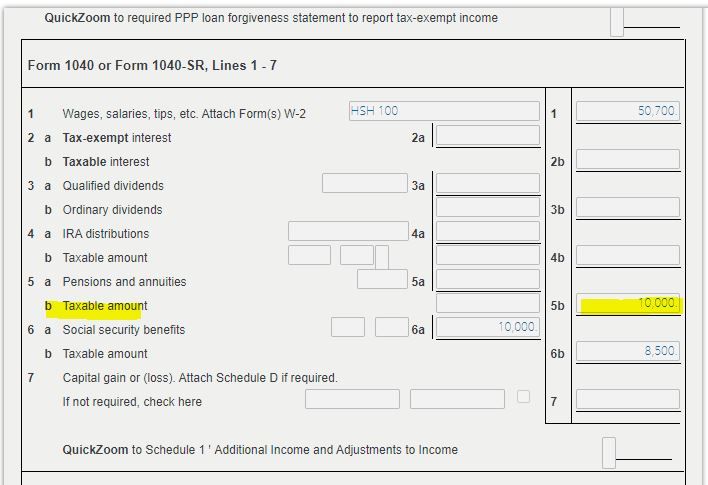

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

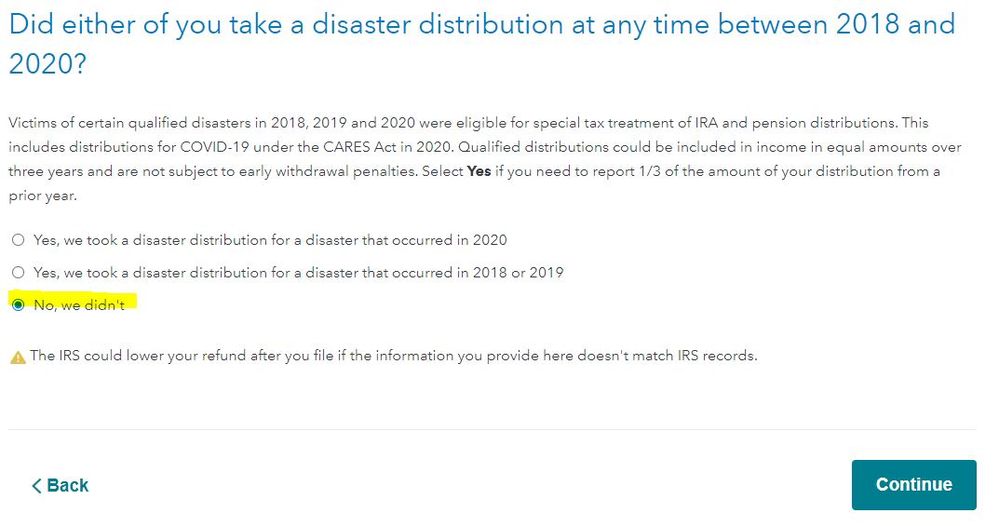

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

Screenshots from the online editions -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

I had them take at 20% from my distribution to cover taxes. Did the the full 20% get applied to the 1/3 I claimed on my 2020 taxes or does it get broken in to thirds to cover each of the 3 years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

@mwheidel wrote:

I had them take at 20% from my distribution to cover taxes. Did the the full 20% get applied to the 1/3 I claimed on my 2020 taxes or does it get broken in to thirds to cover each of the 3 years?

All the federal income taxes withheld from the 2020 distribution were entered on the 2020 tax return as a tax payment and would have been included in the 2020 tax refund that you received.

The taxes withheld cannot be spread over three years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

how can I check if I spread my disaster distribution from my 401k over 3 years? I seriously don't recall. when I check my last years tax return the only form I see is 5329. Please help I cant finish filing because I'm getting the message "You cant file just yet due to disaster tax relief laws passed by congress"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I cant file my federal tax return because it keeps mentioning "Cant file due to disaster tax relief laws passed by Congress". Any idea why?

@aredrose101 wrote:

how can I check if I spread my disaster distribution from my 401k over 3 years? I seriously don't recall. when I check my last years tax return the only form I see is 5329. Please help I cant finish filing because I'm getting the message "You cant file just yet due to disaster tax relief laws passed by congress"

If your 2020 tax return did not include a Form 8915-E then you did not request to have the 2020 distribution spread over three years due to Coronavirus-related issue.

Try this procedure so that you can file your 2021 tax return if you did not have a disaster distribution or you did not spread a 2020 distribution from a retirement account over three years.

If you did not take a disaster distribution from your pension funds between 2018 and 2020, there may be a question that needs to be reviewed. Follow these steps.

- Go to Federal / Wages & Income.

- Scroll down to Wrap up income.

- Continue.

- At the screen Did you take a disaster distribution at any time between 2018 and 2020? answer No.

Now watch the headings under Federal closely.

- When you are in Deductions & Credits.

- Scroll down and click on Wrap up tax breaks.

- Then you are in Other Tax Situations.

- Scroll down and click on Let's keep going.

- Continue through to Federal Review.

If you've tried the previous steps and you did not resolve the question about the disaster distributions in 2020, then try the steps listed below

Go to Wages & Income

-

Scroll down to "Retirement Plans and Social Security

-

Select IRA, 401(K) Pension Plan Withdrawals(1099-R) = Continue (you don't need to add any income forms)

-

Have you ever taken a disaster distribution before 2021? = Yes (even if you didn't)

-

Did either of you take a disaster distribution at any time between 2018 and 2022? = No

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sravwijnbergen

New Member

ericasteven2017

New Member

Veronicapena25

New Member

KELC

Level 1

wphannibal

New Member