- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Bus...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

I have chosen the Standard Deduction for Federal but AZ State Tax calculates Itemized Deductions.

How to change it to Standard Deduction for the State (Arizona) so that I have Standard Deductions for the State as well?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Well, why would you want to change to standard deduction of AZ? The itemized deduction on AZ may be providing a better deduction than the standard deduction on the AZ return.

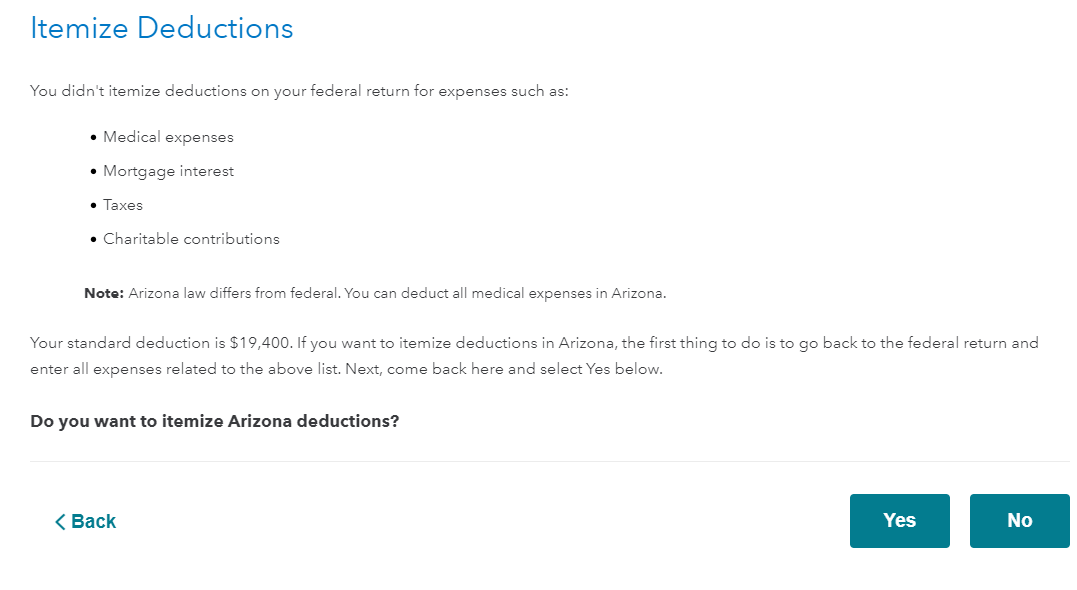

I created a similar return to identify if you can remove the itemized deduction and the screen below shows during the interview section of the AZ return. It is the screen after several adjustments. You can choose no that you do not want to itemize. See screenshot below.

However, an individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. For the most part, an individual may claim those deductions allowable as itemized deductions under the Internal Revenue Code. If claiming Arizona itemized deductions, individuals must complete and include Federal Form 1040, Schedule A, and, if applicable, an Arizona Schedule A with an Arizona return. These forms must be attached to their returns. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Thank you for your reply.

I presume the AZ screen you showed would show up if I reduce my expenses in the Federal Tax (Schedule C etc) ? No charity amounts etc - Correct?

If I reduce the business expenses then the federal tax liability increases even with taking a standard deduction

Although the Federal Return shows Itemized Deductions as higher, it allows the choice of Standard Deduction.

it seems AZ state in TT does not.

So is the only solution to buy a separate State tax module?

Or is there any other solution which will not increase the Federal tax due, But will allow AZ State Taxes to select Standard Deduction?

Thank You

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

No, that screen will show up if you are taking the standard deduction on the federal return. If you itemized on your federal return, Arizona would itemize as well and you won't see that screen. Add all of your expenses and TurboTax will give you the largest deduction. You can switch back and forth on your federal to see how it changes. That link will tell you how.

Business expenses have nothing to do with the standard or itemized deductions. Business expenses only reduce your business income.

You can take either the standard deduction or itemized deductions (line 12 of Form 1040) which reduce taxable income.

If you have a business profit that is generating self-employment tax - that tax can't be reduced by the standard or itemized deductions. And only business expenses can reduce business profits. You are better off taking the higher deduction (itemized or standard) on both your federal and Arizona returns. Taking the lower standard deduction on your AZ return will increase your taxes.

TurboTax will default and record the higher deduction on Line 12 of Form 1040. Some states make you use the same option as you used on your federal return. Arizona is not one of those states. You can choose either option, but TurboTax will default to the larger deduction - the amount that produces the lowest tax liability.

If you want to itemize on your Arizona state return, make sure you have entered all of your itemized deductions in the federal section or you can just itemize on the federal return. When you take the standard deduction for federal, TurboTax ignores the itemized deductions but they remain there in case they are needed for your state return.

There is only one module for each state. Each state module will prepare all available form options for that state.

What are itemized deductions? (they have nothing to do with Schedule C business returns)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Thank you for your reply

I have been choosing Std deduction for my Federal return all the time.

I got the "AZ itemized vs Std deduction" screen to show up Only after I reduced the Charitable Deductions by roughly half.

It does not show unless I reduce Charitable Deductions in Federal Return. I don't know what is the internal limit for these deductions that forces AZ state to be itemized without a choice to make it Standard.

Turbo Tax should fix this simple issue - is there a way to suggest this to TT

I finally went ahead and filed AZ as itemized with Federal as Standard Deduction.

Thank you for your help on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

I've been trying to get similar clarification with KY state tax. Why can't TT allow you to toggle between standard and itemized on the state taxes like it does for Federal tax? When you do this with the Fed tax you can see the benefit or tax difference and validate which is best and also try variations on deductions to see how to optimize in the future. It be nice if TT just said how to do this or that we can't do it manually to be clear for state taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Being able to see the form and understand the deductions goes a long way in making choices. For KY itemized deductions form and instructions, see here. It is a short form and very direct pulling information from the federal. There should not be a need for someone to choose between standard and itemized on the KY state return. Generally, if your deductions exceed $2,980, it will benefit you to itemize. There is no toggle since it is very straightforward.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Why can't I get an answer to my question? I'm not asking for tax advice. I want to know how to force TT to use itemized or standard deductions, manually, so I can see the difference. TT allows this for Fed, why not State? Just want someone to tell me how to do it on TT with a simple on/off like it does for Fed deductions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

I have the same question/issue for CA. I am able to pick standard deduction for Federal returns but TT automatically picks itemized deduction "assuming" that's what I'd want since its higher than Standard ded for State. TT should instead allow me to pick what I want. I am using TT Premier Online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

I think we have well established that TT won't let you independently choose between standard and Itemized State deductions, like it will with the Fed tax. The Fed input and decision drives the State output without the benefit of your opinion or special desire to change. I'm not a TT "expert", but I suspect you could create/save 2 TT files with the fed deductions being standard and itemized differently in each; creating 2 State tax forms that would allow you to submit the Fed tax one way and the State tax the other. I can't think of another way to force the issue as TT currently is currently structured.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

One of the TT expert suggested that the desktop version provides that option. I haven't tried it yet but will do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

Don't hold your breath. TT only allows you to choice and toggle it for the Fed tax and that drives the State. If we are all wrong, great, let us know when you try. I think your going to have to create a second Fed file and play with the fed side to see if you get what you need on the state side and keep it as a second file for state filing, separate from what you do on the Fed side. If TT is right, it should ulitmately be the same, because they say it does it for you and get the best answer, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

I would really like to see this question answered. I'm doing Married Filing Separately and need to switch CA state to Standard Deduction since that's what my spouse used but Turbo Tax doesn't have the option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

The statement that TT follows Fed choice for State isn't right either. I can already choose Std ded. for Fed but TT is picking item. ded for state (since it's larger of the two), which I don't want. If desktop version also doesn't support this, then I'd just end up not showing the deductions at all, in which case TT would default to std ded. for both fed and state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HT to change State (AZ) deduction from Itemized to Standard Deduction for AZ in TT Home & Business

To clarify, TT State does what it thinks is best based on the input you provide for the Fed deductions. It's clear that a Standard deduction for Fed doesn't preclude the itemized for State in TT. The issue we all have is that you can't evaluated and toggle the state as you can the Fed to either itemize or use standard. It's something that seems appropriate and within TT capability. Presumably the potential for taxpayers to make incorrect decisions when TT thinks you should be doing one or the other offsets the cost of the change and benefit to the limited few. I think everyone would be happy if TT put all this into the help literature and on their website. Way too hard to get answers about this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teewilly1962

New Member

jwicklin

Level 1

djpmarconi

Level 1

user17550205713

New Member

rtoler

Returning Member