- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Well, why would you want to change to standard deduction of AZ? The itemized deduction on AZ may be providing a better deduction than the standard deduction on the AZ return.

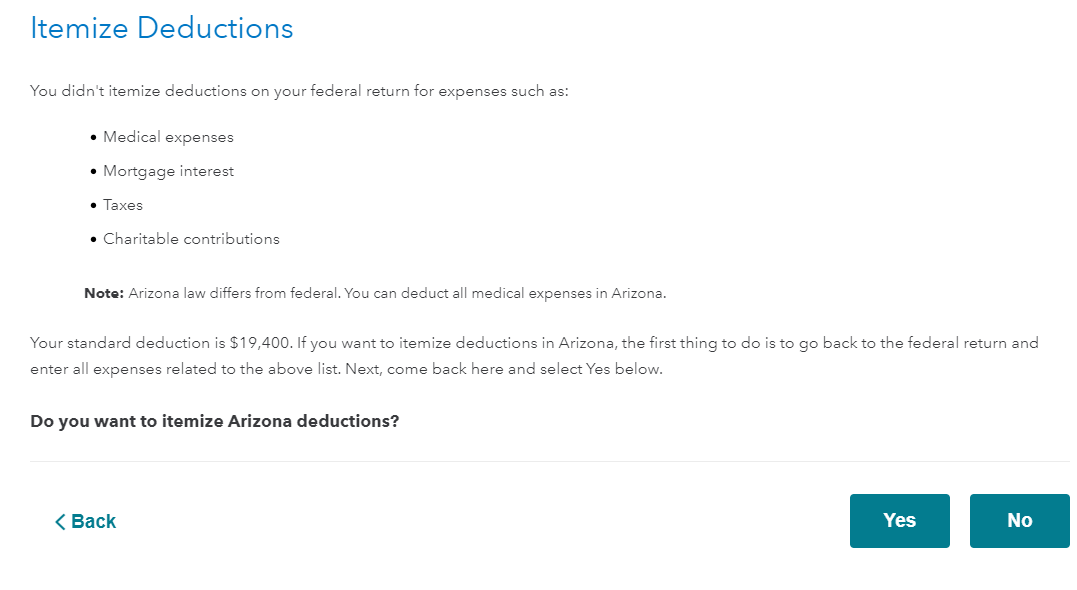

I created a similar return to identify if you can remove the itemized deduction and the screen below shows during the interview section of the AZ return. It is the screen after several adjustments. You can choose no that you do not want to itemize. See screenshot below.

However, an individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. For the most part, an individual may claim those deductions allowable as itemized deductions under the Internal Revenue Code. If claiming Arizona itemized deductions, individuals must complete and include Federal Form 1040, Schedule A, and, if applicable, an Arizona Schedule A with an Arizona return. These forms must be attached to their returns. For the standard deduction amount, please refer to the instructions of the applicable Arizona form and tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"