- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to send 1099-misc?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to send 1099-misc?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to send 1099-misc?

You can only prepare 1099Misc or 1099NEC in the online Self Employed version or the Desktop Home & Business program.

In the Online Self Employed version you use the Quick Employer Forms. The forms are efiled to the IRS and you print and mail them to your contractors and employees. you have to upgrade or Start an Online Self Employed version here,

https://turbotax.intuit.com/personal-taxes/online/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to send 1099-misc?

You can create those by visiting Quick Employer Forms.

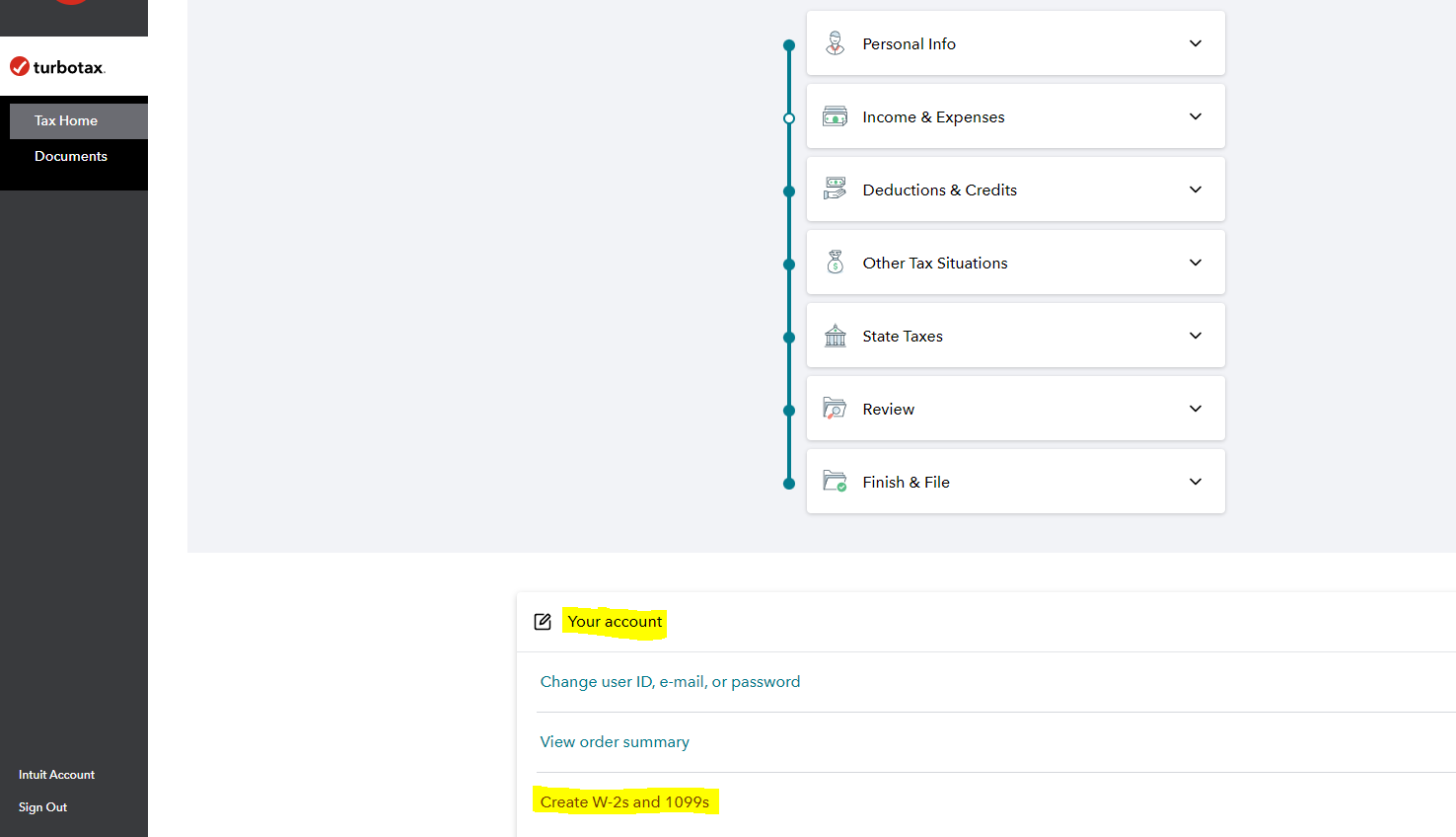

Additionally, please refer to the image below. You can login to your TurboTax Account and press on Tax Home on the left menu. Then scroll down till you see the option " Your Account ". Once you click on it, you should see an option to create 1099s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to send 1099-misc?

Everything that I've read says that bank rewards are not taxable. I cashed out points for $803 and the bank sent me a 1099-MISC. I have already filed my return for 2021 and did not include the $803 as income. D I need to do anything?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lfertorres5

New Member

Rocermj

New Member

hopelessdeadhead

New Member

drmusedeb

New Member

js7632949

New Member