- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

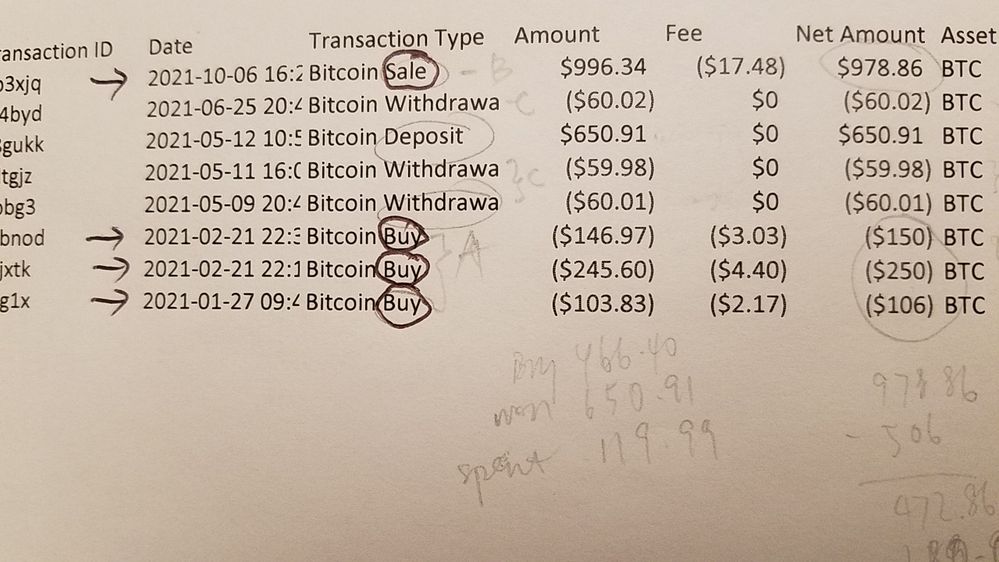

1) I bought some Bitcoin on 3 separate dates and eventually sold off everything in a single transaction 10 months later. Cash App sent me a 1099-B from Block, Inc but I couldn't find it there from the drop down list of selected financial institution in Turbo Tax. What should it be?

Note: I received a 1099-B with only Proceeds box filled with all the other boxes empty, and a cash app report CSV file.

2) When I came to the "Did you get a 1099-B or a brokerage statement for these sales?"

a) If I say YES, there is 2 options to choose from. If I choose "Import from my brokerage" but Cash App is not in the list.

If I choose "I'll type it myself", next page shows another drop down list of bank and brokerage, with the option to select "My bank/brokerage isn't here" and a new box opens up for me to write it. What should I write?

b) If I say NO, it will ask 'Tell us about this sale" with 2 options to either enter one at a time or enter a summary for each sale category.

If I choose one at a time, how do I enter 3 items that have different cost from different dates but with all sold off in a single transaction? It doesn't show which was sold at what price but just one sale proceeds (as in picture).

3) Do I have to mail out form 8453?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

how do I enter 3 items that have different cost from different dates but with all sold off in a single transaction?

The simplest way is to use the total cost of the three items and the proceeds from the three items on one line.

For Date Acquired enter "various".

when you have detailed all your transactions on your filed tax return, there is nothing to be mailed in under separate cover.

The name of the financial institution can be entered manually ; it doesn't matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

Anyone have any idea?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

how do I enter 3 items that have different cost from different dates but with all sold off in a single transaction?

The simplest way is to use the total cost of the three items and the proceeds from the three items on one line.

For Date Acquired enter "various".

when you have detailed all your transactions on your filed tax return, there is nothing to be mailed in under separate cover.

The name of the financial institution can be entered manually ; it doesn't matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

When I went ahead with step (b) and answered NO, I entered the date acquired, proceeds, description but this step did not ask for financial institution name. So when all is done, a summary page comes up with the gross proceeds and gain amount entered but ACCOUNT NUMBER blank and INSTITUTION NAME AS "No Financial Institution".

Does that look alright?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

those items are not required.

are you having fun yet ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

Did you ever get this figured out? I cant see where to find the cost basis or anything else. I had several buys, and bitcoin bonuses from card

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

Although Cash App is says that it can provide a 1099-B Proceeds statement, it may not be be helpful. See here.

Does your sales proceeds (such as above) report 'buys' from which you can infer the cost basis? Were the bitcoin bonuses reflected on the reports that you received?

In TurboTax Online Premier version, 1099-B Proceeds statements may be entered by hand or entered as a summary document. A .csv file may be uploaded from your computer.

You would be able to upload a .csv file by following these steps:

- Go to Federal / Wages & Income / Your income / Investments and Savings.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click Add investments.

- At the screen Let's import your tax info, click Enter a different way.

- Click on Cryptocurrency. Continue.

- Click on Upload it from my computer. Continue.

The .csv should follow this format.

- All the columns from the .csv file were deleted except for the five columns listed below.

- All other lines other than the headings and the five columns of data were deleted.

- Purchase Date

- Date Sold

- Proceeds

- Cost Basis

- Currency Name

This is the .csv file format.

A B C D E

purchase date date sold proceeds cost basis currency name

11/24/2020 2/1/2021 1,779.96 1,916.52 ABFOA

12/7/2020 4/1/2021 1,111.46 1,225.45 ABFOA

11/24/2020 3/1/2021 1,638.54 1,638.54 ABFOA

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

I have the exact same issue and have no clue, bc in all the tutorials where people input their transactions by hand theyre all super super and do not represnet issues with selling all for one price but buying for mulptile prices

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

Just total up your buys and make one entry ... use VARIOUS for the purchase date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

this has not been helpful at all. I have been trying to get my cost basis for over 2 months and I have not once received an ounce of real help. I've been sent links to forums that have not given any clear answers. every time I've tried to reach out to CashApp they inform me they don't report cost basis to the IRS and when I try to look it up in my .csv its never there. I do not know if I'm opening the document incorrectly or if me being at my job opening the document is getting blocked by work firewalls but still, I'm clueless and if i could get some clear direction on how even though i've been forced into full service i'm still not getting and help. At this point i've handed off my process to my expert and if i need to go back and fix something so I can correct this all i would have but i can't. please please I DO NOT KNOW WHAT I'M DOING HELP!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rweddy

Returning Member

tae111

Level 2

user17557017943

New Member

sunflower110603

New Member

anthonysalasr22

New Member