- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import Cash App 1099 as TurboTax doesn't seem to recognize the list of Financial Institution available?

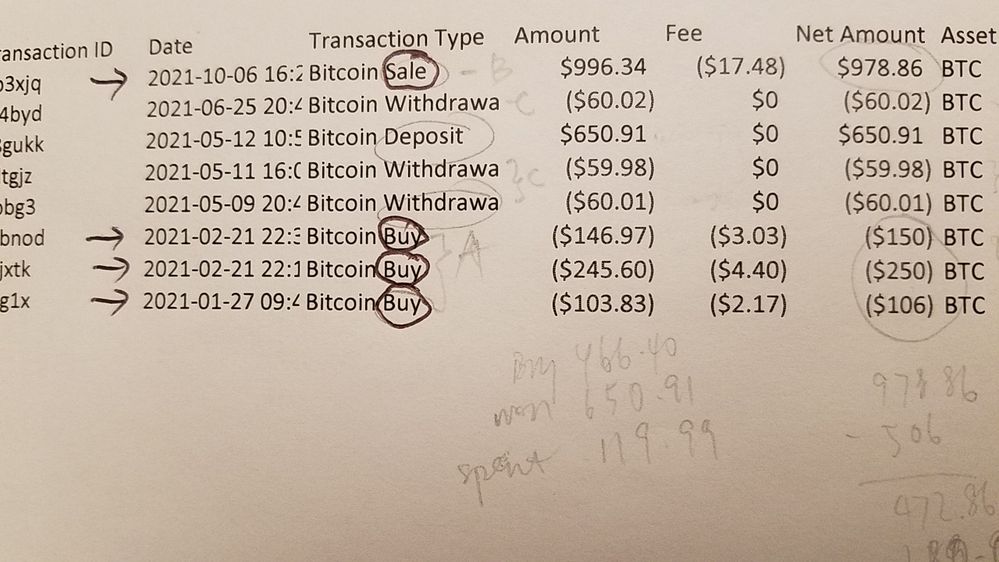

1) I bought some Bitcoin on 3 separate dates and eventually sold off everything in a single transaction 10 months later. Cash App sent me a 1099-B from Block, Inc but I couldn't find it there from the drop down list of selected financial institution in Turbo Tax. What should it be?

Note: I received a 1099-B with only Proceeds box filled with all the other boxes empty, and a cash app report CSV file.

2) When I came to the "Did you get a 1099-B or a brokerage statement for these sales?"

a) If I say YES, there is 2 options to choose from. If I choose "Import from my brokerage" but Cash App is not in the list.

If I choose "I'll type it myself", next page shows another drop down list of bank and brokerage, with the option to select "My bank/brokerage isn't here" and a new box opens up for me to write it. What should I write?

b) If I say NO, it will ask 'Tell us about this sale" with 2 options to either enter one at a time or enter a summary for each sale category.

If I choose one at a time, how do I enter 3 items that have different cost from different dates but with all sold off in a single transaction? It doesn't show which was sold at what price but just one sale proceeds (as in picture).

3) Do I have to mail out form 8453?