- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to import 2022 tax return file when half way through my 2023 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

I am almost complete my 2023 income tax returns just to find out that many data that should be carried over from 2022 is not there. Is there a way to add the 2022 tax file in the middle of the process for the 2023 return? Starting over just going to half day of effort that I have already put in. I am using Turbo Tax Desktop for MAC.

This help article mentions, "Select Begin and choose Use a tax return that's on my computer". But the interface shown on my Turbo Tax app very different prompt and does not show anything like a "Begin" button. It is very misleading.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

You have to do the transfer of the 2022 tax file at the very beginning----BEFORE you enter any 2023 information. You cannot transfer 2022 in when you are already in the middle of preparing the 2023 return. So...either you live with entering information from scratch this time or you clear it and start over.

Launch your program---- do you not see the word "Begin" to the left of the photo on that screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

There no such a word "Begin" or anything similar to the left on that screen. The online instruction is relevant and useless. It has been a terrible experience using Turbo Tax 2023 Desktop for MAC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

And...you are trying to use directions to transfer a pdf---which is next to useless. You need the tax file--not a pdf.

How to transfer last year’s return? https://ttlc.intuit.com/questions/190088

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

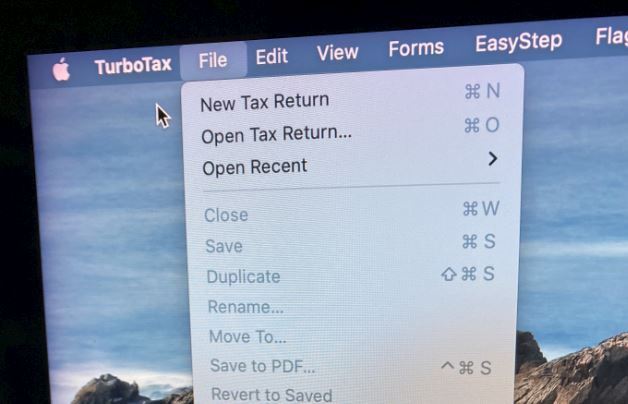

That article is right but won't help you. I assume you have the 2022 tax file on your computer? It ends in .tax2022. You can only transfer at the very beginning before you start a new return. So you would have to start over to transfer it and have to re-enter all your 2023 info again and ignore this return. To start a brand new return go up to the top Apple bar - File-New Tax return, see screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

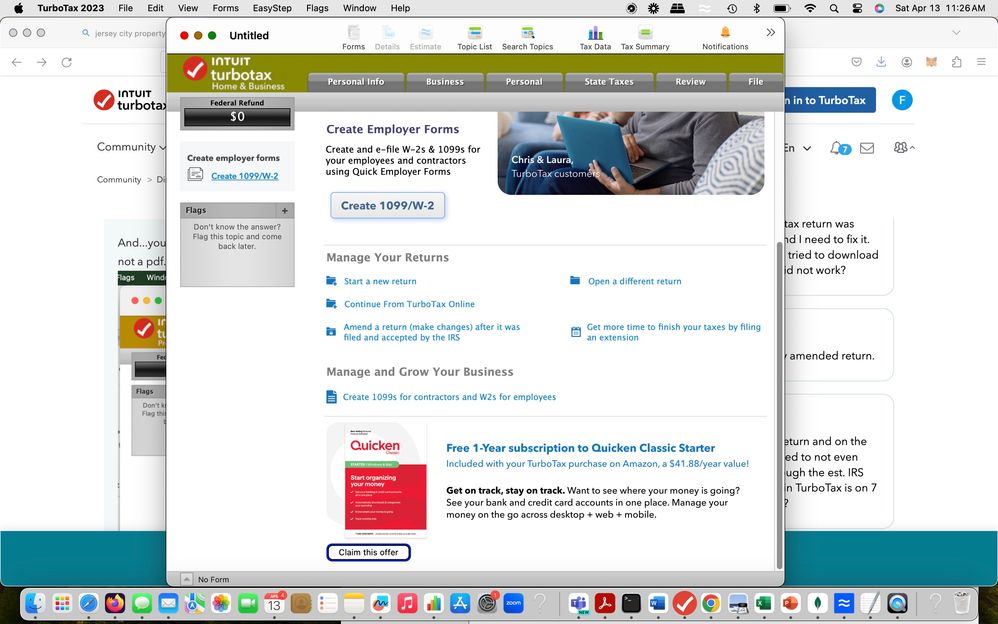

OK you have the Home&Business version. It works a little differently. To start a new return click on Start a New Return, first item under Manage Your Returns. Then on the next screen you probably have to pick start a new Individual tax return instead of a W2/1099 return. Can you make me a screen shot of that next screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

It is a such a critical step that Turbo Tax provided no proper instruction to users. When starting a new return, I followed all the prompt from Turbo Tax to input my info step by step. It asked me to log in with my user name but never asked me to import my 2022 return. I thought by logging in, it might have captured my past tax return data. At the end, we have to waste so much time and effort to start over again.

Very terrible user experience. This type of annoyance has happened a couple times in the past two years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

I have Premier on my Mac----so it may look a little different---but after clicking on Begin the next screen takes you to "Let's get a jump start on your 2023 taxes" and then it gives you a list to click whether you want to

use a tax return that's on my computer

Continue without transferring a tax return

Import from TurboTax online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

@CC-OceanBlue It asked you to log in with your username? That sounds like the Online version. You shouldn't need to log in after you get the program installed and start a new return. @xmasbaby0 is that right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

@VolvoGirl @CC-OceanBlue Correct. Once you have the download on your own computer there is no more "logging in" to start a return or to work on a return in progress. You just launch the program from your own hard drive and have at it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to import 2022 tax return file when half way through my 2023 tax return?

I know exactly what you mean. We use it because there's no better alternative around. Its mediocre software like Microsoft. You import your old filing by opening 2022 return in 2023 version. In Windows, the default file extension is *.tax2023 so not intuitive at all. You have to force it to look for all files. Not sure how that works in MacOS, but hopefully there's an all file mask you can use to open the .tax2022 file. From there, there will be steps to transfer the return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

schirgerdaniel3

New Member

canalessuzette

New Member

dennyrh01

New Member

npattersontherapist

New Member

luis_p

New Member