- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

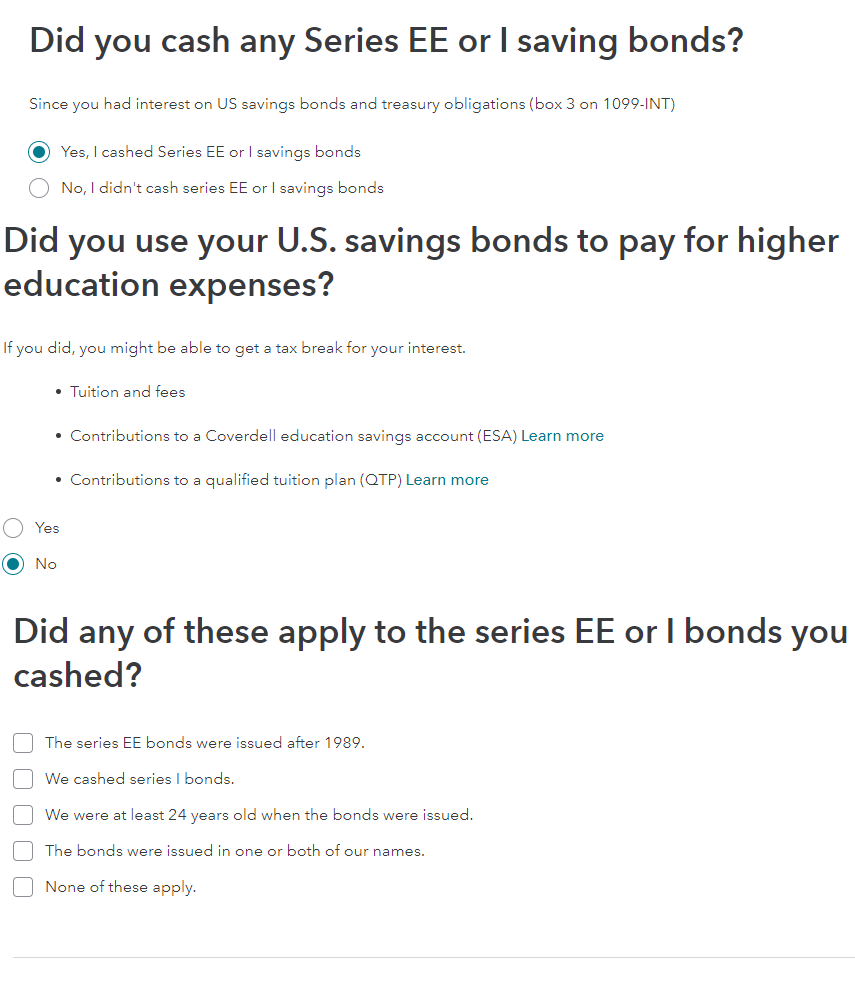

Here’s how to generate Form 8815 to exclude interest from Series EE and I U.S. Savings Bonds issued after 1989:

- After entering your Savings Bond interest in Box 3, go to the screen “Did you cash any Series EE or I saving bonds?”

- Tap YES, I cashed Series EE or I savings bonds, then Continue

- Tap YES on “Did you use your U.S. savings bonds to pay for higher education expenses?”

- On “Did any of these apply to the series EE or I bonds you cashed?” select all that apply

- Fill in your student and tuition info.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

This message . does not come up in my program

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

First make sure you have entered your 1099-INT form so that the questions for excluding the interest do come up. As indicated you must have an amount in Box 3. The screen images are shown below and TurboTax will auto generate Form 8815 if you qualify.

- Who Can Take the Exclusion

- You can take the exclusion if all four of the following apply.

- You cashed qualified U.S. savings bonds in 2022 that were issued after 1989.

- You paid qualified higher education expenses in 2022 for yourself, your spouse, or your dependents.

- Your filing status is any status except married filing separately.

- Your modified adjusted gross income (AGI) is less than: $100,800 if single, head of household, or qualifying widow(er); $158,650 if married filing jointly. See the instructions for line 9 to figure your modified AGI.

- You can take the exclusion if all four of the following apply.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

As with one other responder, I don't get any of these questions when I enter my 1099-int. Will I not even get the additional questions if my AGI exceeds $158K?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

Yes. You should see those screens even if your income is too high to claim the Saving Bond interest exclusion. TurboTax will tell you that your exclusion is 0.

Did you enter your Saving Bond interest in Box 3? You will not see those questions if you entered your interest in Box 1.

For 2022, the exclusion of interest from Series EE and I Savings Bonds used for educational purposes phases out when your modified adjusted gross income (AGI) is more than $100,800 if single, head of household, or qualifying widow(er) and $158,650 if married filing jointly.

At $158k, you are at the upper limit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

When I select 1099-INT from my Income Summary list I get to a screen where I see the interest earned from my brokerage accounts. When I select the "Add Interest Income" I get a screen where I type in the "Received from", and then check the box "My form has info in more that just Box 1", which I select. The options expand to include a Box 3, where I put my Savings Bond EE interest earned. From there is goes to the standard screen about uncommon situations, which there are none. From there is takes me back to the summary screen of interest payments. At no time is am I prompted with screens or questions on how that interest income is used. What am I missing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

Are you using TurboTax CD/Download? If you are, the savings bond questions come after the interest summary screen.

Tap Done on “Here’s the interest we have so far.” You will see “Did you use your U.S. savings bonds to pay for higher education expenses?”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to generate form 8815 to exclude interest from EE Savings bonds issued after 1989

Yes, a downloaded version, and thanks, that worked. I had not hit "Done" after being navigated back to the “Here’s the interest we have so far” page. Once I did that I am seeing the screens that allow me to select how the proceeds for interest on the EE bonds were used. Appreciate it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cirithungol

Returning Member

RicN

Level 2

Zmir

New Member

JudyJoy

Level 2

patamelia

Level 2