- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

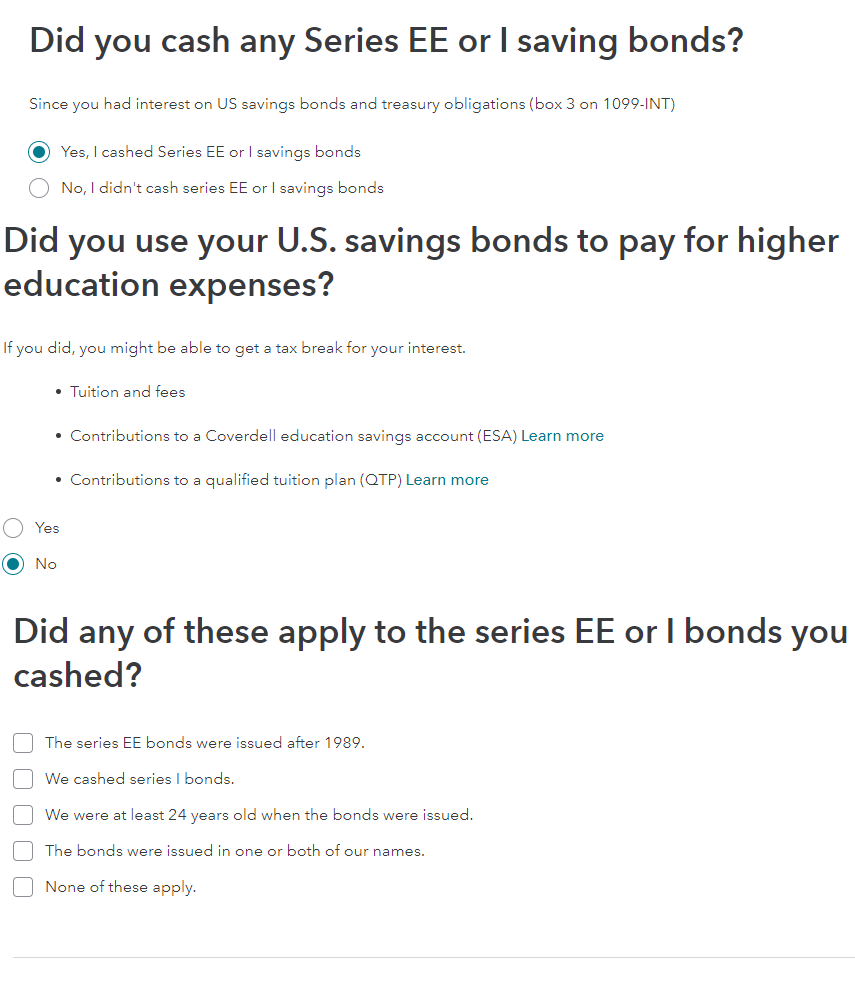

First make sure you have entered your 1099-INT form so that the questions for excluding the interest do come up. As indicated you must have an amount in Box 3. The screen images are shown below and TurboTax will auto generate Form 8815 if you qualify.

- Who Can Take the Exclusion

- You can take the exclusion if all four of the following apply.

- You cashed qualified U.S. savings bonds in 2022 that were issued after 1989.

- You paid qualified higher education expenses in 2022 for yourself, your spouse, or your dependents.

- Your filing status is any status except married filing separately.

- Your modified adjusted gross income (AGI) is less than: $100,800 if single, head of household, or qualifying widow(er); $158,650 if married filing jointly. See the instructions for line 9 to figure your modified AGI.

- You can take the exclusion if all four of the following apply.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 16, 2023

8:32 AM