- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Talk to TurboTax Customer support for a way to get the CD/download version if you already paid for Online.

OR

if you did not pay, just quit Online and use the CD/download version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

You cannot. The TCJA (Tax Cuts and Jobs Act) eliminated all miscellaneous deductions (including non-business bad debts) for tax years 2018-2025. TurboTax still allows you to enter it because there are a few states that still allow it in the state return only. If the state requires such a statement then attached it to your mailed state tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Thank you. As far as I see, IRS still gives it as as valid deduction for 2019 returns, see: https://www.irs.gov/taxtopics/tc453

Perhaps IRS just did not update that page, despite the 2020 date on it.

I’ll definitely look up the TCJA now, but do you happen to have a reference to the provision or a link explaining its elimination of bad debt deductions. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

A non-business bad debt can no longer be claimed as a Schedule A ordinary causality loss. It can be claimed as a capital loss on Schedule D 8949 form as explained in IRA Pub 550 page 55.

https://www.irs.gov/pub/irs-pdf/p550.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Great, thank you so much for the clarification.

So there remains the question: how do I attach the page that IRS requires (detailing the bad debt) in Turbotax? or input that into Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

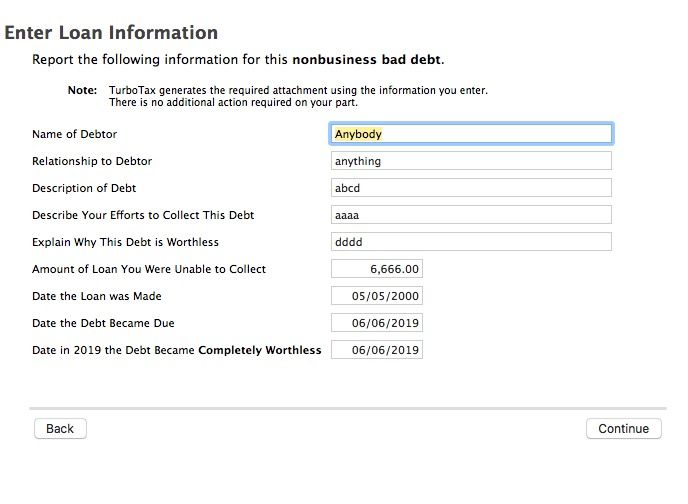

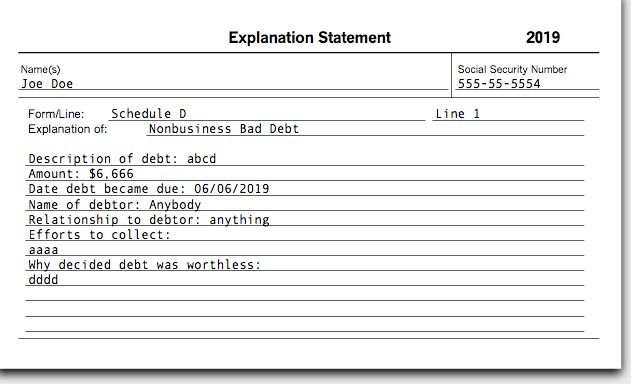

TurboTax adds it automatically when you enter the bad debt information in the bad debt interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

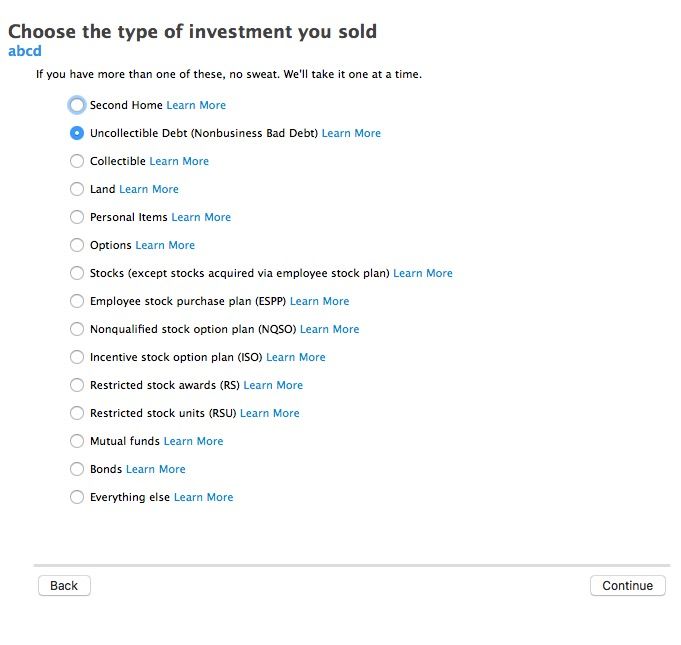

Unfortunately Turbotax (the online premier version) does not have that screen (I assume you're using a CD version?). Turbotax does not seem to present any way of adding nonbusiness bad debt information -- all you get is the screen shown below, and no bad debt "interview."

Does anyone know how to attach the explanatory page IRS requires for non-business bad debts using Turbotax online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

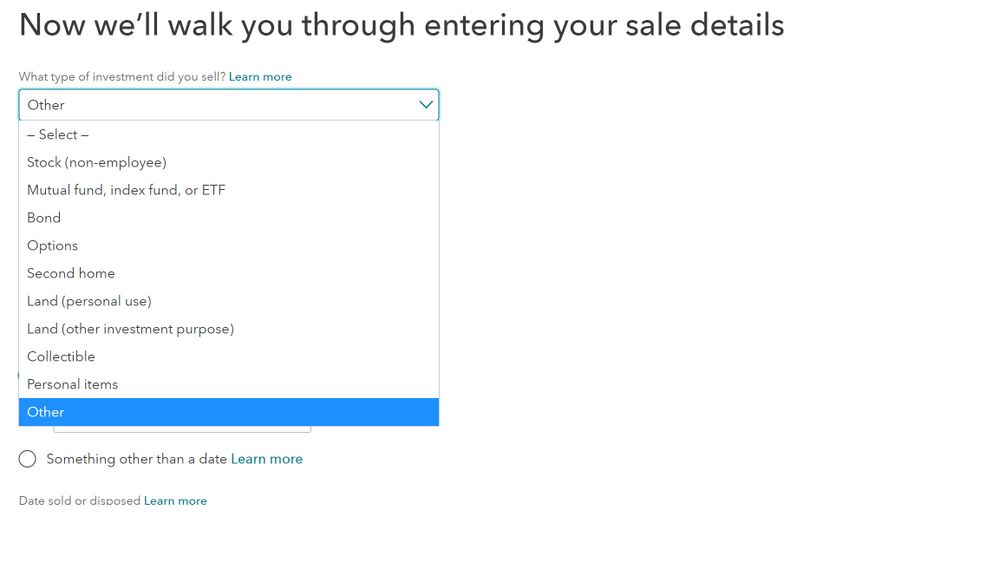

To report the information for a non-business bad debt it is similar to reporting a sell of stock.

When it asks if you received a 1099-B the answer is no.

The type of investment is Other

How did you receive this investment?

Purchase

Description

Non-Business Bad Debt

Date Sold or Disposed

A date in 2019 that you decided the debt was worthless

Proceeds

$0

Cost or other Basis

The amount of the Loan

Link with more information on How to Report Non-Business Bad Deb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Thank you, I had tried that. However, that does NOT allow you to add the explanatory information that IRS requires for nonbusiness bad debt deductions.

Does anyone know how to add that explanatory page in Turbotax premier online?

Here's the information that MUST be included (quoting IRS tax topic # 453):

"A nonbusiness bad debt deduction requires a separate detailed statement attached to your return. The statement must contain: a description of the debt, including the amount and the date it became due; the name of the debtor, and any business or family relationship between you and the debtor; the efforts you made to collect the debt; and why you decided the debt was worthless."

https://www.irs.gov/taxtopics/tc453

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

Did you READ my post above and see the screenshot of the explanation statement that will be part of the tax return that contains that information?

The information about the bad debt that the TurboTax interview asks for *IS* the statement that is required. That is why TurboTax asks those questions which is the information that requires.

What else do you think it should be?

Did you search topics for non-business bad debt and then say you did not receive a 1099-B that takes you to the screen I posted?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

A statement cannot be added to an efiled return ... you must attach a statement to a mailed in return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

@macuser_22: As I said, that "bad debt interview" screen is NOT available in Turbotax premier online. The screen that is available online does not provide all the information IRS wants (for example, listing "the efforts you made to collect the debt"). Please see my excerpt of Tax Topic #453.

(To clarify for others, I assume you are using the CD version. The Turbotax premier online version, even if you type in "1099-B and bad debt," takes you only to the screen I showed; that screen does NOT provide the information that IRS requires, nor does it give you any way of adding that information.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

@Critter, Thanks. Do you think this information from Turbotax is the way to do it? It shows up in the Turbotax help for Form 8949 but does not mention bad debt (however bad debt does go on Form 8949 and Sch D):

If you're required to mail in forms 8949 and 8453, do so within 3 days after the IRS has accepted your e-file. Here's the mailing address:

Internal Revenue Service Attn: Shipping and Receiving, 0254 Receipt and Control Branch Austin, TX 73344

(That zip code is actually a zip plus four that ends in 0254. Turbotax has a rather aggressive SSN stripping algorithm.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

@lopez-post wrote:

@macuser_22: As I said, that "bad debt interview" screen is NOT available in Turbotax premier online. The screen that is available online does not provide all the information IRS wants (for example, listing "the efforts you made to collect the debt"). Please see my excerpt of Tax Topic #453.

I am sure it is. Use search topics for "bad debt, non-business" or go to the income section, investments, stock, bonds, etc. On the first screen "Did you sell any investments in 2019" answer YES.

Did you receive a 1099-B? - answer NO. Then choose non-business bad debt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to add a nonbusiness bad debt? Where in turbotax can I "attach a separate bad-debt statement to the return" (as IRS *requires*)? Thank you.

according to TurboTax 2018, Turbotax will attach the answers you provide as an attachment when e-Filing. "No further action is required on your part".

Anyway, IRS will probably deny your deduction if you can't complete the required info to the satisfaction of the IRS.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aknyc3

New Member

VaBluebell

Level 2

Jackal000

New Member

RayeL

Level 2

shenne1947

New Member