- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How is daughter's tax rate 31%? Received unemployment, subject to Form 8615 "Kiddie Tax", but...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@macuser_22 wrote:

@cloudywithachance I noticed that the filing status at the top of the 8615 form says "joint".

That's a checkbox for parent's filing status. And the child here has unemployment comp plus some wages, so it can't go on a parent's return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@cloudywithachance There does seem to be a problem with the calculations on Form 8615. In playing with this, by chance I noticed an anomaly that might give you a way to work around the problem.

Do you have any qualified dividends on you and your wife's joint tax return? If not, go through the Child's Income interview again, and enter $1 in "Parent's Qualified Dividends." When you press Tab or click Continue you should see the tax due amount get reduced. Go back and delete the qualified dividends that you entered, or change it to zero. Then proceed through the rest of the Child's Income interview until you get back to the income summary screen. Does Form 8615 look correct now, and is the effective tax rate about what you expect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@cloudywithachance wrote:

@Opus 17 Thanks! Token number is 733198.

I seem to have duplicated the problem, although I don't know all the facts that might apply to your situation. Using Turbotax Desktop, form 8615 calculates correctly. Using TT online, the total tax result is too high, although I can't register my text account to actually print the form and verify it. I will try and submit this for investigation.

Meanwhile, you may want to switch to Turbotax desktop that you buy on a download or CD and install on your own computer. It seems to have the correct calculation. You can also view the forms directly at any time. The desktop version can e-file up to 5 tax returns, so you can file for your children and yourself with the same program (each tax return is a separate document, like having multiple word processing documents on the same computer.). Amazon Staples, Costco, and other reputable retailers usually sell the program for less than buying direct from Intuit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@Opus 17 See my post just above. I was able to duplicate the problem in desktop Premier. Try my workaround in your Online test account and see if it corrects the calculation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@rjs wrote:

@cloudywithachance There does seem to be a problem with the calculations on Form 8615. In playing with this, by chance I noticed an anomaly that might give you a way to work around the problem.

I verified that if I add $1 of qualified dividends to the parent's income in the "Child's income" section, the calculation matches the desktop version, which was correct all along.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@rjs wrote:

@Opus 17 See my post just above. I was able to duplicate the problem in desktop Premier. Try my workaround in your Online test account and see if it corrects the calculation.

Oddly, I never experienced the problem in desktop H&B, it calculated correctly to begin with. You might want to add a comment in the Lounge post I started.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@rjs Thanks for your workaround! We do not have any qualified dividends, so that was left blank before. When $1 is entered, it does drop the tax due amount, by $1,670! And changing it back to blank did not increase the amount again.

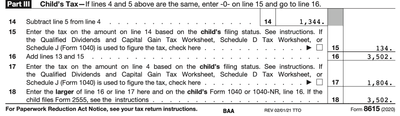

The tax owed is now $3,502, which is the $3,368 amount based on my tax rate + the $134 in 8615 Part III line 15 that wasn't being calculated correctly before! I printed the return and confirmed:

As an aside, I noticed, both yesterday and today, even after the above fix, that the "Child's Income (Under Age 24)" section in the overview always states $0 for this year:

I'm guessing that's not a big deal, since the actual numbers are correct now. Thanks again to @rjs and @Opus 17 and everyone else who responded to help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

Wow I'm glad I found this thread. I was about to give away an extra $2k or so for both of my daughters. How can it be that this hasn't been fixed and people notified? I've got the desktop Deluxe with the latest updates and it still has this bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

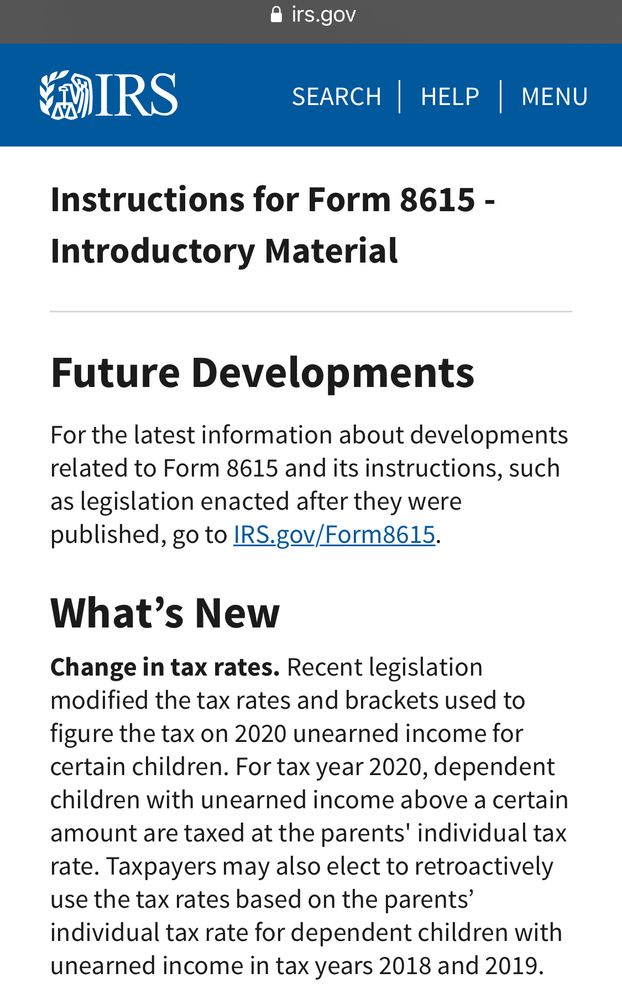

2020 Instructions for IRS Form 8615 Tax for Certain Children Who Have Unearned Income states:

Recent legislation modified the tax rates and brackets used to figure the tax on 2020 unearned income for certain children. For tax year 2020, dependent children with unearned income above a certain amount are taxed at the parents' individual tax rate.

[Edited 02/22/2021 9:03 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@JamesG1 For tax year 2020 it has reverted back to parent’s bracket, which is still higher than the child’s rate, but not as high as trusts and estates rate:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@cjbaker790 wrote:

Wow I'm glad I found this thread. I was about to give away an extra $2k or so for both of my daughters. How can it be that this hasn't been fixed and people notified? I've got the desktop Deluxe with the latest updates and it still has this bug.

If you add $1 of capital gains income, it will activate the correct calculation, then you can re-run the interview and remove the capital gains income. I have not heard of any upcoming fix, although the bug was reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

I thought I was going crazy.... there is a major glitch in the system. We were helping our daughter file and she had earned income of $310 with unemployment around $11,500 and TurboTax was saying she owed over $3,000 in federal taxes and she had already had $120 withheld on the UI for fed taxes. My wife and I file jointly with our marginal rate at 22% so there is no way this calculation is correct. When I tried the above workaround it dropped the taxes down to $2,053 (which in my opinion seems crazy given the pandemic and what UI is for). Anyway, I am now doubting whether this is a correct tax amount given the above. Does this seem right?

BTW, if the amount is correct, thank you for the workaround..... and TurboTax needs to get their act together.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@lovett That looks pretty close, $11,500 minus $2,200 is $9,300. 22% of that is $2,046.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

Thanks for your sanity check. I've been going nuts trying to figure this out and wonder how many people overpaid taxes this year based on this error.

It seems though that the $120 paid already in taxes should be deducted from the $2046 but it doesn't seem to reduce her tax liability ($11,500 is her UI payment minus $2,200 which is $9,300 at our tax rate of 22% =$2,046, but it seems the $120 she already paid should reduce it down to around $1926 or so.....right?).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is daughter's tax rate 31%? She received unemployment, subject to Form 8615 "Kiddie Tax", but parent's marginal rate is 22%!

@lovett The amount at the bottom of Form 8615 is her tax liability and goes back to Form 1040 on Line 16. The $120 withheld would not appear on Form 8615 but should be listed on back on Form 1040 line 25a, b, or c, with the total withheld on line 25d. That amount is then subtracted from the tax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lynnot

New Member

runamuckretreat

New Member

cdhowie689

New Member

kristinacyr

New Member

user17525168329

Level 1