- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@rjs Thanks for your workaround! We do not have any qualified dividends, so that was left blank before. When $1 is entered, it does drop the tax due amount, by $1,670! And changing it back to blank did not increase the amount again.

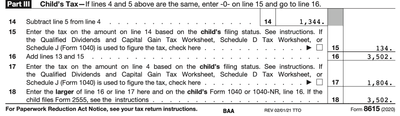

The tax owed is now $3,502, which is the $3,368 amount based on my tax rate + the $134 in 8615 Part III line 15 that wasn't being calculated correctly before! I printed the return and confirmed:

As an aside, I noticed, both yesterday and today, even after the above fix, that the "Child's Income (Under Age 24)" section in the overview always states $0 for this year:

I'm guessing that's not a big deal, since the actual numbers are correct now. Thanks again to @rjs and @Opus 17 and everyone else who responded to help!