- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I enter a backdoor Roth IRA conversion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

7k was taken from a bank account and put into a Trad IRA in 2021, that 7k was moved to Roth. Now understanding that 7k is too much she is moving 1k back to Trad IRA. Going to re characterize that 1k today.

1099-r was correct at 7k since 7k was moved from trad to roth in 2021.

I assume we need to show 1/7th loss/gains on the 1k we are moving back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Thank you for that information.

No, you cannot recharacterize conversions, do not move it back to the traditional IRA. You will have to request the withdrawal of excess contribution plus earnings from the Roth IRA (since the excess is in there).

Currently, you are showing only a $5,000 contribution (entered $6,000 traditional IRA contribution and withdrawn $1,000 excess). You will have to enter the $7,000 as contributed and then you can enter that you are withdrawing the $1,000 excess by the due date.

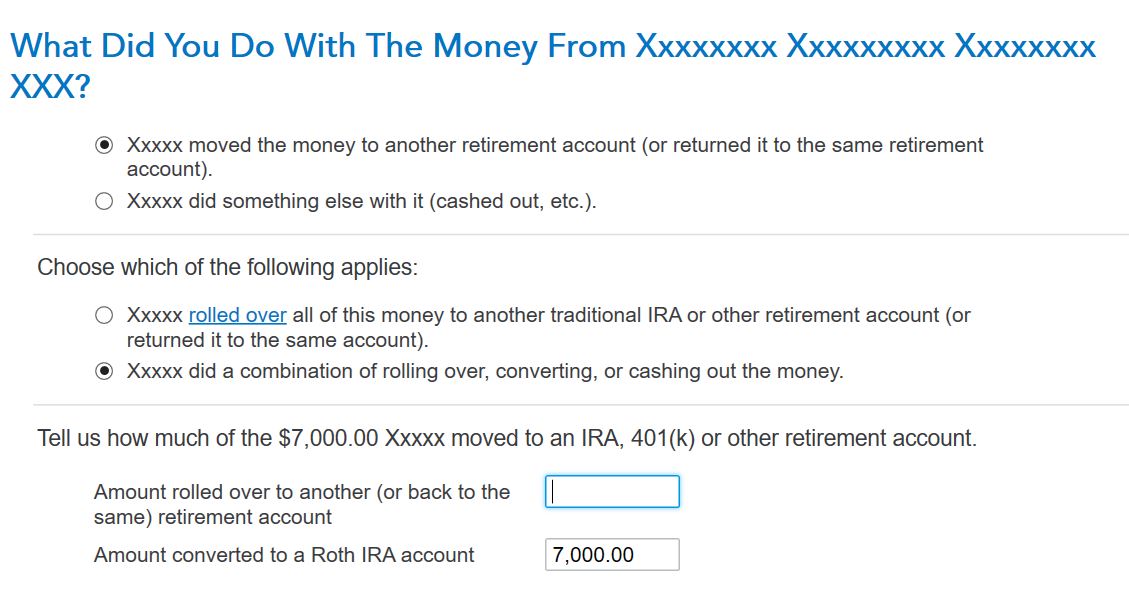

You will keep the Form 1099-R for the $7,000 conversion (only enter one Form 1099-R as shown) you will need to select that you converted the funds (moving funds from traditional IRA to Roth IRA is not a rollover).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Great, I think I got it now.

Waiting on the excess with gains from Fidelity but assuming its around $40.00. So the excess amount I am entering is 1040. So ultimately will need to pay the tax on the 1040, right?

You have been a huge help, thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Yes, you will pay tax on the $40 excess earnings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

What affects line 4b? I did a backdoor roth (non-deductible contribution to IRA -> roth ira), but my 4b keeps showing up with a misc. taxable amount everytime i enter my 1099-r. I can't figure out where this number is being calculated from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

If you have deductible and nondeductible IRA contributions, part of the Roth conversion is taxable, which will flow to Line 4b.

If you have nondeductible IRA contributions, only the earnings are taxable and reported on Line 4b.

@mrouzan

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I have this same problem. The instructions do not give me any of this. The distribution code on the deductible (traditional) IRA is 7 and that might be what's causing the problem. I did not get any kind of tax form for my Roth IRA.

My situation: I just did a rollover of some (not all of) already existing funds from a traditional IRA to the Roth. I imported the 1099-R form from the source (traditional) IRA. So like you, I'm getting that excess contribution problem and like you, TurboTax is making me pay taxes that I shouldn't have to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

To verify, you didn’t make any contributions for 2021 and only converted funds from a traditional IRA to Roth IRA? If yes, then please verify that you did not enter anything in the IRA contribution section.

You will only enter your Form 1099-R and answer the follow-up questions. Please be aware, that if you only had pre-tax funds in the traditional IRA then this conversion will be taxable.

To enter the 1099-R conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2020 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Yes, I am confirming: I did not make any traditional IRA contributions in 2021, NOR did I make any Roth CONTRIBUTIONS from after-tax money (like a checking account). I had a partial distribution from a traditional IRA that was then deposited (net of fees) into my Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Please help. I have tried these steps multiple times over the past few days.

My problem is on step number 4: The TurboTax website never asks me this question.

The closest question is this:

- Yes, this money was rolled over to a Roth IRA

- No, I didn’t

I have been a loyal customer for 7 years

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Also, I didn't have an 8606 form in my 2020 tax return. Did you mean 2021? Or what did you mean? Please advise. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Entering a Back Door Roth Conversion is a two-step process.

You’ll receive a Form 1099-R with code 2 in box 7 (or code 7 if you’re over 59 ½) in the year you make your Roth conversion. You should report your conversion for the year you receive this 1099-R:

- If you received this form in 2021, complete both steps below to report it on your 2021 taxes

- If you'll receive this form in 2022, wait to report it on your 2022 taxes. In this case, only complete Step 1 below for your 2021 taxes. You’ll complete both steps next year when filing your taxes for 2022

Click this link for the steps for How to Enter a Back-Door Roth Conversion.

If you didn't make any non-deductible IRA contributions in 2020, you wouldn't have a Form 8606. TurboTax will generate one for 2021, as you mentioned.

These situations generate a Form 8606:

- Nondeductible contributions made to a traditional IRA

- Distributions from a traditional, SEP or SIMPLE IRA that had nondeductible contributions (excluding rollovers, conversions, recharacterizations, qualified charitable distributions, one-time distribution to fund an HSA, or return of certain contributions)

- Conversions from a traditional, SEP, or SIMPLE IRA to a Roth IRA

- Distributions from a Roth IRA (other than rollovers, recharacterizations, or a return of certain contributions)

Click this link for more info on Form 8606.

@brilliantatbreakfast

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hello, I am also having issues with this. I believe I have followed all of the steps laid out in this thread and elsewhere, tried a few weeks ago then decided to wait until the fix was rolled out on the 31st. It is still not working properly, on the form 1040 it is still showing a large portion of our contributions as taxable despite being backdoor roth. Please let me know what I can send to get assistance with this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hi, I was hoping to get clarification on your comment below. If the 2020 contribution was made in 2021 and the 2020 conversion was made in 2021, should the contribution be shown on the 2020 tax but the conversion not shown until 2021? That is what I did on my 2020 tax return, I only showed the contribution since no 1099-R generated until 2021. It sounded like the original poster you replied to did something similar to me, so I want to confirm whether or not I need to redo my 2020 taxes. I am currently having issues too because TT is showing one of the $7,000 as taxable and one as non-taxable (both contributions and conversions for 2020 and 2021 occurred on the same day in March 2021 so no income generated prior to conversion). Before I move forward with completing my 2021 taxes, I want to determine if I have a problem with my 2020 taxes.

"You should not be entering your 2020 contributions or conversions on your 2021 return. Those should have been entered on your 2020 return. If they were not then you need to go back and amend the 2020 return to include those amounts".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Yes, you report the non-deductible contribution in 2020 and then the conversion to a Roth in 2021 when you receive the 1099-R if you made the non-deductible contribution between January 1, 2021 and May 17, 2021 for the 2020 tax year.

If you reported the contribution as non-deductible, you should find Form 8606 in your 2020 return. Line 14 should have your total basis, which should be the amount of your 2020 contribution ($7,000). In 2021, if you again made a $7,000 non-deductible contribution, you would enter that in the Traditional and Roth IRA Contributions section of your return. When entering this year's contribution, it should also ask Let's find your IRA basis. You will enter that line 14 amount from your 2020 Form 8606. You will then mark this year's contribution as nondeductible. If your 2020 Form 8606 has the amount of your contribution on Line 14, then you did everything correctly last year and you will not have to file an amended return.

You should also have received Form 1099-R for $14,000 which captures the conversion of both your 2020 and 2021 contributions. You will again confirm the amount of your IRA basis at the beginning of the year when entering Form 1099-R. It will also ask you the balance of all your IRAs at the end of the year.

Between your basis carryover from last year and your nondeductible contribution this year, the entire conversion should be nontaxable if you have nothing left in your traditional IRAs after making the conversion.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lkjr

New Member

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tianwaifeixian

Level 4

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill