- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thank you for that information.

No, you cannot recharacterize conversions, do not move it back to the traditional IRA. You will have to request the withdrawal of excess contribution plus earnings from the Roth IRA (since the excess is in there).

Currently, you are showing only a $5,000 contribution (entered $6,000 traditional IRA contribution and withdrawn $1,000 excess). You will have to enter the $7,000 as contributed and then you can enter that you are withdrawing the $1,000 excess by the due date.

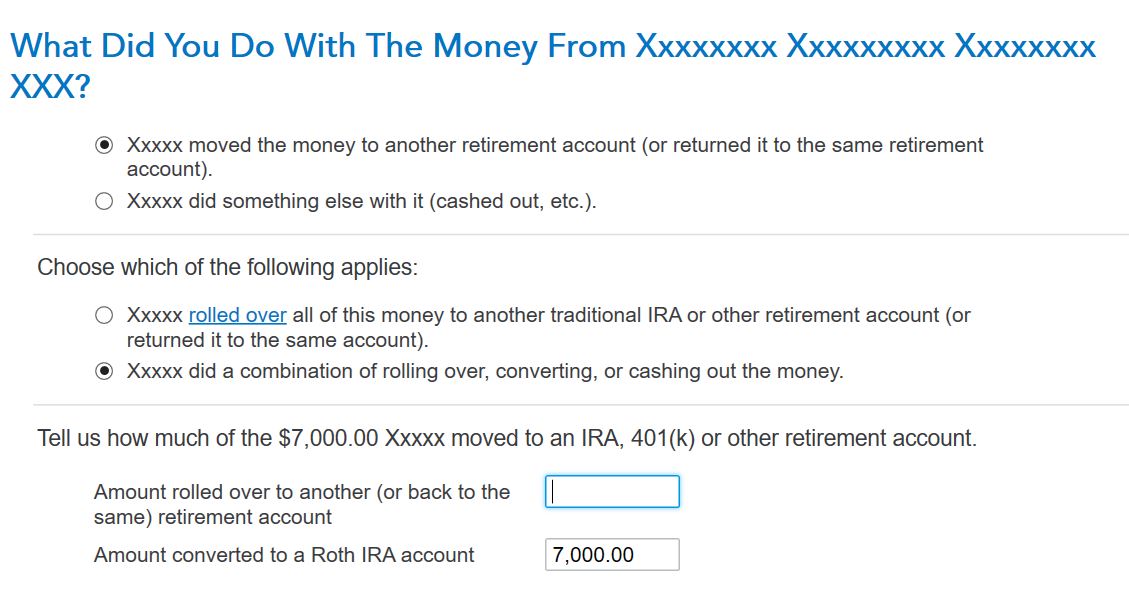

You will keep the Form 1099-R for the $7,000 conversion (only enter one Form 1099-R as shown) you will need to select that you converted the funds (moving funds from traditional IRA to Roth IRA is not a rollover).

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 28, 2022

9:16 AM