- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is th...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Yes.

You can use TurboTax Self-Employed to create your 1099-MISC forms.

The forms can be electronically filed with the Social Security Administration and the IRS only.

Creating 1099-MISC forms in TTO SE

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

One year ago in January 2020, I used "TurboTax Home & Business 2019" to eFile my 1099-MISC forms for the 2019 tax year.

- TTax had glitches and I had to re-enter lots of data after TTax "lost" my initial data, but eventually it worked OK and the IRS confirmed receipt of the forms I eFiled via TTax. (The price to eFile was included in the Home & Business software.)

This year I bought and installed "TurboTax Home & Business 2020" and entered data for 25 forms 1099-NEC.

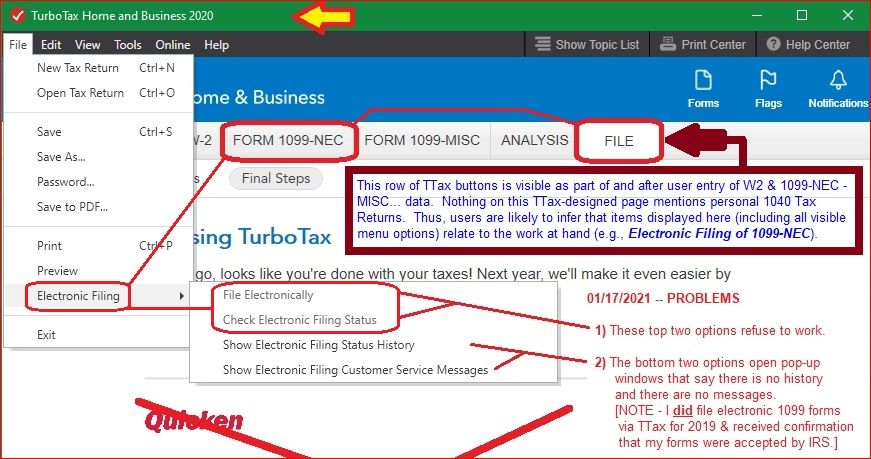

- PROBLEM -- As of 01/17/2021, TurboTax Home & Business for 2020 FAILS to let me to eFile my 25 forms 1099-NEC.

- TTax's menu options for electronic filing of current forms are dimmed and refuse to do anything.

- Menu options for "electronic filing status history" and "customer service messages" open pop-up windows that say there is No History and there are No Messages.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Are you using the Windows Home & Business? Did you enter them into the Quick Employer Forms or the built in W2/1099 Reporter? You can do them 2 ways. Either on your computer or online using Quick Employer Forms. Only Quick Employer Forms efiles them. I haven't seen any problems yet Efiling them. Unless you are the first to report it. I have seen other people who have efiled them. But that might be from the Online Self Employed version but that still uses Quick Employer Forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Thanks for the info about Quick Employer Forms being the only option for eFiling of 1099-NEC, and that it is available ONLINE ONLY. Aarrgh. It would have been very helpful if instructions within TTax Home & Business 2020 (desktop computer, Windows 10) had said something about this before I wasted too much time entering data for 25 people that, apparently, cannot be eFiled.

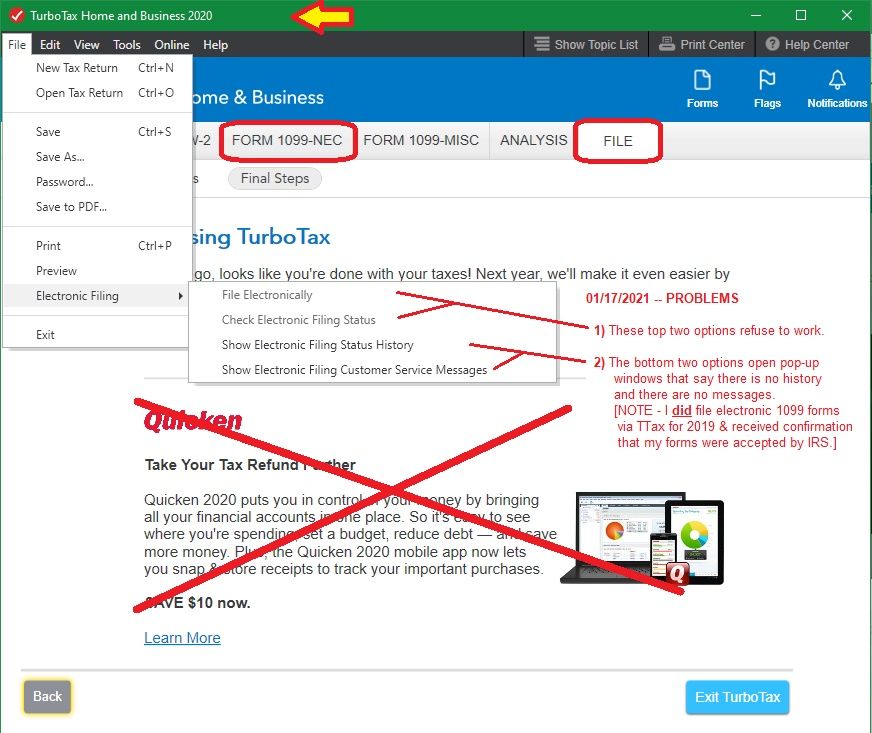

I saved my (now useless) work and and started another "New Return" -- This time the critical options to choose "Online" or "Desktop" preparation of forms appeared (see Image #1).

- TTax PROBLEM: On my first attempt (taken immediately after installing TTax from CD, updating & entering my license code), these important options did NOT appear.

- Instead, TTax took me directly to the instructions for importing last year's tax file and (finding none for 1099-MISC or -NEC) prompted me to begin entering my 2020 data.

SUGGESTION to TTAX: Provide instructions in TTax Home & Business 2020-2021-2022-etc. (desktop computers, Windows OS) that make it very clear (before, while and after a user enters data) that eFile is NOT available for 1099-NEC, -MISC, etc. except via Quick Employer Forms which is ONLINE ONLY, and can only be accessed via "Start a New Return."

IMAGE #1 -- Want to eFile 1099-NEC, -MISC -- BEWARE!!! Do NOT choose "Desktop"

IMAGE #2 -- View after entering 1099-NEC data -- Fails to allow Electronic Filing, but NO explanation of why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Not sure what you mean "....available ONLINE ONLY". You can use the Quick Employer Forms from the Desktop program (not only from the online Self Emloyed version) but yes they are only entered and processed online and not on your computer. So you would have to save the pdf file at the end to have copies. The two choices you get seem pretty clear. You do them either Online or On Your Computer. And the Computer column says Print (free) whereas the Online choice says Efile.

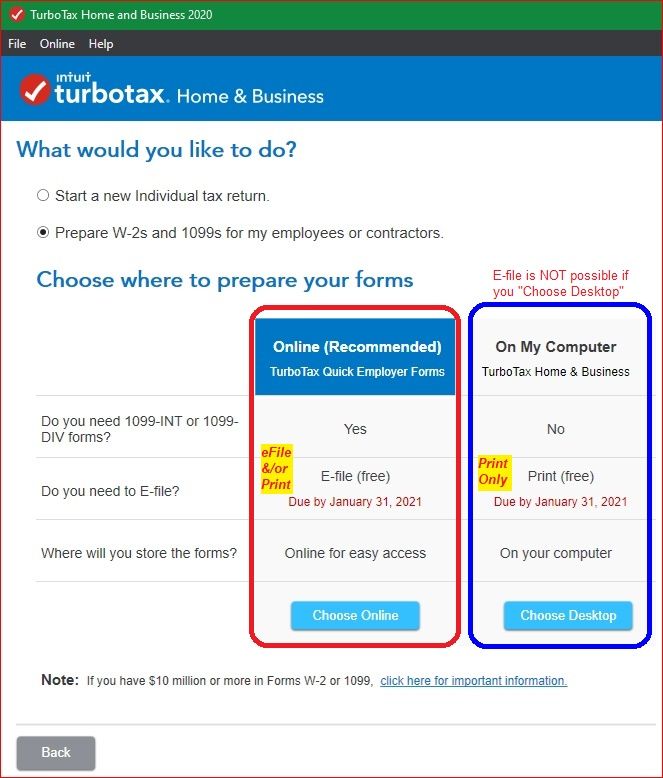

OH, those menu items under FILE are for your actual personal 1040 return, not the W2/1099 returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Thank you, again.

RE: E-File of 1099-NEC/W2 is "...available ONLINE ONLY"

- Refers to the blue TTax buttons shown in my IMAGE #1 (in my previous reply) (i.e., "Choose Online" or "Choose Desktop").

- If "online only" is confusing, maybe TTax can clarify its button labels.

- E-File of 1099-NEC can only be accomplished via TTax by clicking "Choose Online." Thus, "online only."

RE: Menu items under FILE -- I had just finished entering 1099-NEC data (see Image #3 below) and wanted to eFile.

- Nothing on that TTax-designed page says anything about the menu items under FILE as applying only to personal 1040 Tax Returns.

- I assumed (wrongly) that "dead" menu items would not show up, or would include explanations of why they don't work.

IMAGE #3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Are you still confused? The On My Computer says Print on the efile row. I guess it should say Print Only?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

I'm not confused any longer. I did these steps:

- Got out of the TTax desktop version of Home & Business 2020 by starting a new return (an illogical requirement),

- Selected the "Prepare W2's/1099's" box (still within TTax Home/Business), and then

- Clicked the blue "Choose Online" button which took me to Quick Employer Forms (via Google Chrome, my default web browser).

- Next I logged in to QEF with my TTax username and password,

- and, the online QEF web pages worked fine to enter data & eFile the forms.

Much Easier way to find QEF = go to this website:

- quickemployerforms.intuit.com

Those of us who do just one or two TTax returns each year will appreciate not having to search "the community" in order to figure out (or in my case, re-discover) how to do things that ought to be intuitive and/or visible in helpful menus.

Access to QEF and the ability to eFile 1099-NEC, 1099-MISC & W2 forms really is "online only."

- Hopefully TTax software developers will reduce future confusion by adding hints or revising menus within TTax Home & Business to clarify where & how eFiling of 1099-NEC/W2 does and does not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Look, I have done my tax with Turbo for years. If it is going to be a problem this year, I will go somewhere else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

I am retired. It looks like this is going to be a problem so I will use someone else. Goodbye.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

In TurboTax Desktop, you will need to be using the Home and Business product or TurboTax Business product to access Quick Employer Forms. You will need to create a new return and it will ask if you want to complete W-2s or 1099s. You can create them in TurboTax Online also, if you are using the Self Employed product. The deadline for mailing 1099-NEC to recipients was January 31.

Click HERE for more information on using Quick Employer Forms.

The pandemic has affected your taxes in many ways. Including reporting in TurboTax the amount of stimulus money you received. Click Here for more information on how the Pandemic affected your 2020 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

I had this exact question(s). Your question and the responses will save me a lot of time and the frustration of inputting a lot of data that can't be efiled.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I e-file the 1099-MISC or 1099-NEC for expenses that I have paid to contractors. Is this possible through TurboTax Self-Employed?

Eric is spot on with his comments. Thanks to his efforts I know exactly how to proceed.

TTax is a great product, I have used their product since the company started.

However, there are times that what would seem intuitive to you who create and support the software, is in reality not intuitive to those of us using this software.

Thanks very much to Eric for taking the time to create such a well-thought out and clear set of questions/comments.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

seple

New Member

ekudamlev

New Member

carolynmkendall509

New Member

ke-neuner

New Member

scatkins

Level 2