- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: filing fedeal as Head of household, but failed checking in California state tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

Hi,

I am living abroad and married a foreigner who does not have ITIN or SSN, no income from USA, no other connection to USA either. I have a son living with me. My wife (NRA) will not fill US tax either. In this situation, I am eligible to file as Head of household in Federal return. I do live with my NRA wife in 2021.

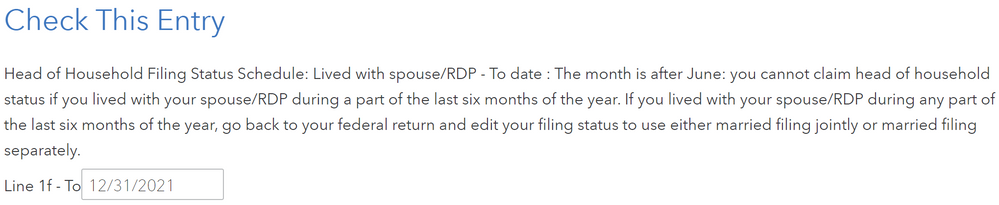

However, in California state tax return preparation, it said:

It is true if my wife is not NRA. However, in my situation, my federal return has accepted my hoh status, why the state return rejects it?

Thanks.

-Feng

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

@fma2022 = again, I sm not an expert on this matter, but

1) you can't list your spouse on the tax forms because no SSN or ITIN

2) CA specifically states you are considered "not married" for this purpose.

so looks like you are listed as 'single' for this purpose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

More information: I live in China the whole year of 2021 with my NRA wife and son. We did not return to USA for any time of the year. I maintained an address in California for communication purpose.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

A bit more information: My son is a US citizen and 15 years old. He is my dependent. That is why I am qualified as HoH in federal return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

@fma2022 - I am not the expert here, but have a question, are you listing your wife on the tax return at all??

per the information below, you are considered 'unmarried' so why are you answering how long you lived with your spouse in 2021?

isn't it immaterial since the State of CA considers you "unmarried" for this purpose?

Again not the expert, and do not know the CA return, but if there are questions about your marital status, should you be answering them as "unmarried / single" for this purpose??????

this is from FTB Publication 1540

Nonresident Alien Spouse/RDPs

If your spouse/RDP was a nonresident alien at any time during the year, you are unmarried or not a registered domestic partner for head of household purposes. If you are unmarried and not a registered domestic partner, you have a wider range of relatives who can qualify you for head of household filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

Hi,

It is true that I was considered "unmarried" for tax purpose.

So it is ok for me to submit my marriage status as "Single" /Head of household? It bothered me a because I was actually married, but to a NRA (who was not and will be not be treated as a resident alient).

Thanks.

-Feng

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

@fma2022 = again, I sm not an expert on this matter, but

1) you can't list your spouse on the tax forms because no SSN or ITIN

2) CA specifically states you are considered "not married" for this purpose.

so looks like you are listed as 'single' for this purpose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

Hi,

Yes, I think you are correct. I thought this over and over. It is true that "unmarried" equals "single" for tax purpose. There is no "unmarried" option in the tax form. 🙂

Thanks a lot.

Best regards,

-Feng

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Omar80

Level 3

sacap

Level 2

anthonyhalphin5

New Member

user17552925565

Level 1

at-rogers135

New Member