- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

filing fedeal as Head of household, but failed checking in California state tax

Hi,

I am living abroad and married a foreigner who does not have ITIN or SSN, no income from USA, no other connection to USA either. I have a son living with me. My wife (NRA) will not fill US tax either. In this situation, I am eligible to file as Head of household in Federal return. I do live with my NRA wife in 2021.

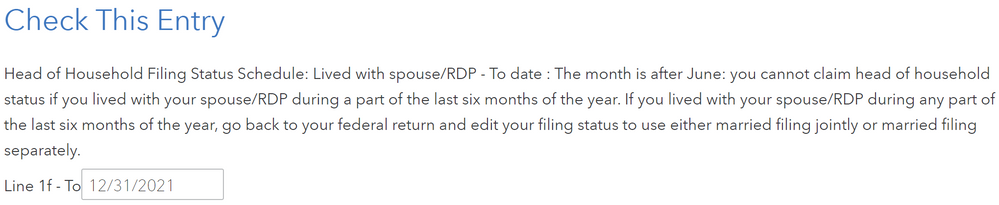

However, in California state tax return preparation, it said:

It is true if my wife is not NRA. However, in my situation, my federal return has accepted my hoh status, why the state return rejects it?

Thanks.

-Feng

Topics:

June 9, 2022

6:58 PM