- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Filing Extension

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

If you e-filed your federal extension, nothing is needed for the federal return.

As for Georgia, you can either mail the Form IT-303 or attach Federal Form 4868 (Federal extension form) to the state return.

Please review the help articles here and here to better assist you. If you need further assistance, please let us know.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

It says - A federal extension will also extend your Georgia filing deadline as long as you attach Federal Form 4868 to your Georgia return. So, as long as I pay any dues by 4/18 to GA and attach the fed extension when I file the GA return later, I should be good?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

@lali000 wrote:

It says - A federal extension will also extend your Georgia filing deadline as long as you attach Federal Form 4868 to your Georgia return. So, as long as I pay any dues by 4/18 to GA and attach the fed extension when I file the GA return later, I should be good?

You are correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

As I said earlier, I paid the taxes due on irs.gov selecting the 2021 extension option based on your previous note. Does that constitute e-filing the federal extension?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

@lali000 wrote:

As I said earlier, I paid the taxes due on irs.gov selecting the 2021 extension option based on your previous note. Does that constitute e-filing the federal extension?

It constitutes filing a federal extension and having the extension accepted by the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

One last question on this topic - how does the "amount due" paid outside of the TT desktop get applied to the return when I am ready to file. Do I need to manually update an amount on a form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

@lali000 wrote:

One last question on this topic - how does the "amount due" paid outside of the TT desktop get applied to the return when I am ready to file. Do I need to manually update an amount on a form?

You will need to enter the amount paid with the extension, both federal and state (if a state extension payment was made)

To enter, change or delete a payment made with an extension request (Federal, State, Local) -

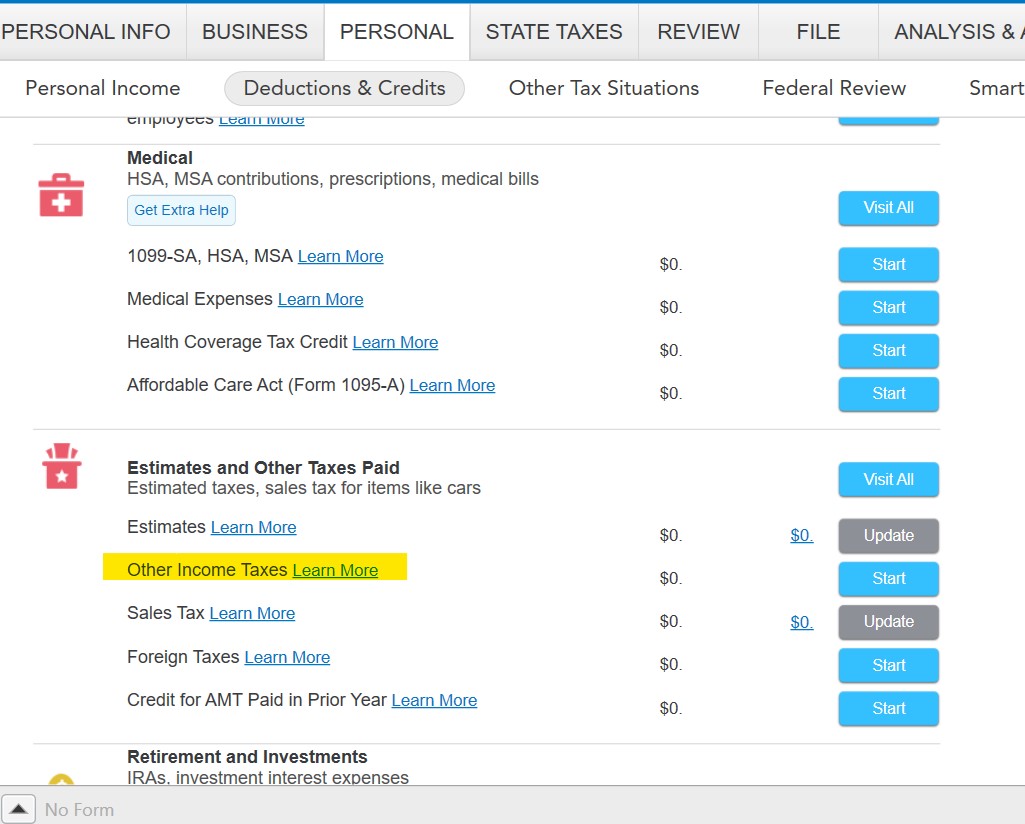

- Click on Federal Taxes (Personal using Home and Business)

- Click on Deductions and Credits

- Click on I'll choose what I work on (if shown)

- Scroll down to Estimates and Other Taxes Paid

- On Income Taxes Paid, click on the start or update button

On the next screen select the type of extension payment made and click on the start or update button

Or enter federal extension payment in the Search box located in the upper right of the program screen. Click on Jump to federal extension payment

The federal extension payment will be shown on Schedule 3 Line 10. The amount from Schedule 3 Part II Line 15 flows to Form 1040 Line 31

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was able to upload a .pdf of my W2 but I’m not seeing the option to do this for my wife’s W2s. There was an option for Turbo Tax to get the W2s from ADP but there is no “box D” o

Yes, you can enter the amount you paid with your extension in TurboTax in the Other Income Taxes area within the Estimates and Other Taxes Paid section (in Deductions and Credits).

Click Start next to that line item and you will be asked to enter any payments made with your 2021 extension. It will show up on Line 31 of Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

franlilynj

New Member

Will_B

New Member

christine1

Level 2

zjakobsky

New Member

user17698848567

New Member