- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Federal estimated tax payments made in January for previous year not credited?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

Unfortunately, no.

Federal tax payments made in 2018 to cover prior taxes such as 2017 are not a deduction.

Federal payments made in 2018 toward your tax year 2018 obligation are estimated payments that should be entered in your current tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

Unfortunately, no.

Federal tax payments made in 2018 to cover prior taxes such as 2017 are not a deduction.

Federal payments made in 2018 toward your tax year 2018 obligation are estimated payments that should be entered in your current tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

I saw the reply that federal estimated tax payments made in 2018 for the prior year cannot be counted as deductions...this seems odd/I'm not sure how to proceed next year with taxes, because the 4th quarter taxes aren't even due until January 15, so how does one get those tax payments still credited as "taxes paid"?

I actually made a tax payment in February of 2018 towards our 2017 federal estimated taxes, so it sounds like I don't record this anywhere on my taxes??? That also seems surprising-- it then would seem as if I didn't pay them!?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

Did you include the Feb 2018 payment on your 2017 return as a payment? How did you pay it in Feb? Did you pay it online at the IRS or send in a check? If you sent a check did you use a 1040ES 2017 slip or a payment with an 2017 extension? You always include an estimated payment on the return it was for (not the year it was paid).

But the 4th quarter 1040ES payment is always due Jan 15. So I don't know if you paid in Feb right. You may have actually paid a 2018 1st quarter estimated payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

Thanks for such a quick reply! I'm glad you asked about whether I recorded it as paid in 2017, because that caused me to go back to 2017 taxes, and I discovered that I did, in fact, already record it in 2017 taxes.

Going forward: does it make a difference if you submit estimate taxes electronically, or by check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I enter Federal Income Taxes paid in 2018 for the tax year 2017? Our tax liability was much higher than the prepaids made.

No. Just quicker to pay the IRS directly and then you know they got it and applied it to the right year.

You can pay here and be sure to pick the right year. And pay on time. I always pay the 4th quarter before Dec 31 and don't wait until Jan 15.

https://www.irs.gov/payments

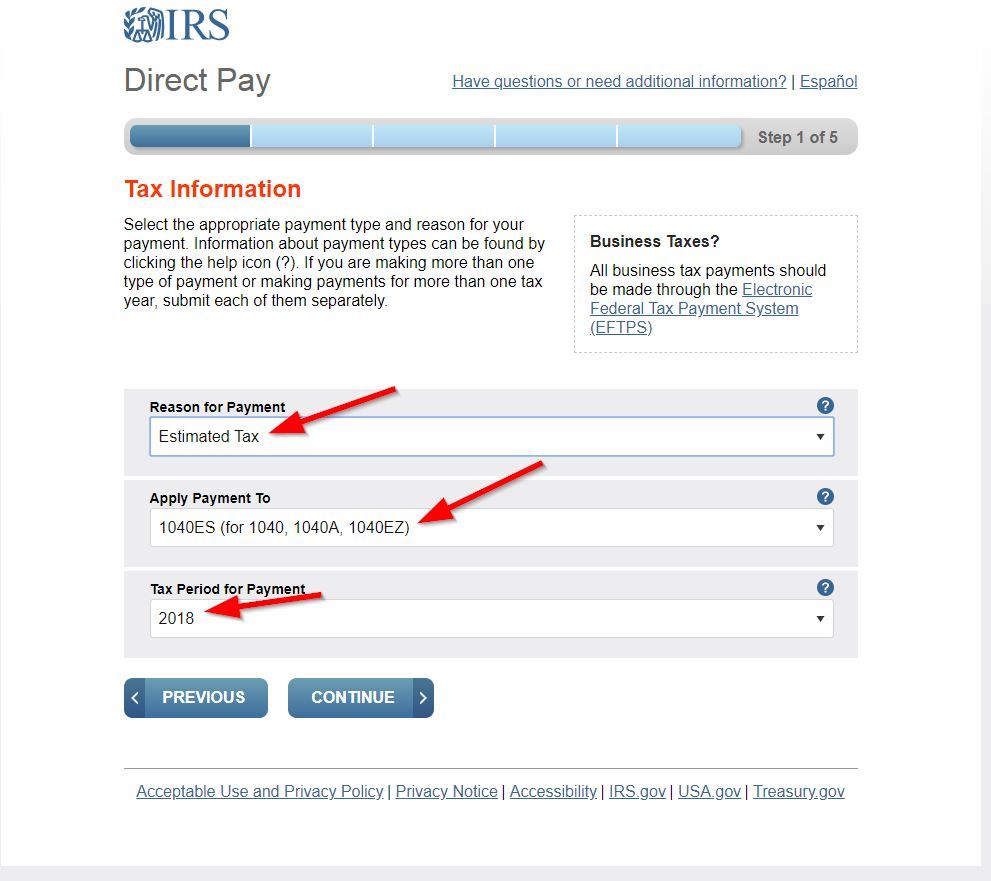

See this screen on how to apply estimates. Now you should pick 2019.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

andrii16

New Member

sakilee0209

Level 2

garne2t2

Level 1

delgado-e-maria

New Member

learning_about_taxes

New Member