- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Expected timing of the software update for elimination of APTC repayment for 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Help re: the timing of the software update for the APTC repayment for 2020.

I had about $10k in APTC for 2020 (line 29 of form 8962).

Last week the TT software (rightly) suggested holding off on filing my federal taxes until TT could update the software to incorporate the elimination of the requirement to repay the APTC. I downloaded an update this afternoon and looked to see if the update was incorporated. There was no change to form 8962 or my numbers; however, there was also no notice to hold off on filing my federal return.

Does anyone know when TT will have the software updated? I've seen a reference for an option to sign up for an email when this update is implemented, but don't know where to go. If anyone can point me in the right direction, that would be most appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

It is not possible to make instant updates to tax software just because Congress has passed this or that law. This is for a variety of reasons:

The first reason is that we have to wait for guidance from the IRS on how the IRS is going to implement these changes.

For example, the law says that the repayment of excess Premium Tax Credit is waived for 2020. You might think that this is clear, but what about the collateral issues?

Self-employed taxpayers who have to repay excess PTC can apply that to the Self-employed Health insurance deduction. Will that still be true when the taxpayer doesn't have to repay the excess PTC? Congress didn't say so the IRS has to decide. Furthermore, the Self-employed health insurance deduction and the Self-employed SEP, SIMPLE, and qualified plans deduction have peculiar interactions where the value of one affects the other. Will this change? Again, Congress does not say so the IRS has to consider all the possibilities and issued rules on how we are to proceed.

The IRS has also said that they are considering automatically calculating the difference in tax for taxpayers who have receive unemployment compensation and sending out refund checks, and have implied that they might do the same for the excess PTC issue. So they have asked taxpayers to wait and not amend their returns until the IRS decides what it is going to do.

This, too, will affect TurboTax's response: to amend or not to amend?

Even when TurboTax receives the guidance that hasn't come yet, there is still work to do.

- TurboTax has to read and understand the guidance and design a response.

- TurboTax has to code the underlying code

- TurboTax has to design and create the screen for the interviews

- TurboTax has to design the changes to PDF forms (if any) and to the XML forms that are e-filed

- These changes have to be approved by the IRS

- TurboTax has to create test cases to test the changes

- TurboTax has to create regression tests to make sure that the changes did not break something else

- TurboTax has to create documentation for internal and external audiences

- TurboTax has to package the changes so that they can be rolled out to Online servers and to CD/download software users

In short, you and we will have to wait until the IRS issues guidance on how these tax law changes are meant to be interpreted and implemented - and this will take time.

Normally, tax laws changes are finished before December 31st, but this has been a year of "moving the goalposts" on practically a daily basis. It is very difficult to plan anything when the Congress, the IRS, or the states change the rules on the fly.

Give the process a chance - when TurboTax knows something, then you will know something shortly thereafter as TurboTax works through the steps I listed above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Might you have any clues or suggestions as to whether one might wait until the new filing deadline of May 17 2021 to see if Form 8962 has been adjusted to reflect a new policy (and TurboTax adjusting their calculations accordingly), or just pull the trigger and file the return now, and "trust" that if a refund of the excess advance premium tax credit repayment on Line 29 of Form 8962 is owed back, it will be issued in some way, at some point in the future?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

@ddhub thank you for posting this regarding elimination of APTC repayment.

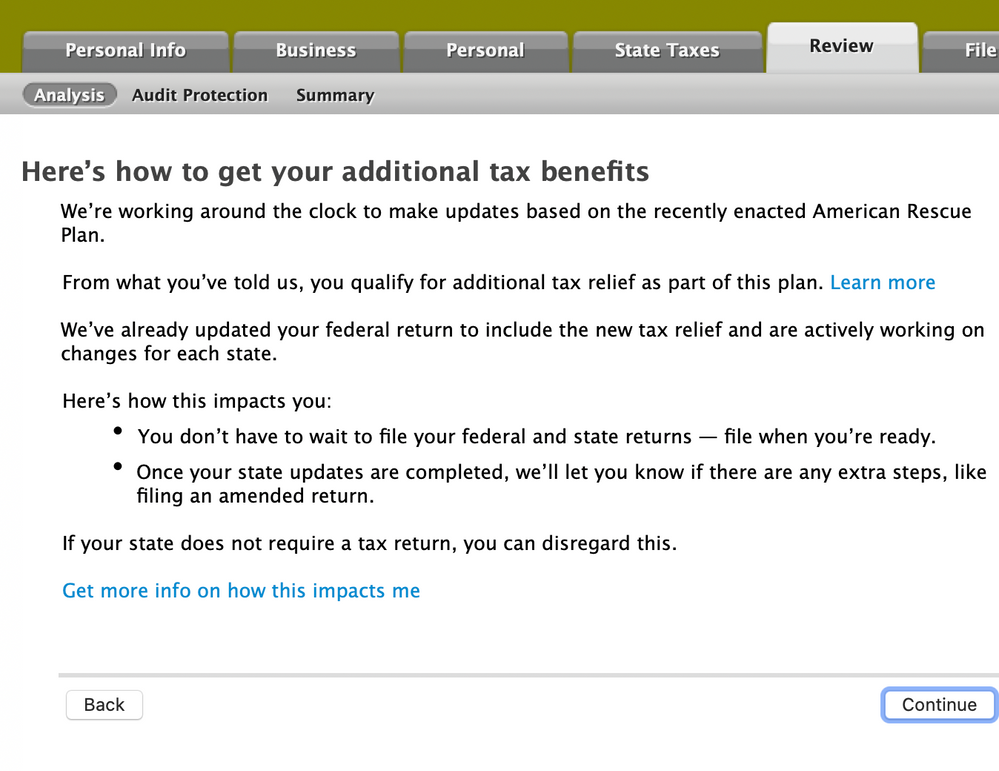

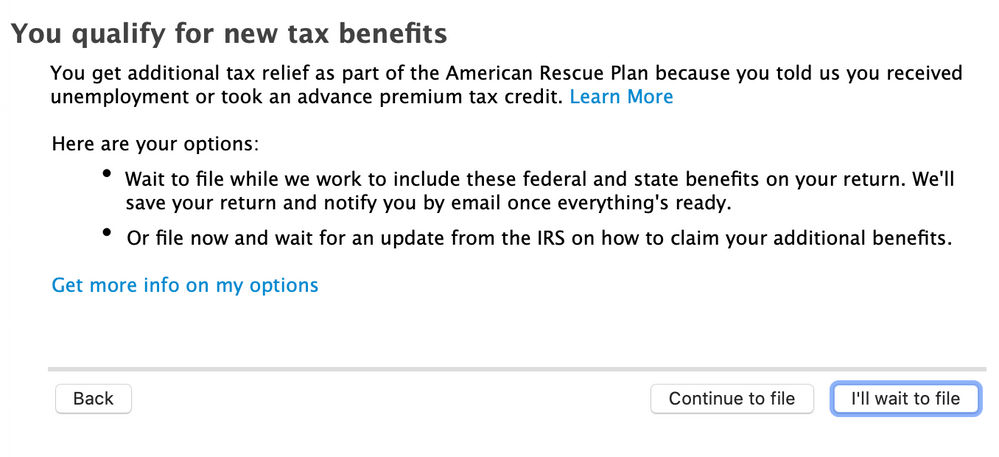

I wrongly assumed the TurboTax update on 3/26 included both Unemployment Update & APTC Update based on the fact that after I tapped on REVIEW Tab, TurboTax stated "We've already updated your federal return to include the new tax relief...." and no further mention of advance premium tax credit as indicated in the previous REVIEW Tab result message. I have posted both REVIEW Tab messages from TurboTax below for your review.

TURBOTAX GET YOUR ACT TOGETHER HERE and post the proper REVIEW Tab message !!

HERE IS THE REVIEW MESSAGE AFTER THE 3/26 UPDATE

HERE IS THE REVIEW MESSAGE BEFORE THE 3/26 UPDATE...........

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

@Subsidyhit - thanks for posting a picture of the original warning from TT to not file your taxes until the proper update for the APTC has been completed. Based on the input from @BillM223 (Employee Tax Expert) this may take a long time to get resolved (between the IRS providing guidance and then for TT and other software providers to make the appropriate updates). If this doesn't occur before the new federal tax deadline I'll have to file an extension. What would be most helpful is for TT to send an alert when this update is completed. I saw an earlier reference for TT users to sign up for email updates - do you (or anyone reading this) know where I can sign up? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Bill - thanks for the lengthy response. Do you know where I can sign up to receive an email update from TT when these updates are finally completed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Check Back for Updates to this Page

We’re reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021. Taxpayers who filed a 2020 tax return and reported an excess advance premium tax credit repayment on Line 29 of Form 8962, Premium Tax Credit, should not file an amended tax return only to get a refund of this amount. The IRS will provide more details soon. For the latest updates, check IRS.gov/coronavirus.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Yes, this is quite confusing, and Intuit is not doing a good job of indicating which parts have been updated. When you click on the "Learn More" link after the 3/26 update, it absolutely states that both the Unemployment and the APTC issues have been updated. Yet, in TT Home and Business, my return at 203% of Fed. Pov. is STILL showing that I have to repay $800. (Yes, I had minimal self-employment income as well as unemployment.)

Bugged or still awaiting guidance? I don't know, but as a customer since the days of MacInTax, this is the first time I'm losing confidence in Intuit, not in the product, but in the failure to properly communicate the status of these changes. I too would like to know how I can get signed up on an email list to be advised when this is resolved, or how to report it as a potential bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

That part of the TurboTax program has not been updated. We are still waiting on the IRS. There is no guidance has been issued yet. To read details from the IRS, click here:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Then Intuit should fix the "Learn More" text immediately to indicate such as related to the APTC repayment. Barring any communication from Intuit or happening upon this thread, how would a customer be aware that, contrary to what TurboTax states in the program, it is NOT fixed.

If the program tells you it is resolved, you would have no reason to doubt it, until you found that it was showing hundreds or thousands of additional dollars in tax. I understand now that they are awaiting guidance, but to leave the misleading text in the program reduces customers' confidence in the product and the company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Thanks for confirming that this hasn't been updated. I understand there is a process before TT will update its software, but how/when will be notified that the software has been updated with the proper fix for the APTC? I can't find anyone with TT who can give me an answer on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Drake Software has this:

As of April 3, 2021, EF message 2613 has been removed and returns with excess Advanced Premium Tax Credit (APTC) can now be filed.

The American Rescue Plan Act of 2021 (ARPA), passed in March 2021, contains a provision to no longer require repayment of any excess APTC on 2020 tax returns. Recent IRS guidance relative to this provision instructs taxpayers who have an amount on line 29 of Form 8962 to not include Form 8962 with their return. “

the unemployment provision got updated immediately - how hard is it to turn off the form so we can file our taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Why wouldn’t the self employed be treated like everyone else. If you don’t have to pay back 100% of what you might owe why would you want to pay back anything to get back a deduction worth 30% or so of the amount you pay back? A self employed person shouldn’t pay anything back either. The IRS shouldn’t read anything into the congressional intent. No one should file an 8962 for 2020. The feds already have the 1095-A. Sorry. Just eliminate the form and be done with it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Expected timing of the software update for elimination of APTC repayment for 2020

Unfortunately, because the IRS has not released the guidance, TurboTax cannot schedule the work and testing that needs to be done. I would be delighted to give you a link where you could be notified of released updates, but until the IRS can give us a complete picture of the whole elephant and not just this part or that, no scheduling of work and testing can be done.

The issue is far larger than just deleting the 8962.

And you forgot to include the rest of the quote:

"the IRS intends to make internal changes that will prevent these taxpayers from receiving correspondence regarding Form 8962 not being filed."

The present IRS practice is to Accept returns with a 8962 (i.e., all returns), then about three weeks after Acceptance, to place the return that should have had an 8962 into a holding queue and to write the taxpayer a letter asking for the 8962, which holds up processing and any refund. Last year, any taxpayer who should have filed an 8962 but didn't had their refunds held up for months.

So if the IRS has not updated its internal procedures - and software - by the time that a return hits the queue, it will be held up for manual processing which is very likely a worse result than just waiting a bit to file - especially since the IRS has delayed the filing date IN PART FOR EXACTLY THIS REASON to May 17th (June 15th in Texas, Louisiana, and Oklahoma).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

Lily725

Level 2

Phillymcgregor

New Member

gbriel

Returning Member

Secord3788

Returning Member