- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: e-file 2019 1040X with turbotax desktop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

I mailed my daughters 1040X back in May and it still does not show up on the IRS "where's my amended return" site

Now that the IRS accepts 1040X electronically, (and I think TTAX does as well???)

I wanted to open TurboTax and e-file it.

When I try that it says that its already been e-filed which it has not...

Is there a way I can force this to happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Since an amended tax return has been filed, the IRS requests that you do NOT file another return with the same information.

The IRS has not been processing paper tax returns for several months due to the pandemic and limited staffing. Then have only just recently started to process approximately 11 million paper tax returns in the order received.

Go to this IRS website for information - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it.

Do not file a second tax return or contact the IRS about the status of your return.

Go to this IRS website for the status of an amended tax return - https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Since an amended tax return has been filed, the IRS requests that you do NOT file another return with the same information.

The IRS has not been processing paper tax returns for several months due to the pandemic and limited staffing. Then have only just recently started to process approximately 11 million paper tax returns in the order received.

Go to this IRS website for information - https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue

We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it.

Do not file a second tax return or contact the IRS about the status of your return.

Go to this IRS website for the status of an amended tax return - https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

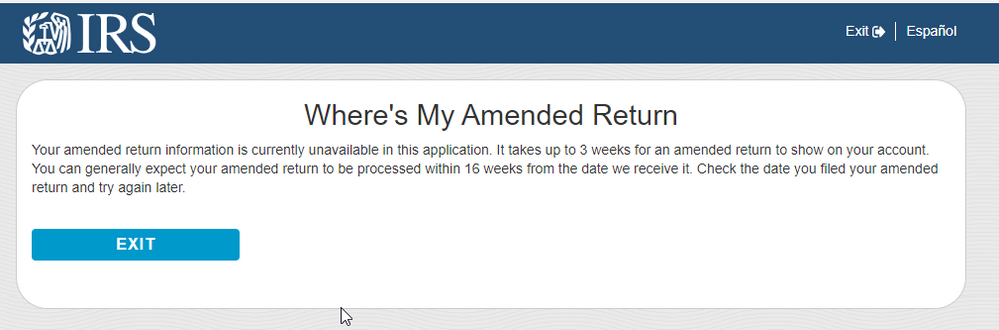

as stated, I went to the wheres my return site and its useless (its been like this for at least 3 months)

You'd think they'd want us to re-file electronically so that they don't have to process it manually

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Do NOT file the amended return AGAIN ... paper filed amended returns this year are taking 4 - 6 months to process and you must be patient ... do NOT efile it now as this can delay the processing even further.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

I have been waiting 5 and 1/2 months now and the IRS still is not showing that they received my 1040X. I call them every month. No they are saying I should probably file again and they told me " you do know you can file the 1040X electronically?" I tried on Turbotax and it will not allow me to e-file. I have not seen any other tax programs that will allow it either. I did see something about the IRS not accepting any e-files between the end of August and the end of January. Does anyone know if this is true? Does anyone know when Turbotax will allow us to e-file 2019 amended return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Beginning with the 2019 tax year, you can e-file federal amended returns. For tax years prior to 2019, federal amended returns must be filed by mailing in a paper return.

The IRS has not announced when they will start accepting e-filed returns. It's generally sometime between January 15 to February 1. See eFile for additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Does Turbo tax allow e-filing 2019 1040-x if the original was e-filed through a different software program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

@bobbinicks2 wrote:

Does Turbo tax allow e-filing 2019 1040-x if the original was e-filed through a different software program?

No. A 2019 amended tan return cannot be e-filed using TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

hola nesesito saber como obtener mi 1040 del year 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Si preparó la declaración usando TurboTax, estará disponible en tu cuenta si usó TurboTax en línea o en el programa instalado de TurboTax de 2019 si lo instaló en su computadora.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

estoy tratando tengo computer nueva y no puedo ingresar

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file 2019 1040X with turbotax desktop

Probablemente necesita comunicarse con servicio al cliente para ayuda. El número de TurboTax está en el enlace anexo: How do I contact TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

roybnikkih

New Member

gerald_hwang

New Member

ahkhan99

New Member

jjon12346

New Member

user17550208594

New Member