- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Can someone please tell me WHERE in Q9 the IRS states that Medicaid Waiver Payments MUST be included in the calculations of BOTH the EIC and the ACTC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

The text in IRS A9 answer to Q9 clearly states

"you may choose to include all, but not part, of these payments in earned income for determining the EIC >>OR<< the ACTC, if these payments are otherwise earned income (wages or income from self-employment).

The emphasis here being on the word OR meaning we can choose to include medicaid waiver payments in the calculation of one or both of these refundable credits

The IRS has updated Publication 4491-X, VITA Alert 2020-03, and the Form 1040 Instructions to account for the Feigh decision.

The following instructions for ProSeries have been modified to incorporate the May 15, 2019 Tax Court Decision of Feigh v. Commissioner 152 T.C. No. 15. In that decision, the Tax Court ruled that the Feighs were allowed to exclude their difficulty of care / Medicaid waiver payments from gross income, but they could be includible as earned income for the Earned Income Tax Credit and the Child Tax Credit.

Note 1: If taxpayer received Medicaid Waiver payments, volunteers should ask whether they received payments in prior years. If so, they may want to amend their tax returns. But to receive any refund for the 2016 tax year, the taxpayer generally must file the amendment before April 15, 2020.

Note 2: No taxpayer is required to add their Medicaid-waiver payment to their AGI for purposes of claiming EITC or the child tax credit. However, some taxpayers may be helped and some may be hurt by this adjustment. The taxpayer has the right to do their return the way that is best for them as long as it is lawful.

Background: Taxpayers who provide home-based healthcare for a family member and receive payment from the state as Medicaid Waiver difficulty-of-care payments may benefit from a recent court ruling (Feigh v Cmmr, 152 T.C. No.15). Pursuant to Notice 2014-7, some taxpayers who receive Medicaid- waiver payments for home health care provided to an individual under a state Home and Community- Based Services Waiver program may exclude such payments from their gross income. However, the same taxpayer may choose to add their Medicaid-waiver payments back into their AGI as earned income for the purpose of EITC and/or child tax credit eligibility and calculation.

Provide the EITC to taxpayers who have no other earned income;

Increase EITC for other taxpayers.

As a result of this ruling, taxpayers in this situation may:

1. Exclude the qualified Medicaid-waiver payments from their gross income; and/or

2. Include the qualified Medicaid-waiver payments in their earned income for tax-credit purposes.

Choosing to include the Medicaid-waiver payments as earned income may:

• Enable the child tax credit and additional child tax credit to be claimed for taxpayers who have

no other earned income;

However, choosing to include the Medicaid-waiver payments may also decrease the amount of EITC in some instances. These taxpayers may choose not to add the payments for EITC calculation. However, if payments are included as earned income, they must be included in full (the client is not allowed to include only part of the payments).

Taxpayers who are otherwise ineligible for the EITC - for instance, married taxpayers who file separately

or taxpayers without an SSN - will still not be able receive EITC under this provision.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

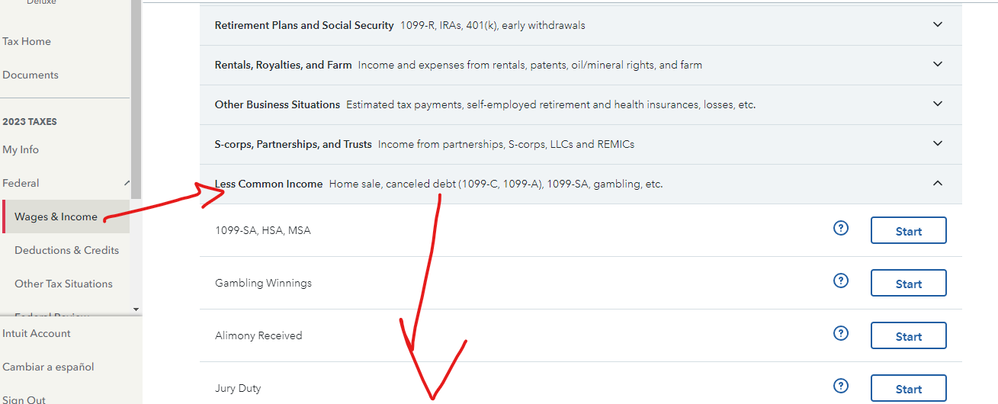

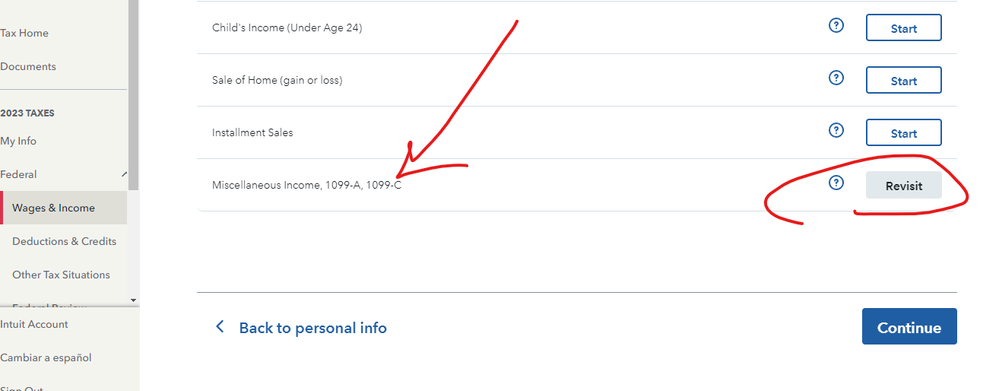

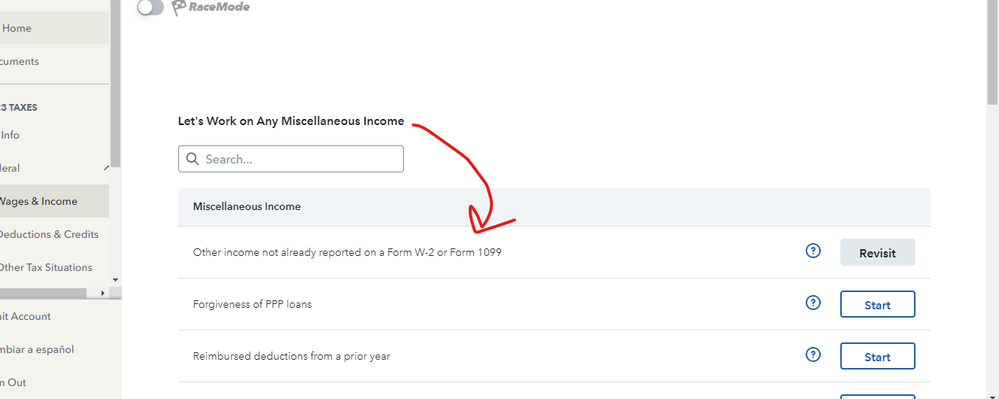

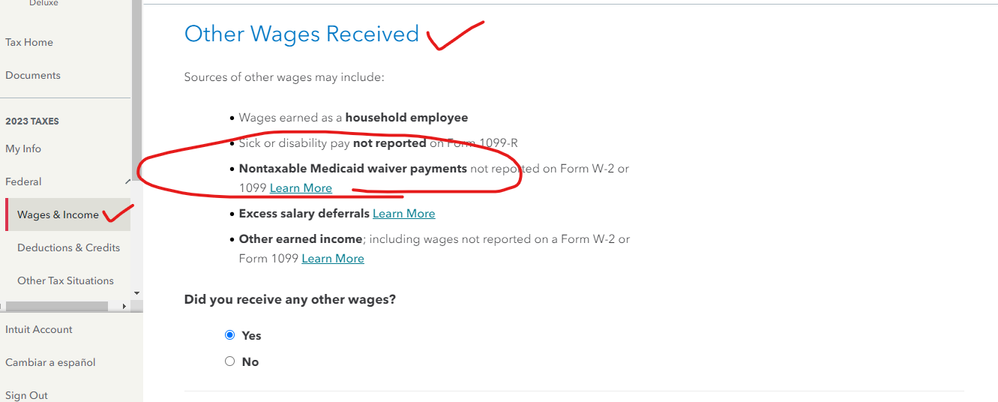

If you want to enter the medicaid waiver payments for the credits ... follow this path ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

← ProSeries-Entering... 8

The following REPLACES page 115 of the ProSeries Manual

Medicaid Waiver Payments (and Qualified Foster Care Payments)

The IRS has updated Publication 4491-X, VITA Alert 2020-03, and the Form 1040 Instructions to account

for the Feigh decision.

The following instructions for ProSeries have been modified to incorporate the May 15, 2019 Tax Court

Decision of Feigh v. Commissioner 152 T.C. No. 15. In that decision, the Tax Court ruled that the Feighs

were allowed to exclude their difficulty of care / Medicaid waiver payments from gross income, but they could be includible as earned income for the Earned Income Tax Credit and the Child Tax Credit.

Note 1: If taxpayer received Medicaid Waiver payments, volunteers should ask whether they received payments in prior years. If so, they may want to amend their tax returns. But to receive any refund for

the 2016 tax year, the taxpayer generally must file the amendment before April 15, 2020.

Note 2: No taxpayer is required to add their Medicaid-waiver payment to their AGI for purposes of

claiming EITC or the child tax credit. However, some taxpayers may be helped and some may be hurt by

this adjustment. The taxpayer has the right to do their return the way that is best for them as long as it

is lawful.

Background: Taxpayers who provide home-based healthcare for a family member and receive payment

from the state as Medicaid Waiver difficulty-of-care payments may benefit from a recent court ruling

(Feigh v Cmmr, 152 T.C. No.15). Pursuant to Notice 2014-7, some taxpayers who receive Medicaid-

waiver payments for home health care provided to an individual under a state Home and Community-

Based Services Waiver program may exclude such payments from their gross income. However, the

same taxpayer may choose to add their Medicaid-waiver payments back into their AGI as earned income

for the purpose of EITC and/or child tax credit eligibility and calculation.

Provide the EITC to taxpayers who have no other earned income;

Increase EITC for other taxpayers.

As a result of this ruling, taxpayers in this situation may:

1. Exclude the qualified Medicaid-waiver payments from their gross income; and/or

2. Include the qualified Medicaid-waiver payments in their earned income for tax-credit purposes.

Choosing to include the Medicaid-waiver payments as earned income may:

• Enable the child tax credit and additional child tax credit to be claimed for taxpayers who have

no other earned income;

=

However, choosing to include the Medicaid-waiver payments may also decrease the amount of EITC in

some instances. These taxpayers may choose not to add the payments for EITC calculation. However, if

payments are included as earned income, they must be included in full (the client is not allowed to

include only part of the payments).

Taxpayers who are otherwise ineligible for the EITC - for instance, married taxpayers who file separately

or taxpayers without an SSN - will still not be able receive EITC under this provision.

If I am not mistaken, this clearly establishes that taxpayers may CHOOSE to include Medicaid Waiver Payments as earned income for the calculation of the CTC and ACTC while excluding it in the calculation of the EIC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

This will benefit live-in caretakers who recieve Medicaid Waiver Payments and have additional self employment income on the side.

In these cases live in care providers can choose to include MWP income to calculate the ACTC and exclude it for the EIC if it is beneficial to do so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

If you want to enter the medicaid waiver payments for the credits ... follow this path ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

Does this path allow MWP income to be included for the ACTC and excluded for the EIC on the same return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

If there are two separate taxpayers receiving excludable income under Notice 2014-7, can one include the income and the other choose not to for the EITC? The language as follows states "As result of this ruling, taxpayers in this situation may:

1. Exclude the qualified Medicaid-waiver payments from their gross income; and/or

2. Include the qualified Medicaid-waiver payments in their earned income for tax-credit purposes."

But, there's also Q9 which states:"you may choose to include all, but not part, of these payments."

This raises the question: Is a couple married and filing jointly considered a single taxpayer, or are they taxpayers who each can choose to include or exclude the income for the EITC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

Are you saying both spouses each received separate W2's with Medicaid Waiver Payments? If so, the income from w2 1 has the option of being included or excluded and w2 2 has the option of being included or excluded. They are treated separately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

Yes, we're married and filing jointly, both with excludable Medicare waiver payments on separate W-2 forms. Where, though, on the tax filing will the IRS see that only one income was being counted for the EITC? Line one on the 1040 combines our earned income, which is too high for the credit, and then it's all subtracted on Schedule 1, line 8, lowering our AGI and effectively removing all of our earned income. While TurboTax Deluxe provides the option of including either, both, or neither as earned income in the EITC section, I don't see where the IRS can see that calculation in that actual tax forms. It factors in the value of the credit on the 1040, but there doesn't seem to be form, schedule, or worksheet that shows the IRS how that figure was arrived at. It seems likely that the EITC will be rejected by the IRS based on our earned income being too high or the AGI being too low, even though we should have the option of excluding or including that income for the EITC under notice 2014-7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid waiver payments are not required to be included as earned income for both the EIC and the ACTC, taxpayers can choose to include their MWP to calculate one or both.

Ensure you are entering everything according to these instructions: How do I enter my tax-exempt Medicaid waiver payments from IHSS in TurboTax?

When you get to the Earned Income Credit section in Deductions & Credits, you’ll be asked if you want to add your Medicaid waiver payment to your income for this credit. You can answer based on what benefits you most.

TurboTax can exempt income under Notice 2014-7 per the IRS instructions for Medicaid Waiver payments from IHHS. This Notice provides that certain payments received by an individual care provider under a state Medicaid Home and Community-Based Services Waiver (Medicaid waiver) program are difficulty of care payments and excludable as income. Additionally, you can choose to use this income to calculate Earned Income Credit. Regardless, the income will remain non-taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

user17539892623

Returning Member

kat2015-

New Member

rodiy2k21

Returning Member

jjalles

New Member