- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Can anyone tell me how to know if i’m eligible for the unemployment refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone tell me how to know if i’m eligible for the unemployment refund?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone tell me how to know if i’m eligible for the unemployment refund?

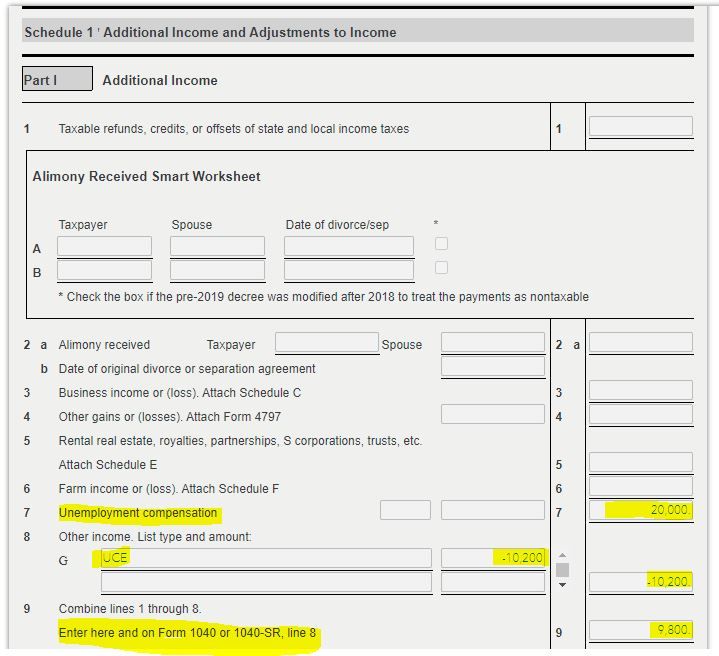

You're eligible to exclude the unemployment compensation if it was received in 2020 and your modified adjusted gross income (AGI) is less than $150,000. The modified AGI for purposes of qualifying for this exclusion is your adjusted gross income for 2020 minus the total unemployment compensation you received. This threshold stays the same for all filing statuses, regardless of whether you're married and file a joint tax return (it doesn't double to $300,000).

To determine if you're under the $150,000 threshold and qualify for the exclusion, subtract all of the unemployment compensation reported on Schedule 1, Line 7, from the amount of your AGI reported on Line 11 of Form 1040, 1040-SR, or 1040-NR.

In the 2020 TurboTax software the unemployment compensation exclusion is included. Enter your UC received in 2020 as reported to you on the Form 1099-G you received from your state.

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can anyone tell me how to know if i’m eligible for the unemployment refund?

If line 16 of form 1040 is more than 0, you will probably get an additional refund when the IRS refigures your tax based on the $10,200 unemployment exclusion.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

y2kconfuse

New Member

jillianknight0913

New Member

bhsong206

Level 2

lwolbrueck

New Member

pandam97

Level 1