- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

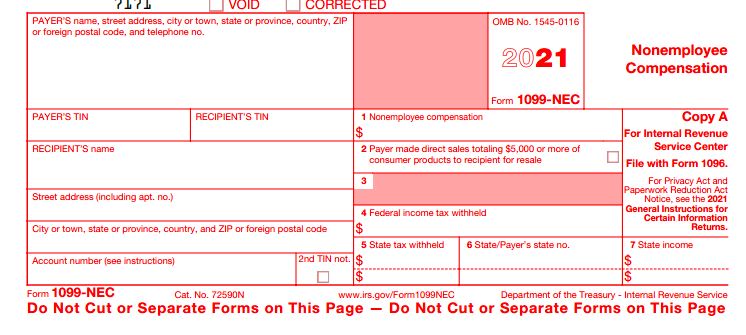

Ok ... the OLD 1099-misc box 7 is now on the NEW 1099-NEC box 1 ... this is new starting with 2020 returns.

Back up to this screen where you add in the Sch C income and look at the options again ... first one is the new NEC form. Do not use the 1099-misc screen for any box 7 income ... it is no longer valid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

You have to wait for a program update to add the 1099NEC to the step by step interview. Switch to Forms Mode and open the 1099NEC there as someone posted above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

@roperwin1544 When you receive the 2020 1099 for "non-employee compensation" is will not look like it did before. No longer will it be on a 1099-MISC in box 7 - it will be on a new 2020 1099-NEC form that the IRS is still working on and has not released yet. There are a LOT of tax form changes for 2020 and the IRS is very slow to finalize them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

how can payers send you a 1099-NEC if the IRS is still working on it ?

OK, still a few weeks to go ...

Do payers know this ? ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

If a business needs to send these forms out then they will know it when the program they use tells them or when they try to order the forms from the IRS or buy them at the store. It is the business's responsibility to educate themselves on this new situation that has been in the news for more than a year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

I cannot find that anywhere in the TT program...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

@roperwin1544 wrote:

I cannot find that anywhere in the TT program...

@roperwin1544 Forms Mode (click the Forms icon in the upper right side of the screen).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

Don't worry, the version you have is not updated for the step-by-step mode. It is frustrating but you can try this to solve it for now:

1. Go to your main Business Income screen

2. Switch to form mode by clicking on the Forms button on the top right corner of the screen.

3. Now TT switches you to the Form mode.

4. On the left panel of the screen you will see Forms in My Return. Scroll to the top to find 1099-NEC-Wks (Your company name) and click on it. This will open the Form 1099-NEC form on the right side.

5. Enter the earning in Nonemployee compensation edit box in Box 1.

6. Last step is to link this to the Schedule C by double click the "Schedule C" icon (little box) in the line below where you enter the earning amount. TT brings up a dialog box for you to set up the link. Choose the correct company name to link to Schedule C. If you transfer information from 2019 TT to 2020 TT then you will see the familiar names, otherwise, you can create a brand new form where you will enter the the company name, EIN, etc.

7. Now you have successfully create a NEC form.

8. Switch back to Step-by-step mode and there you will see the dollar amount you entered under the 1099-MISC income row.

I am disappointed at TT for leaving this portion out at the moment. If they don't fix this in 10 days, I am gonna return the software to Costco and let TT feel the pain for the poor job they did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

I am an independent Tupperware Consultant. For tax year 2020, I received a 1099-MISC and a 1099-NEC. Box number 7 on the MISC is only checked and printed on the back of the form is the financial info that relates to that box. I am very confused since box #7 is totally missing on the TT Self-Employed online version. What I'm reading here sounds like I possibly shouldn't have received both the MISC and the NEC and that I should just combine them? Can someone confirm that please? TIA

I should add that the info in box #1 on the NEC is not the same as the info that relates to box #7 on the MISC though. Should I just combine them and move on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

That is correct- Box 7 on the 1099-MISC is for sales of $5,000 or more of consumer products to a person on a buy-sell, deposit-commission, or other commission basis for resale (by the buyer or any other person) anywhere other than in a permanent retail establishment. The 1099-NEC is the Nonemployee Compensation which is the old Box 7.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

Thank you @MaryK4 for the quick reply. Can you confirm what you are stating is correct? Is it correct that there should only be one form and I should list the info on the 1099-NEC and quit going around in circles on the MISC? lol Literally, the online system had me in a cycle of click here...click here..then I would just be back at the same 1099-MISC page I had been at previously and still not able to enter info in box 7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 7 of 1099 MISC in Turbot Tax 2020 Home & Business is missing!

Form 1099-NEC is the form used now to report non-employee compensation, you can see it here:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RobertBurns

New Member

Rojees82

New Member

Wulin

New Member

highstream

Returning Member

cerebral-security

New Member