- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I have a K-1 from a partnership that I've passively invested in for several years. Never had an issue entering it in TT until this year. I entered all of the boxes off of the form exactly, but when I do the SmartCheck I get this error. I have entered all the information I have, but the error continues to reappear. Where is this Statement A and what am I missing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

The statement A is an additional statement that would be attached to the K-1 you received.

If you did not receive this information please check with the tax preparer of the business tax return to get the information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Where is the Statement A in TurboTax that the information needs to be entered into, and what boxes should I be looking for on the paper Statement A I should have received.

The error message is sort of vague.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I also have the issue that I have a Statement A, but I don't know where to enter it in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Try using these steps for this question for Schedule K-1 Box 20 Code Z needing Statement A.

Be sure to answer all the questions, as TurboTax Expert DavidS127 notes regarding inputting details for Box 20 Code Z: Continue through the K-1 interview after you have entered your value for box 20 code Z.

Enter the code Z when you enter the K-1, but you don't need to enter an amount.

Continue on, and there is a screen near the end of the interview titled "We need some more information about your 199A income or loss".

This screen must be completed in order for your box 20 code Z information to be correctly input into TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

You must go back to the K-1 entry and after you enter the Box 20 Code Z, continue until you see "We need some information about your 199A income or loss"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I am a limited partner. According to the tax preparer of the business unit, Statement A is required for a General partner, not a Limited partner.

I filled out all boxes for W2 wages, UBI, Rental income and still got this error message.

Does TT has a bug?

Please advise of a work around to get rid of this error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I kept getting the same CompleteCheck error and after a lengthy ordeal, I got this to work:

If your Statement A lists no values for any "income (loss)" category, go to the "We need some information about your 199A income and loss" screen, check the box next to "[PARTNERSHIP] has ordinary business income (loss)" and enter "0" for the amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

This solved it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Solved, thanks to KathrynG3's instructions. After selecting code Z, I left the box blank and subsequently filled out the screen titled 'We need some more information about your 199A income or loss' where I checked the applicable boxes and entered my data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

What does the statement A look like

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Here is the order that should appear in your return in Box 20

- if there is a Z, select Z in the drop down and leave the $ blank.

- Next screen asks about the risk. indicate you are at risk

- Then there will be a screen that appears that says, We see that you have 199A income.Here you have three choices to make. pick one that is applicable to you.

- Next screen will say we need some information about your 199A income. at the very bottom are selections to make. Now these are usually on a supplemental statement that come with the K1. Check all your disclosure statements that came with the K1 to see if the information is anywhere to be found.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

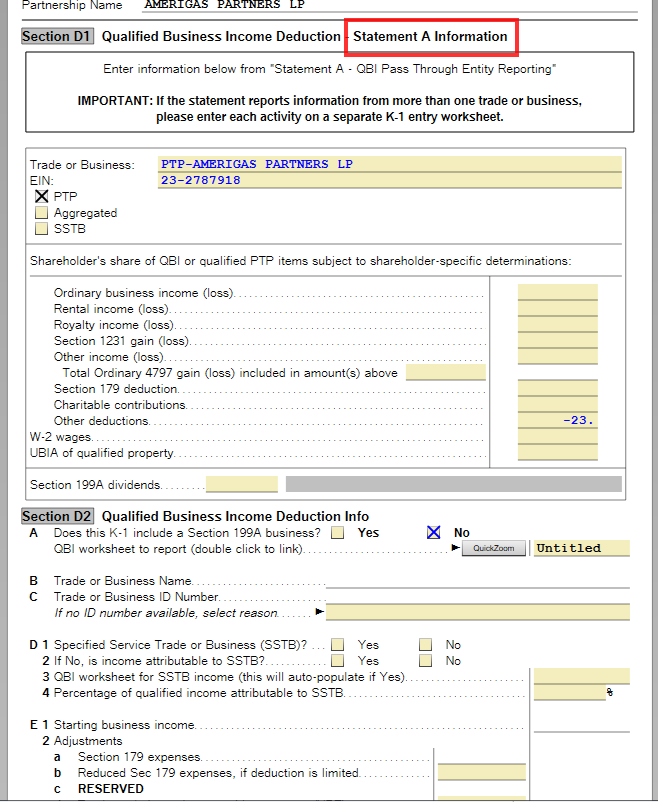

@jdj1s Entering 0 for "ordinary business income gain (loss)" makes the error go away LOL I did that according to your suggestion while editing "Statement A" in forms mode and as soon as I put 0 the error went away. @Ashweso asked what "Statement A" looks like. Here's mine before I put 0 and the error was still happening:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Oh my goodness! I wasted 4 hours trying to figure this out and this helped bypass the problem.

Leave the Z value empty and entering on the subsequent screen solved it.

Phew. I can now go relax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I called TurboTax to get the answer for my case. Line 20Z on my K-1, quoted Qualified Business Income (QBI), W-2 wages and Unadjusted basis of qualified property (UBIA). I had to go to the end of the K-1 review where it asks more about Section 199A income. There is a question where it says it needs more information about your 199A income. I had to make sure everything that was listed for box 20Z was checked off in the section. I had to check off business income for the QBI and enter that amount. I had to check off W-2 wages and enter that amount. And I had to check off UBIA of qualified property for the UBIA and enter that amount. Once I did that the error went away and my forms were correct when I went back to see if everything was where it should be. Hope this helps!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RedRaider97

New Member

user17604719363

Returning Member

Edge10

Level 2

statusquo

Level 3

pjm96moore

New Member