in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Balance sheet retained earnings question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance sheet retained earnings question

Doing taxes on my own for my S corporation with TurboTax Business 2022.

1. I entered beginning of year and end of year amounts on "Enter Your Assets Quick Entry" of Balance Sheet.

My Balance Sheet is not balanced and trying to figure it out.

Q1. Where are Retained Earnings amounts coming from on "Enter Your Liabilities and Capital Quick Entry" ?

Q2. Why in the world on Reconciling Retained Earning sheet Beginning Book Retained Earnings show 0? It's not true, i entered an amount there see item 1 above.

Q3. Above amount shows 0 and no way to override it... where is it coming from? What is logic? Or is it a bug in the software?

Please help,

Thanks,

Paul B.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance sheet retained earnings question

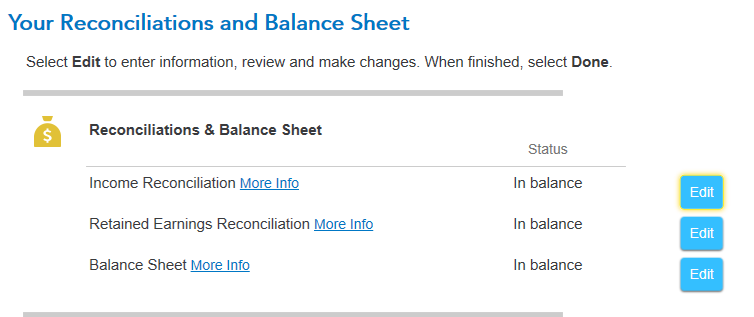

On the balance sheet entry, the retained earnings amounts come from your retained earnings reconciliation. You should reconcile and enter any differences in your Income Reconciliation and Retained Earnings Reconciliation before you enter your Balance Sheet.

To get back to this screen in TurboTax Business you can:

- Open your tax return

- Under the Federal Taxes tab click Balance Sheet

- Click Edit for the Income Reconciliation and verify the book to tax balances

- Click Edit for the Retained Earnings Reconciliation and verify or enter the book to tax balances

- Click Edit for the Balance Sheet and now verify your asset entries, then your liabilities and capital entries

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance sheet retained earnings question

Hi there--

I found this posting and need to do the same thing. I am using TurboTax Business 2022.

Using these instructions, I cannot find "Retained Earnings Reconciliation" anywhere on my screen. I've tried using the search tool, no help.

Can anyone advise where to find this?

TW

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance sheet retained earnings question

In TurboTax Business for an 1120-S,

- Select Federal Taxes across the top of the screen.

- Select Balance Sheet across the top of the screen.

You may have to enter your balance sheet entries. Then you reconcile the entries at this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

goodsonds56

Level 1

user17522541929

New Member

Fasi

New Member

keeponjeepin

Level 2

droidboye

New Member