- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Avoid the Surprise Refund Processing Fee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

On one page, Turbo Tax says it’s $24.99 to e-file my state taxes. Next page, it wants to charge my card $39.99 as a Refund Processing Service fee. I’ve Never heard of a refund processing service fee and it’s a horrible thing to surprise people with. How can I avoid paying this Refund Processing Service fee?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Pay your TurboTax fees upfront with a credit card to avoid that refund processing fee. That is the fee charged for having a third party bank remove your TT fees from your federal refund and sending you the rest.

OR You can also avoid that $24.99 state e-filing fee by printing and mailing your state return instead of e-filing it.

You can still e-file federal--that is free with desktop software. But mail the state. It will save you the $24.99 and the $39.99.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS and/or your state received the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Turbo Tax did not tell me that there would be an additional $39.99 fee for having a third party bank remove their $24.99 fee for my state return from my federal refund. And they never gave me a chance to pay any additional fees, up front. I paid $69.99 up front for the TT Deluxe software. That was the only communication from them. I feel that’s highway robbery. Thank you for responding, to let me know. They did not charge this, last year. If this is how it’s going to be, I’ll be shopping for a new tax service, for next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

There has always been a state e-filing fee with desktop software. Earlier in the tax season that state e-file fee is $19.99 but later--around mid-March -- it increases to $24.99. Sorry--but in order to have the fees taken out of your refund, they charge the refund processing fee. Of course it is onerous. That is why you should just print the state return and mail it. Or if you really want to e-file state, pay that fee with a credit card to avoid the extra processing fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

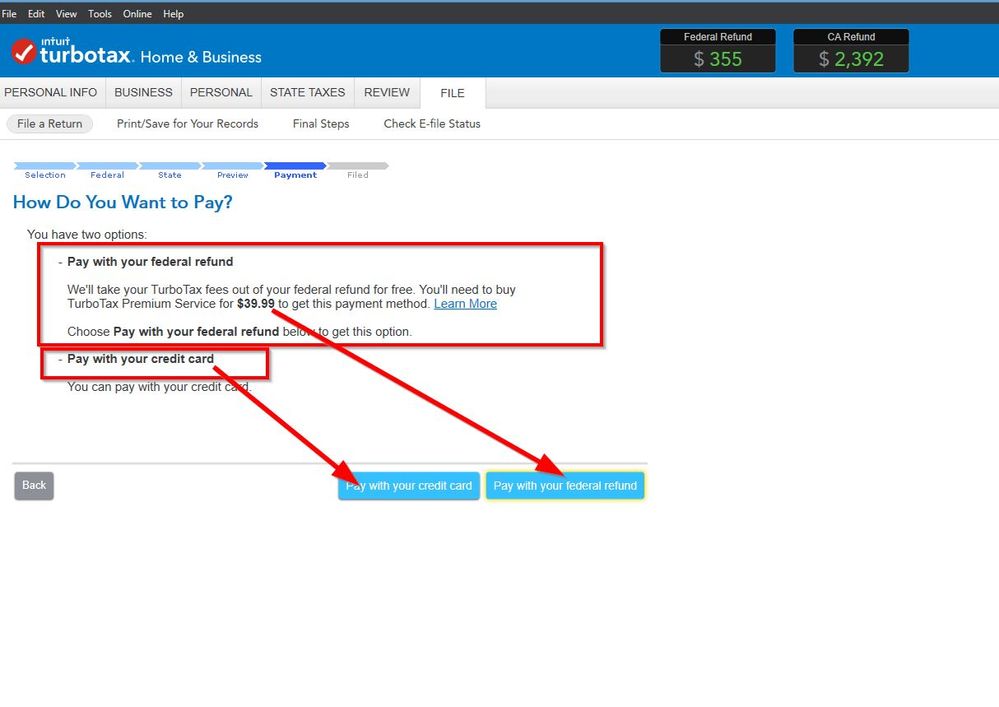

As you complete the FILE tab in step 1 the fee is presented and the option to have the turbo tax fee withheld from the federal refund is an option but it is not required ... always read the screens carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

You’re missing the point. Yes, there’s always been a fee to e-file a state return. But Turbo Tax has never mentioned, or charged me, an additional fee for deducting it from my federal refund. But the biggest point of all is that they’re attempting to charge an additional $39.99 on my card instead of (maybe in addition to?!) the $24.99 for e-filing state! That’s highway robbery! How can I change the charge on my card to the correct $24.99?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Frankly, I find it worthwhile to pay the e-filing fee versus printing out reams of paper!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Yes you have to go though the File screens slowly and watch what you click on. There is one screen that can trip you up. have you filed yet? If not you can pay by credit card and remove the 39.99 Refund Processing Service charge (44.99 in California). Go back through the File tab and watch for this screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

I never see a File tab and step 1. It’s never presented to me. I read screens VERY carefully. Every year, I receive an email from TT announcing my produt will be available soon. Make sure I have the correct product chosen (mine is Deluxe $69.99) and credit card and shipping info is correct. It says $69.99 will be my total. It says I can sign in to see my full product description (I does not say there’s been any changes), mentions changing to Windows 10 from Windows 7, then gives me a deadline to make changes (by 10-31-19, for next year). There is No Mention of any other fees, even in the small print! With their 60 day guarantee of satisfaction— it’s way past 60 days before you get the inflated surprise fees! So when I respond to this email (with little time before deadline!) and choose my regular produt— They’ve Got Me. They’ve Changed my fee to e-file state from the agreed upon $24.99 to $39.99 without giving me a way to correct it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

There's has always been the extra service charge to have the state efile fee deducted from a federal refund. You are either not remembering right or you paid upfront with a credit card. Go back and look at your credit card statements. And they do not charge your credit card for both, just the 24.99. Unless you added another service like Audit Defense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Oh, I do too! I Do Not think it’s cool to say TT’s fee will be $24.99 on one page to e-file state, then on the very next page, ask you to agree to charge $39.99 to your card!

P.S. For this Live Community thread, I have “Email me when someone replies” and I’m Not receiving any emails. I’m not blocking any pop-ups, neither am I blocking any responses from intuit. I have been nothing but compliant all around and this is how I get treated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Sorry I was typing the post above at the same time as you. You don't see a File tab? Like in my screen shot? Are you using Windows or Mac? You have to go though the File tab to efile.

There is always an extra 24.99 fee to efile the state return. It was 19.99 before March 1 then goes up each year. Or you can print and mail state for free.

The extra 39.99 is to have the 24.99 deducted from your federal refund. So it will be both 24.99+39.99 = 64.98

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

Can you post a screen shot that it will charge 39.99 to your credit card instead of the 24.99?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

WHAT?! T.T. is showing Different Screens to Different Customers! Thanks for the screen shot! I am unable to screen shot what they’re showing me, but I can type it out. Your screen informs you that there’s a T.T. Premium Service you can buy for $39.99 that takes your fees out of your refund for a fee. The second screen “Pay with your credit card” doesn’t explicitly say you can avoid the fee, but that’s the way they roll.

The screen they show ME says: “If you don’t want to use a credit card, you can subtract the fees from your federal tax refund and have the balance of your refund deposited directly to your bank account. There is an additional fee of $39.99 for this Refund Processing Service.” The “Use your credit card” choice says, “you can charge your fees to your credit card.” So the reader is left deciding if I want to give them $39.99 from my refund, or $39.99 charged to my card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Avoid the Surprise Refund Processing Fee

No. There are not different screens. You are not understanding them. Read my whole screen shot above. The 39.99 is in ADDITION to the 24.99 efile fee if you want it deducted from your refund. It doesn't get charged to your credit card .

OR you can pay only the 24.99 directly with a credit card.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

theresaromero505

New Member

stansburyc

New Member

zsbprice456

New Member

rosamamya28

New Member

sozdemirezgi

New Member