- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

The stimulus checks that were sent out this year are really an advance on a credit you can get when you file your 2020 tax return. So--good news--if you are filing a joint return, no one can claim you as dependents and you will get the stimulus for a married couple. Look for it on line 30 of your 2020 Form 1040.

Best Wishes!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

Your eligibility for the Recovery Rebate Credit is based on your 2020 federal tax return, dependency status and filing status. The credit is entered on your 2020 Federal tax return, Form 1040 Line 30.

The Recovery Rebate Credit is figured like the 2020 Economic Impact Payment, except that the credit eligibility and the credit amount are based on the tax year 2020 information shown on the 2020 tax returns filed in 2021.

Generally, you are eligible to claim the Recovery Rebate Credit, if you were a U.S. citizen or U.S. resident alien in 2020, are not a dependent of another taxpayer for tax year 2020, and have a social security number valid for employment that is issued before the due date of your 2020 tax return (including extensions).

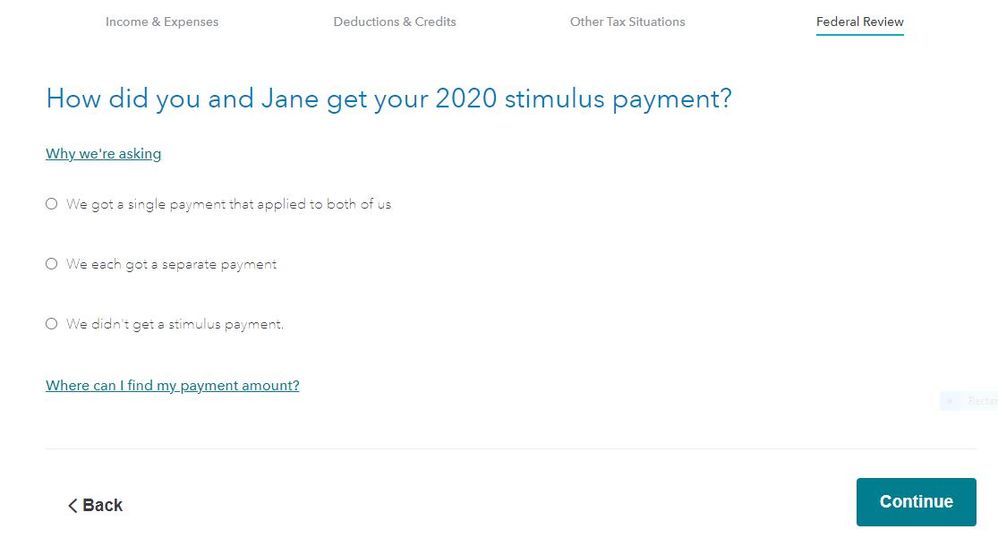

Using TurboTax you will be asked about any stimulus payment received during 2020 in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

I'm looking at Federal Review and I don't see the Stimulus question.

Is there something else I have to do to reach that question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 is the first year that I will not be claimed as a dependent, and I also recently got married and will be filing joint. Will we receive the new stimulus check?

@hillconner8160 wrote:

I'm looking at Federal Review and I don't see the Stimulus question.

Is there something else I have to do to reach that question?

Have you entered your all personal information in the My Info section of the program? Did you enter that you are being claimed as a dependent? Dependents are not eligible for the stimulus payment.

The Stimulus page is right after you complete the Other Tax Situations section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mmarie2816

New Member

kalkaram

New Member

kevk1

Level 1

Vowels1029

New Member

Sgiraldo2025

Level 2