- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-B RSUs How to enter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B RSUs How to enter

Hi,

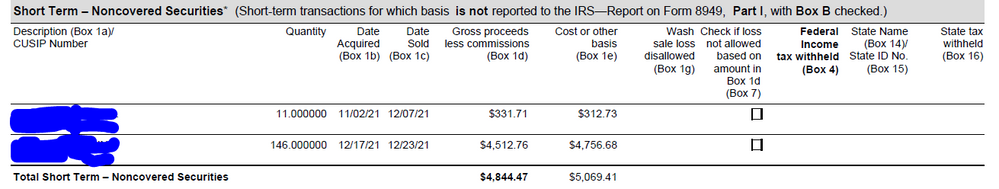

I was provided with a 1099-B for RSUs that were sold to cover taxes. the 1099-B had cost basis provided, an screenshot example below. Do I just enter this as a regular 1099-B? Do I have to do anything special and adjust any cost basis? The screenshot only contains RSUs sold to cover taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B RSUs How to enter

Yes, you can enter this as a regular 1099-B. You can still select RSU as the type of investment that you sold, but it does not look as if an adjustment is necessary to your cost basis.

It's strange that they held the shares so long before selling them to cover the taxes, but everything looks correct on your 1099-B. Your W-2 should have the $4,844 spread out amongst your state and federal taxes. The cost of all your shares that vested in 2021, not just the ones held to cover taxes should be reported as compensation in Box 1 of your W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B RSUs How to enter

@RaifH - Thank you!

Just to understand this a little bit more, so by entering 1099-B I am getting taxed for the taxes that was paid? this is assuming I had a capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-B RSUs How to enter

The cost or other basis reported on your 1099-B is the value of the stocks on the date they vested. From that day on, if the stock increases in value, you will be taxed on capital gains when you sell it.

Usually on a sell to cover, the stocks are sold as soon as they are vested so there would not be a capital gain. But yes, if the stocks were held and the sell to cover was not executed for several weeks after they vested, you do pay capital gains on the difference between the sale date and the vesting date. Of course, if they went up in value in that time, there would also be more taxes withheld from the sale which would more than cover the capital gains.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

starkyfubbs

Level 4

ngabi

Level 2

di-b-keller

New Member

Steph2024

Level 1

katie46

New Member