- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

I purchased a home (first and only) in late 2024. I paid $3,000 points at closing. I paid a small amount of interest at closing (less than $600). I didn't receive a 1098 (because interest paid was <$600). How do I input my points? Please advise. Many thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

If you are using the desktop version, you can do it either way. If you are comfortable with forms, as long as it in something that has a blue font, you can enter it in there. If you enter anything that is a calculated field, you may get an error and won't be able to e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

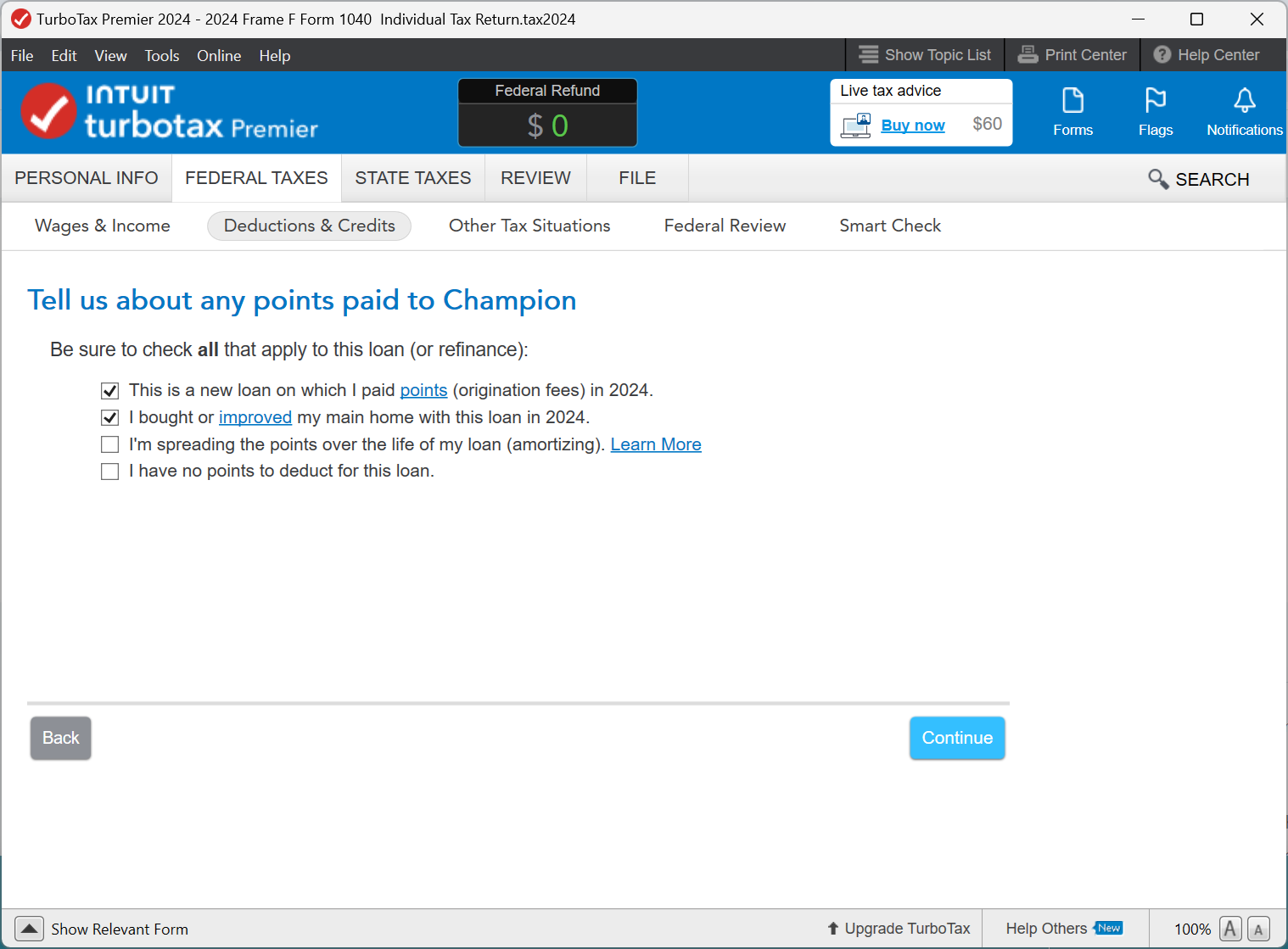

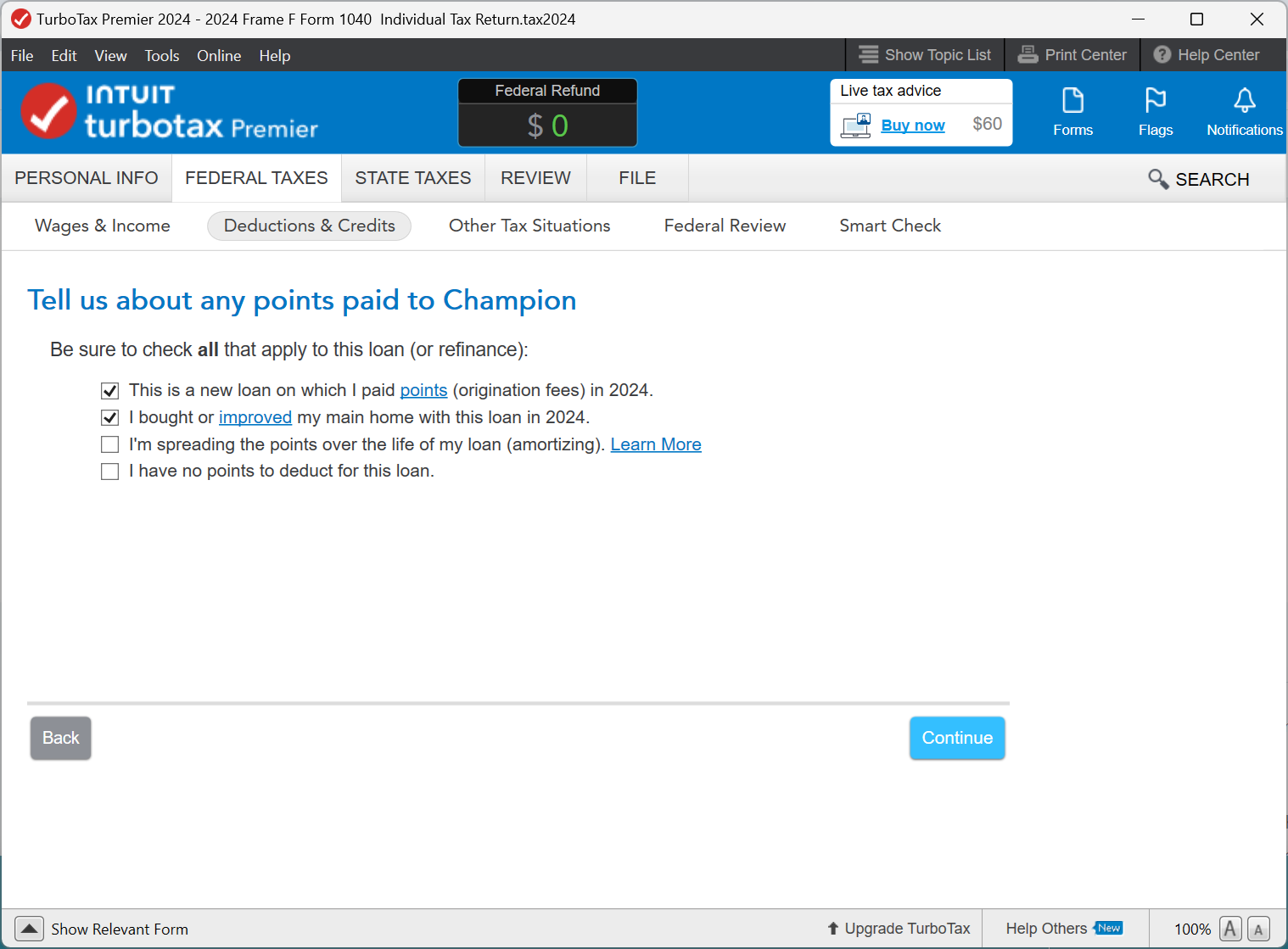

Be careful how you answer the question about the loan. When i tested this in the program, the point i entered were being amortized. To correct, when I was directed to the screen asking me about the points, I made sure I selected the first two check boxes the screen. When I did this, I was able to deduct the points. See screenshot below that illustrates this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

You can use your closing statement for reporting the points and add the interest as well.

Report as if you did receive Form 1098.

Get the info for the Lender from your statements or contact them directly.

Deductions & Credits

Your Home

Mortgage Interest, Points, Refinancing, and Insurance

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

Thanks. One follow-up question:

Do I use the Q&As to fill in a "fake" 1098... or do I use Forms Mode to manually enter the figures... or do I use some other method?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

If you are using the desktop version, you can do it either way. If you are comfortable with forms, as long as it in something that has a blue font, you can enter it in there. If you enter anything that is a calculated field, you may get an error and won't be able to e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

Entering the "points" may have no effect at all on your tax due or refund.

Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund. The deductions you enter do not necessarily count “dollar for dollar;” many of them are subject to meeting tough thresholds—medical expenses, for example, must meet a threshold that is pretty hard to reach. (Only the amount that is MORE than 7.5% of your AGI counts) The software program uses all the IRS rules that apply to the expenses you enter, and it tells you if you have enough to use your itemized deductions or if using the standard deduction is more advantageous for you. Under the tax laws that have been in effect since 2018, some deductions have been capped—there is a $10,000 limit to the itemized deductions for state, local, property and sales taxes.

The standard deduction makes some of your income “tax free.” It is not a refund. You will see your standard or itemized deduction amount on line 12 of your 2024 Form 1040.

2024 STANDARD DEDUCTION AMOUNTS

SINGLE $14,600 (65 or older/legally blind + $1950)

MARRIED FILING SEPARATELY $14,600 (65 or older/legally blind + $1550)

MARRIED FILING JOINTLY $29,200 (65 or older/legally blind + $1550)

HEAD OF HOUSEHOLD $21,900 (65 or older/legally blind + $1950)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

I'm entering info from my closing statement as if I received a 1098. My mortgage loan is NOT any of the following:

- Loan on a second home

- Home equity loan, or

- Loan to refinance your home (if not used for home improvements)

However, TT is forcing me to amortize my points. How do I get TT to NOT amortize my points? Please advise. Many thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Purchased Home Late in Year. Paid Points. Didn't Receive a 1098. How Do I Input Points?

Be careful how you answer the question about the loan. When i tested this in the program, the point i entered were being amortized. To correct, when I was directed to the screen asking me about the points, I made sure I selected the first two check boxes the screen. When I did this, I was able to deduct the points. See screenshot below that illustrates this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sidneyd37

New Member

habitatoffice131

New Member

Coolbreeze3136

New Member

niallmadden

New Member

NADamewood

Level 1