- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Pay by Check

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

I completed my return with TurboTax but choose the "pay by check" option. Instead of sending a cheque, I paid online using one of the 3 processors mentioned on the IRS website.

In this case, am I supposed to mail in my return forms to IRS or did TurboTax do that for me already?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

TurboTax e-filed your return if YOU clicked the big orange button that said "Transmit my returns now." Did you do that? TurboTax never mails anything in for you.

Did you e-file? Did you click a big orange button that said “Transmit my returns now?”

When you e-file your federal return you will receive two emails from TurboTax. The first one will say that your return was submitted. The second email will tell you if your federal return was accepted or rejected. If you e-filed a state return, there will be a third email to tell you if the state accepted or rejected your state return.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If the IRS accepted it, what does it say here?

Or does your account say “Ready to Mail?”

Note: If it says “Ready to Mail” or “Printed” that means YOU have to mail it yourself. TurboTax does not mail your tax return for you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

In the File section of the program you have the option to e-file your tax return or to print and mail your tax return. Which did you select?

You complete your online tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large button labeled "Transmit my returns now".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

Thanks for that detailed response. Unfortunately, I do not remember if I selected "Transmit my returns now".

I did receive 2 emails from TurboTax titled:

1. In Progress: Your TurboTax Return Status

2. TurboTax Update: Federal Return Accepted

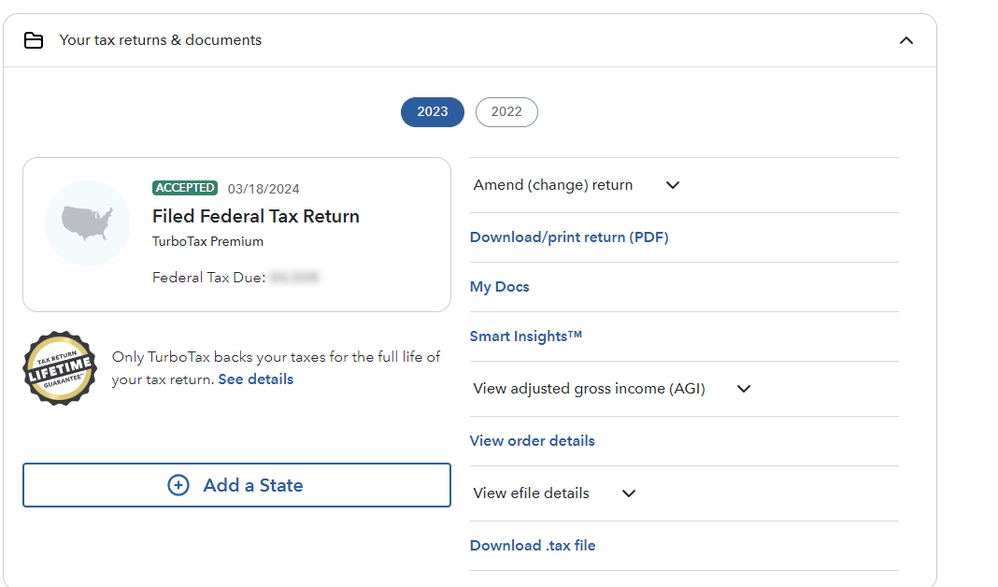

This is what I see when I login to my account.

Unfortunately, I get an error "The information you entered doesn't match our records" on https://www.irs.gov/refunds.

Surprisingly, I get the same error if I try to access my 2022 return.

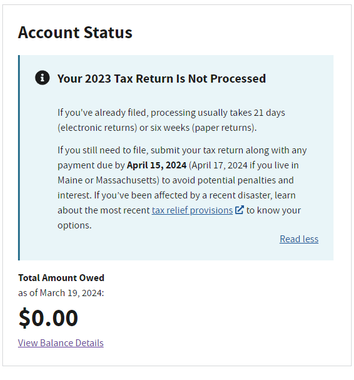

This is what I see when I login to my irs.gov account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

Unfortunately, I do not remember but I have attached some screenshots in my reply to the other answer.

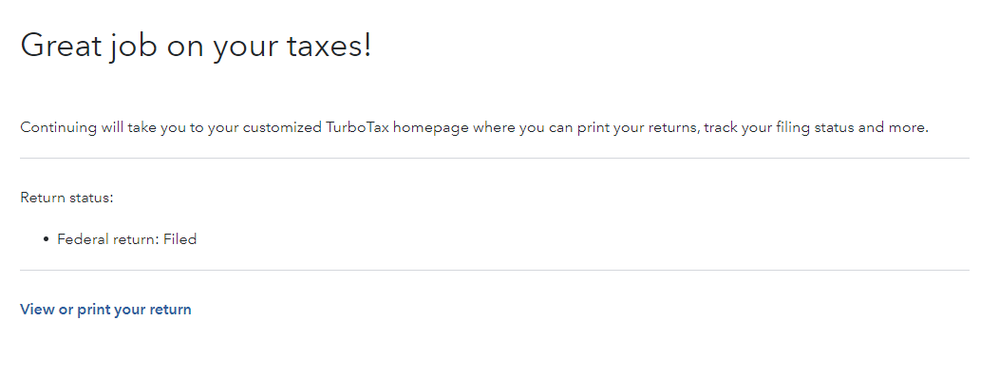

If I go back to the File section now, it shows me this and then takes me to the homepage when I press Continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

Sometimes people get confused by the “summary” given by TurboTax and use the wrong amount for the federal refund. Make sure you are only using the federal refund amount, and not an amount that combined your federal and state refunds.

Your federal refund amount is on line 35a of your Form 1040

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

Well, I am not expecting a refund - so my 35a is blank.

Rather, I owed some tax which is why I chose to mail in the cheque.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

You will not see anything on the IRS refund site since you are not getting a refund. But your account shows that your return was accepted. Sounds like you did e-file and you did mail a check, so you are good.

Watch your bank account for the check to be paid. And then check your online account with the IRS.

https://www.irs.gov/payments/your-online-account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

Ok.

To confirm - if I had mistakenly opted to 'to print and mail your tax return' (in which case I would have been liable for mailing my tax forms to IRS) instead of 'e-filing', I would have not seen the 'accepted' status on my dashboard?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pay by Check

@jainvarun Yes---correct. If you did not e-file you would not see the word "accepted." TurboTax has no way to know if you put your tax return in an envelope and take it to a mailbox. But TT does know if you e-filed and if the return was accepted.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tay1234

New Member

sandmgandg

New Member

laura_borealis

Level 4

Mispaw88

New Member

kbh229

New Member