- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

I have the same problem. They corrected this programming error in an update I downloaded today, except my return was already efiled. My return has yet to be accepted or rejected by the IRS after a week.

This is a significant programming error TurboTax!

What do I do now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

What to do now: Wait to see if your tax return is accepted or rejected. Then...

- If it is rejected, update your return for the AMT carryforward and resubmit. How do I fix a rejected return?

- If it is accepted, you will need to file an amendment. Here is an article about How do I amend my tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

The corrected Form 8801 is expected to be release later today (Release 20). You need to check on it this weekend.

You should delete the form in your return. When a corrected form is updated it is possible for some old calculations is still in the form. Deleting the form will allow only the corrected form to be loaded.

To delete a form off of your return you need to:

- Select Tax Forms in the Black bar on the left side of the screen.

- Select Tools from the drop down menu.

- On the Tools Center Select Delete a form.

- Locate the form on the list and select Delete.

- You will be asked to confirm the deletion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Sunday 3/8, same problem here. I tried to override the blank space and enter the amount from line 24 as the instructions prescribe, but now turbo tax won't e-file for me because of the override.

Any update Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

In fact, and weirdly, line 25 was properly included when I saved a copy last Sunday (3/1) but when I updated TT today and re-opened the file, suddenly I owed a lot more federal tax than a week ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

3/12 still waiting for an update for this glitch. Nothing for this was included in the latest update that I just downloaded. Intuit, are you listening?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Deleting the form did not work. What now? Has your software actually been corrected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Software has not been corrected. I just keep waiting for an update that solves this problem. I suppose I could call Intuit, but ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

I am having the same problem and waiting for an update to fix it. Why is it taking so long to fix such a huge problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

new update today, but the problem is still not fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Deleting the form does not work. Is this programming error ever going to be corrected? Do I have to purchase a competing product to get a correct tax return? This is ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

Please help, Turbotax, even if you're working from home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

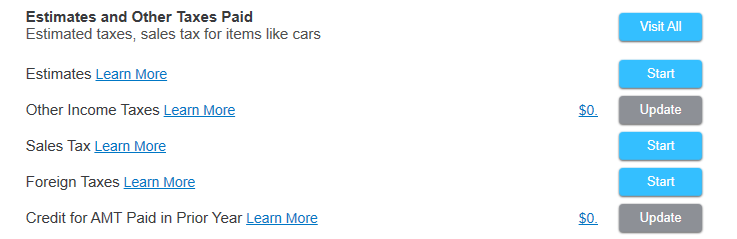

Did you try entering the AMT carryover in the "Estimates and Other Taxes Paid" section in the "Deductions and Credits" area of TurboTax?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

None of my AMT carryforward posted on line 25 of form 8801, therefore $0 transferred to Schedule 3, line 6. My AMT is $101000?

That worked! Thanks so much. It seems like the info from 2018 form 6251 did not automatically transfer and autofill into 2019 forms. Manually entering the info via the step-by-step Deductions and Credits section (specifically "Credit for AMT paid in prior year") did the trick.

Thanks again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djpmarconi

Level 1

HNKDZ

Returning Member

Kuehnertbridget

New Member

kac42

Level 1

binarysolo358

New Member