- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Missing 2021 Form 1116

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Using Premium edition. Have less than $600 Foreign Tax Withheld from stock dividends. Turbo Tax will not let me file as it insists I fill out Form 1116 which is not required. Should have not up dated TurboTax on 02/19/2021 when ready to E-file.............

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Intuit has turned into a political party. Do as much as possible to piss off your customer base.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

The form will be available on TurboTax on 3/3/2022. It is still under construction.

See

https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Says available 2/17 but wasn't available 2/19 on my PC version. Is there a new date to expect it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

3/3/22

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

The Form 1116 foreign tax credit will be available on 3/3/2022.

Click on the link for more information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Not will be

Currently scheduled

The scheduled dates have been

2/17 changed to 2/24 changed to 2/25 changed to 3/4

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Typo not 3/4

currently 3/3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

You can click on TT Forms and manually enter the correct foreign tax credit (just refer to the available IRS instructions while TT puzzles them out). At least you will be able to compute your taxes due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

nw13 - You can, but then you must make all the calculations yourself. For example 3e) "gross income from all sources" is often not just AGI. If you actually have foreign business, then it gets even more complicated. The reason one buys TurboTax software is to handle those complications and perform the calculations. If I have to do the form by hand, why buy TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

Still not available in TT as of 2/21/22 and now the link showing TT form availability is pushed back to 3/3. I'm glad I found this thread because the "error" the program gives is the IRS has not released the final version but when I looked at the IRS website it looked like it was done for a while and found no indication it was not final which was confusing me. TT needs to have a better message in a case like this as to what is going on!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

This link: https://care-cdn.prodsupportsite.a.intuit.com/forms-availability/turbotax_fed_online_individual.html

indicates that FORM 1116 will be available on Turbotax now on 03/03/2022.

I spent a few hours yesterday trying to wrap up my 1040 early because of planned travel. I was frustrated that the form was not available on Turbotax, and annoyed that Turbotax incorrectly blames the IRS. The Form 1116 is available from the IRS and has been for weeks now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

As of 2/20/2022, the form 1116 is not usable. At IRS website it is available for quite sometime. You wrote the Form will be updated on around 2/17/2022. How long further do you think it will take? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

to LoganathanB Expert Employee:

Why should we believe the March 3 date any more than all the other dates Intuit put out and then ignored?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missing 2021 Form 1116

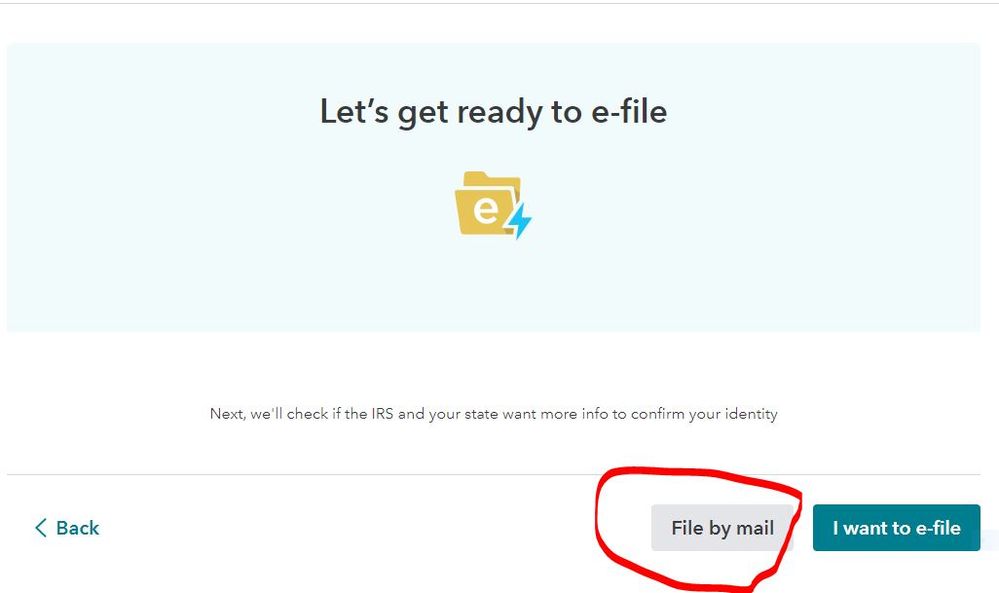

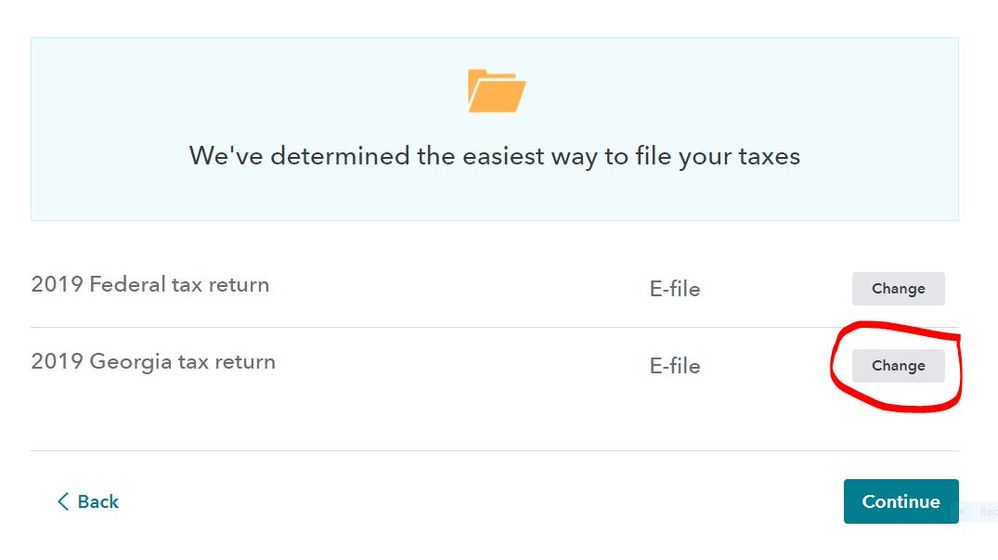

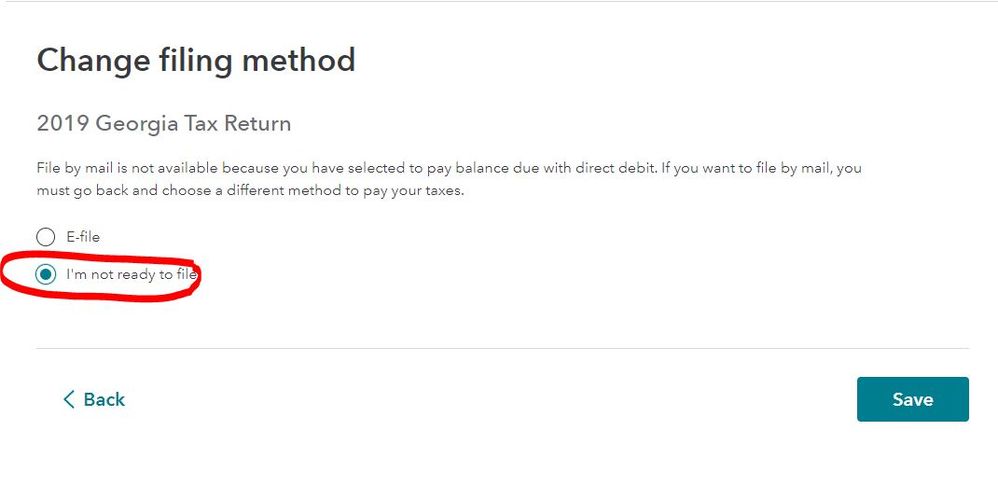

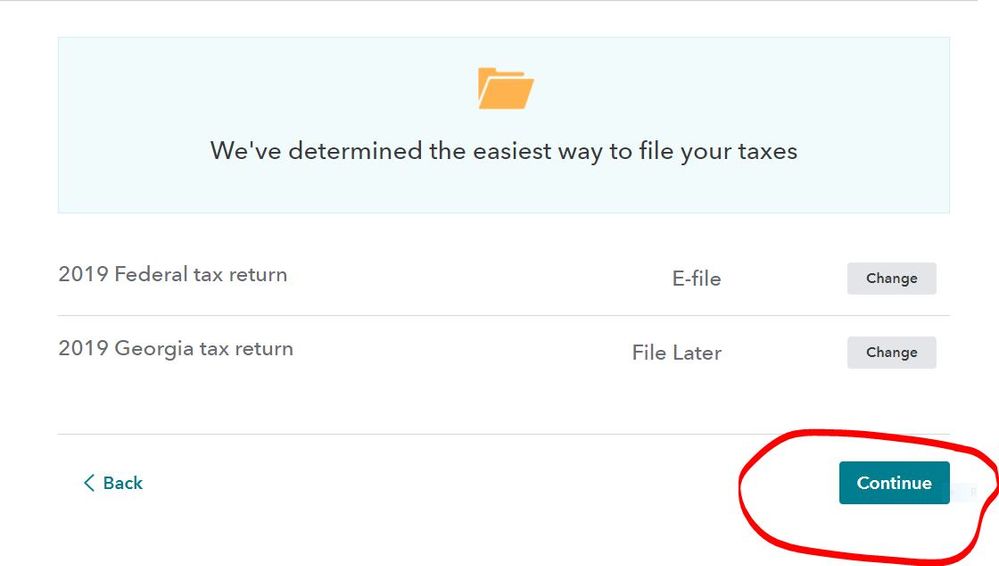

@rifi There is an option to not e-file the state return and e-file the federal return. It is in the File section of the online program when starting Step 3 and does NOT require you to delete the state return.

These screenshots were from a 2019 tax return but are still valid for tax year 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17721252444

Level 2

tigr_ldy

Level 2

firedrake123

Level 2

laurag25

Level 4

taxation13371337

Returning Member